With the explosion of Generative AI Sam Altman has become one of the most famous entrepreneurs on the planet. But not much has been written about his fintech investments.

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

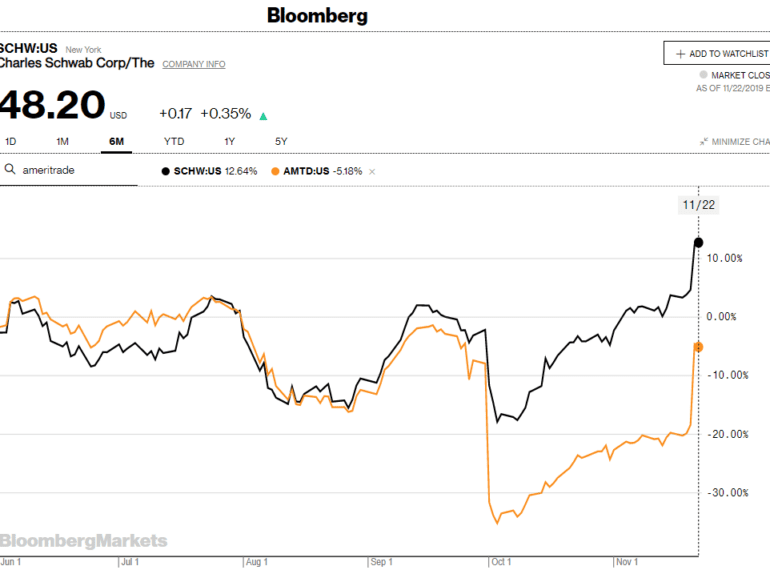

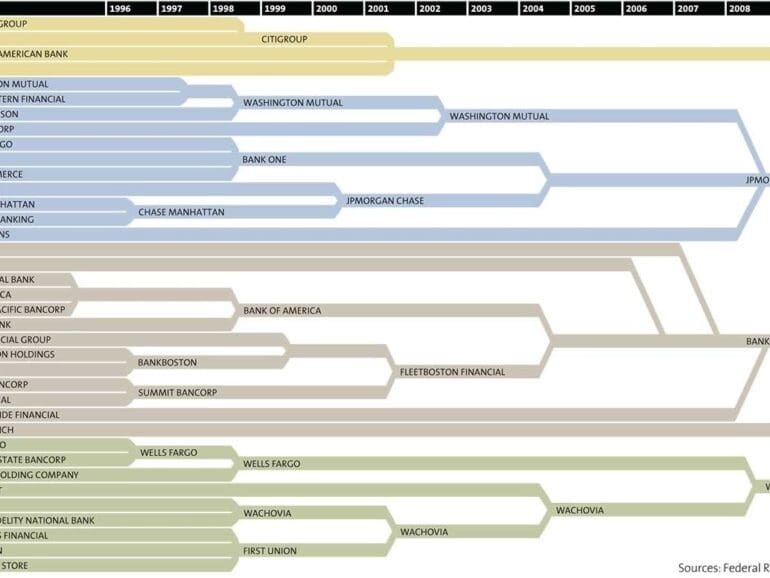

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

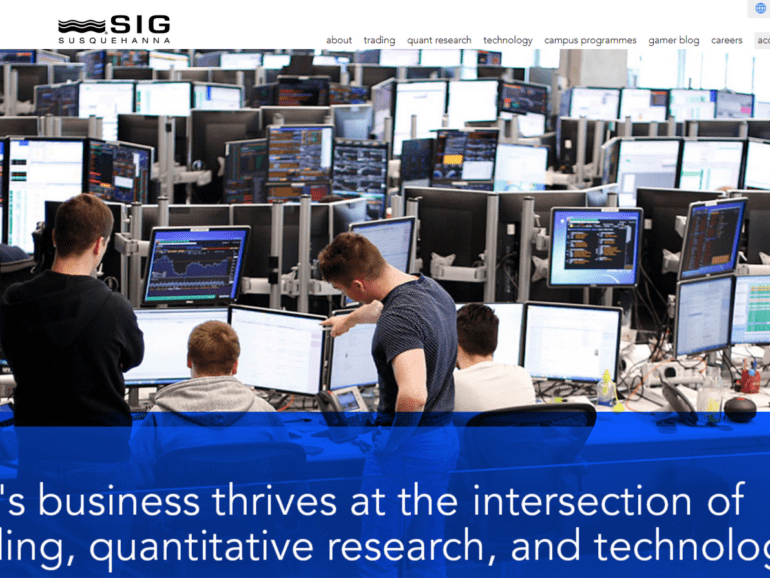

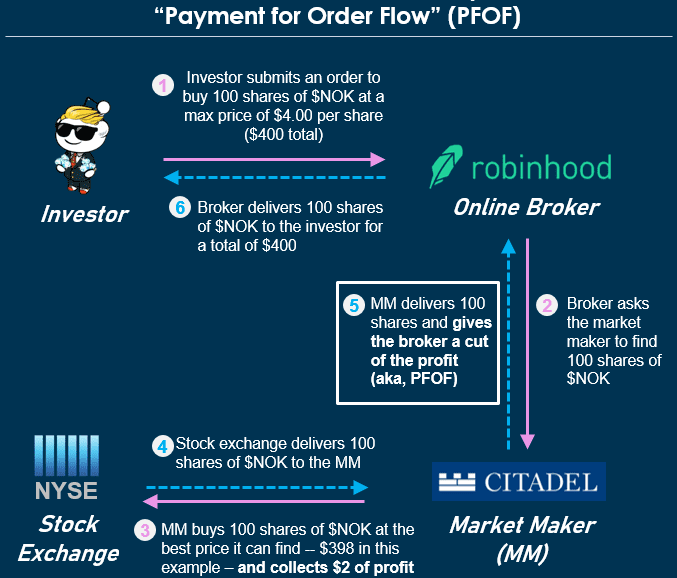

In this conversation, we talk with Paul Rowady, who is the Director of Research for Alphacution Research Conservatory. Paul has a deep background in capital markets, derivatives, and the macro structure of the industry. He has been uncovering the transformation of that structure with data driven analyses, making visible the economics of market makers like Citadel and retail order flow aggregators like Robinhood. This is a rich discussion of what trading stocks is really like. And make sure to check out Alphacution.

F-Prime released their latest State of Fintech report and it shows an industry back on the upswing but with still a lot of work to do.

In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

This week, we look at Betterment launching a bank account and payments feature. They are not the first, but they could be the best! Still, it feels like the world has moved on. Barriers to entry around digital finance have collapsed, and shifted industry goal posts. Hundreds of companies are integrating API-based solutions that connect to banking and investment entities. Amazon, Google, and Apple are there already. And let's not forget the incredible pressure from the COVID recession: 20MM+ unemployed, $100 billion decrease in global remittances, 1 in 8 banks being unprofitable. Is it time for incremental improvement, or a sea change?

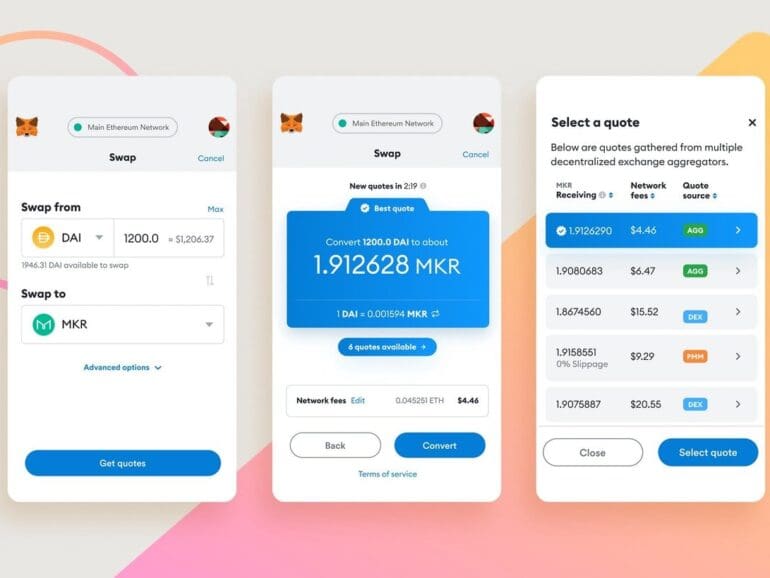

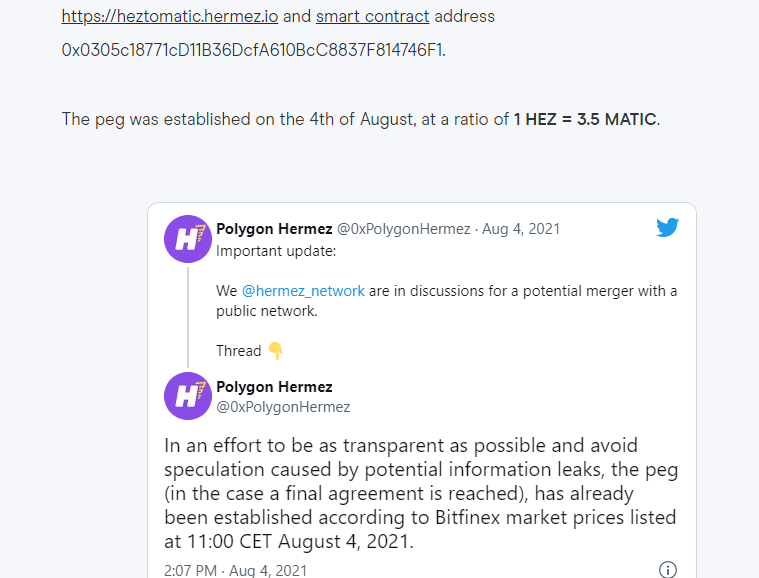

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

In this conversation, we talk all things capital markets and investing with Yoni Assia, the founder and CEO of eToro, one of the fastest-growing and largest global digital investing companies, brokerages, and applications out there.

More specifically, we discuss the eating habits of Warren Buffet, community-driven investment challenging incumbent investing practices, the purposes of investing and trading, of financial health, of investment education, of gamification of investment strategy, of capital markets and GameStop and the connection between capital, memes and fashion, and finally machine learning’s influence of investment behaviour.