Colombian fintech Bold secured $50 million in a series C round led by private equity firm General Atlantic.

This week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

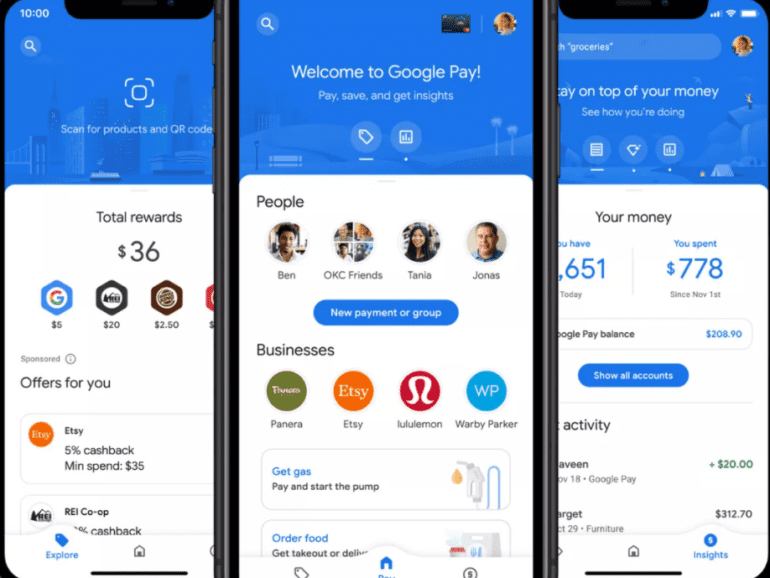

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

Coinbase is going to go public.

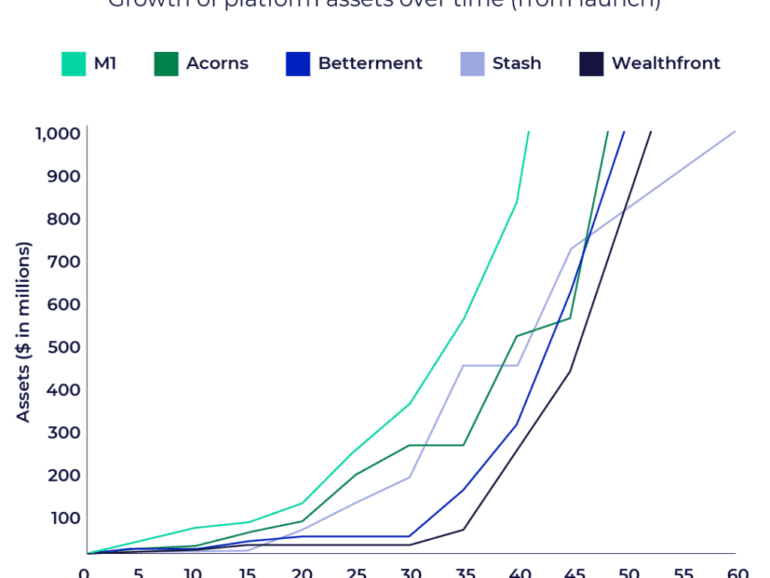

The news hit Reuters, then Coindesk, and then the rest of the world. It feels like big news! The crypto broker is beating Robinhood, Acorns, Stash, Revolut, Betterment, and Wealthfront to the public markets. It's even beating SoFi, which is trying to get a national bank license (and who doesn't want to own a bank!).

In this conversation, we talk with Brian Barnes of M1 Finance, about finance “super apps”, the cost-efficiencies of robo-advisors, fractionalized share trading, and tackling the titans of the Wealth Management industry. We also discuss the nuts and bolts of the financial infrastructure making this possible.

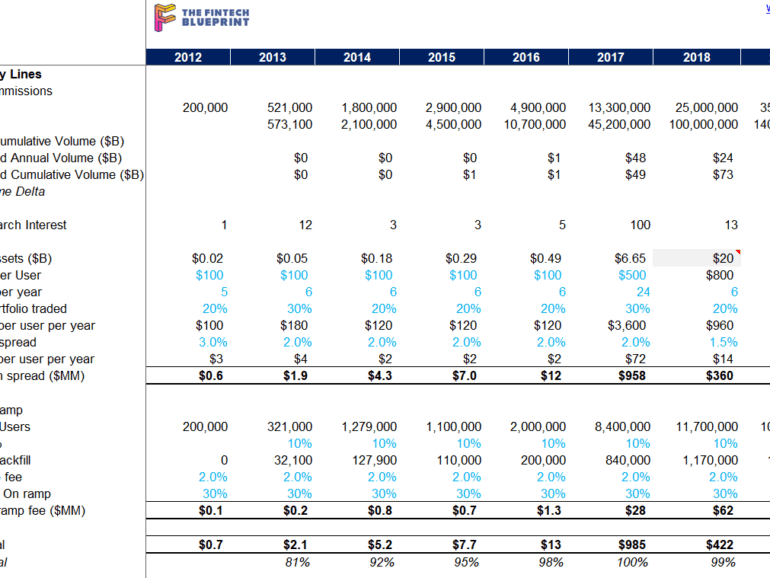

M1 Finance bundles together roboadvisory, neobanking and lending into a single “super app”, allowing for combined pricing power (i.e., charging nothing on asset allocation). The firm currently has $3 billion in AUM, a growth of 50% in the past four months and tripling their total in just over a year. Notably, the company has its own broker/dealer and offers fractional shares, and partners with Lincoln Savings bank on the deposit accounts. That makes for a compelling business model from securities lending, interchange, and order flow.

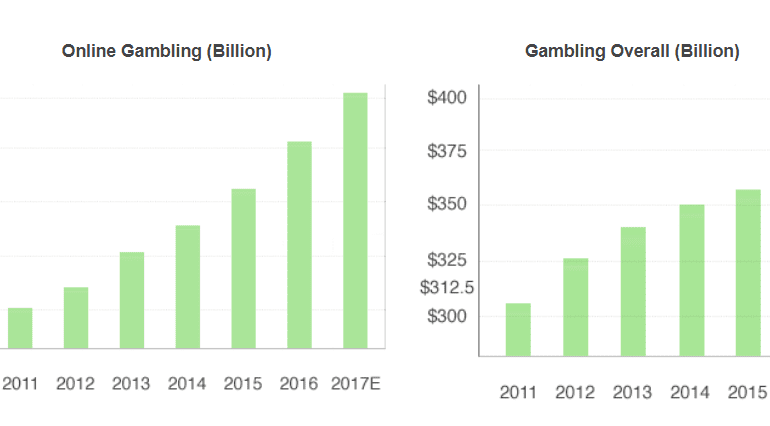

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

We are syndicating a deep conversation across roboadvice, high tech and payments, and fintech bundling that we had with Craig Iskowitz of Ezra Group Consulting.

Check out Ezra Group Consulting here to learn more about digital wealth and Craig’s consulting practice. He is one of the sharpest software consultants in the RIA space, and his firm works with wealth management firms and fintech vendors to provide technology strategy and market research.

We had a lot of fun in this conversation and cover TD & Schwab, Wealthsimple, M1 Finance, Ant & Tencent, and Robinhood, among others. The full transcript is provided along with the recording — worth a read for the illustrations alone.

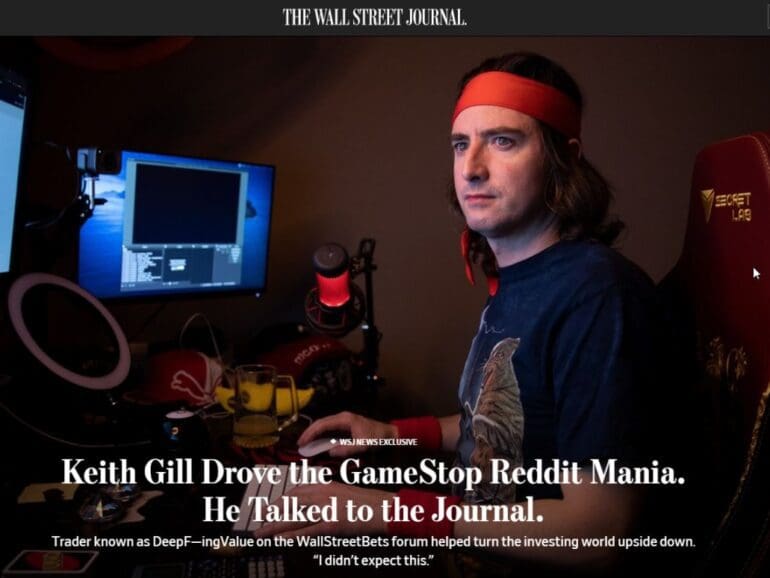

Despite its best efforts to the contrary, Robinhood did end up stealing from the rich and giving to the poor.

Melvin Capital, the $8 billion hedge fund that didn’t find GameStop funny, lost 53% of its portfolio in January ($7 billion) trying to short against the rallying cries of the Reddit Capitalist Union. Gabe Plotkin also faces the embarrassment of having to get bailed out by your old boss.

Speaking of, New York Mets owner and former name-on-the-door of SAC Capital, known most recently for its insider trading fine of $1.8 billion, Steven A. Cohen, put $2.8 billion of capital into Melvin’s fund.

Ken Griffin, owner of the Citadel hedge fund (an investor in Melvin), and Citadel Securities (a massive market maker and buyer-of-order-flow for Robinhood), is seeing capital losses in the former and Washington cries for scrutiny into market structure in regards to the latter.

Robinhood itself — which for goodness sake is *not Wall Street*, but as *Silicon Valley* as it possibly gets — raised $1 billion immediately to protect itself from class action lawsuits, DTCC capital calls, and a now-rapidly-closing IPO window. That means Yuri Milner of DST Global chipping in yet again.

That’s at least 4 people that have had a very bad, no good day.

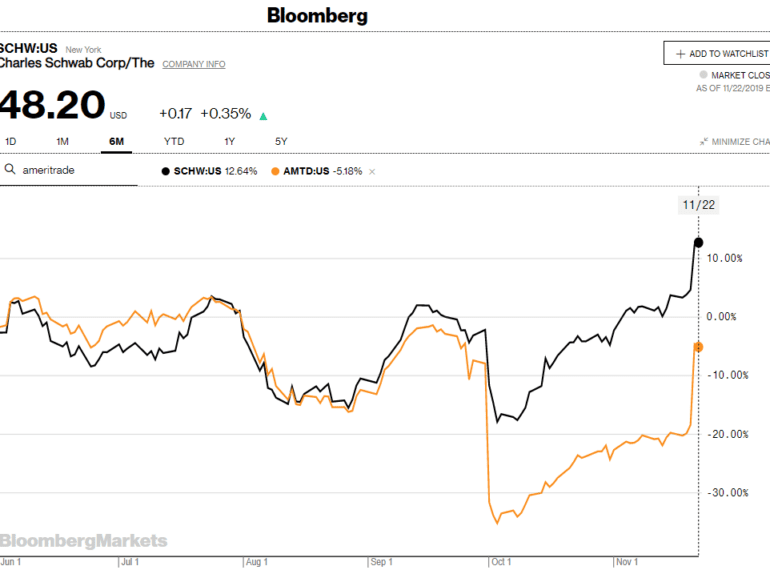

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

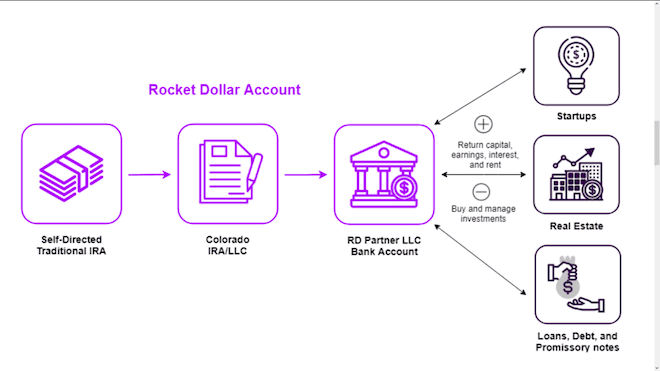

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!