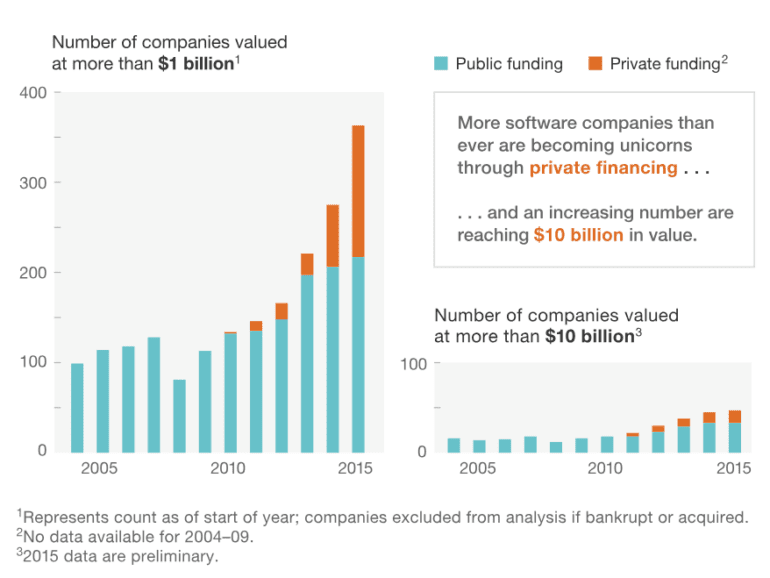

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

This week, we cover these ideas:

The Acorns SPAC deal, including its valuation and detailed metrics

The growth levers and obstacles for point-solutions as they scale into the millions of users and hundred of millions of revenues

What a $50 billion fund should do to roll this stuff up

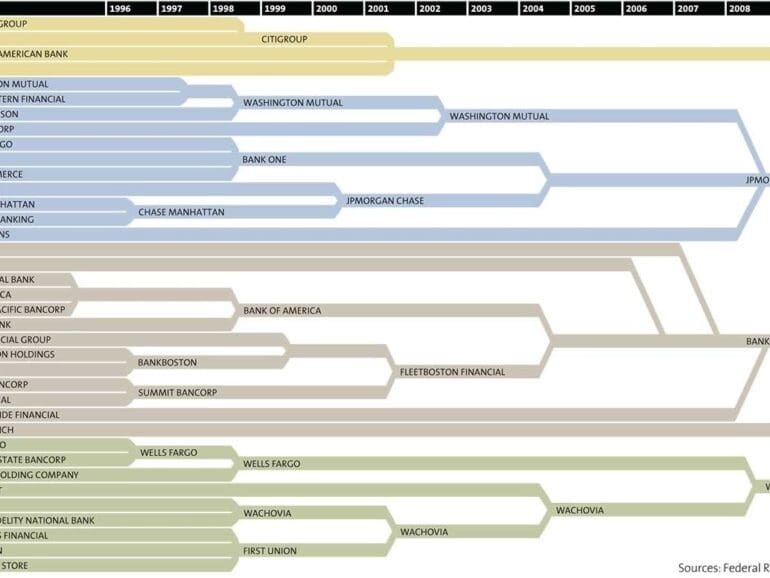

It is looking like a pretty good time to go consolidating individual financial product footprints. Leaving aside whether consolidated companies are good or bad for some particular reason, the simple observation is that there are just far too many point-solution brands out there. Too many to be left alone to operate. And now a number of them are going to be public, which means that a number of them are going to be up for sale.

This week, we cover these ideas:

How market structure determines the types of companies and projects that succeed

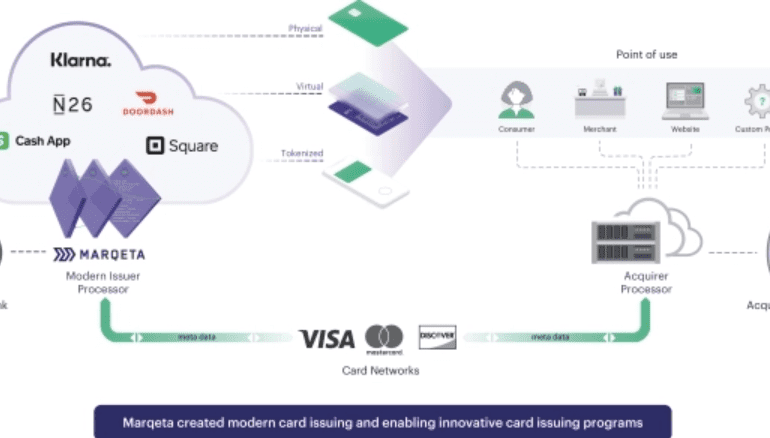

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

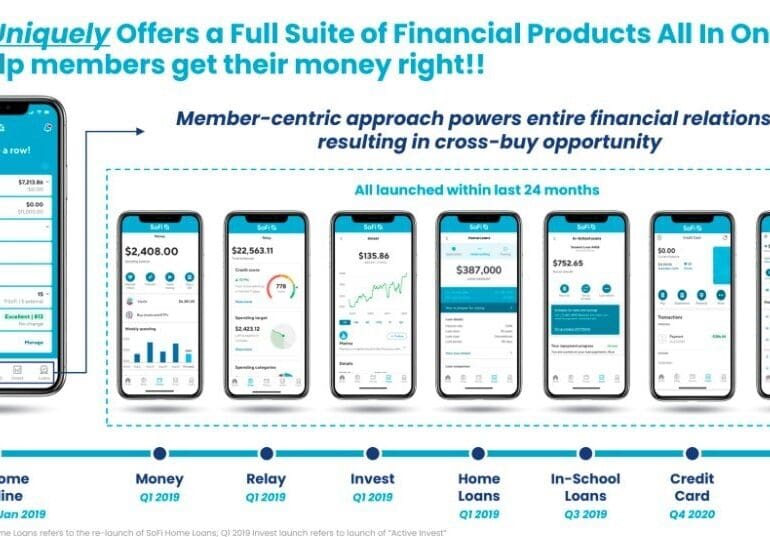

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

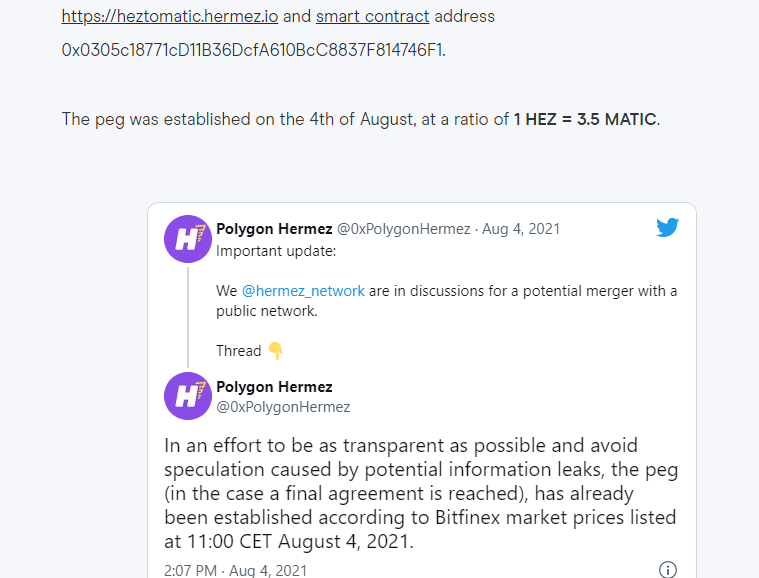

We look at the state of M&A in decentralized protocols, and the particular challenges and opportunities they present. Our analysis starts with Polygon, which has just spent $400 million on Mir, after committing $250 million to Hermez Network, in order to build out privacy and scalability technology. We then revisit several examples of acquisitions and mergers of various networks and business models, highlighting the strange problems that arise in combining corporations with tokens. We end with a few examples that seem more authentic, highlighting how they echo familiar legal rights, like tag alongs and drag alongs, from corporate law.

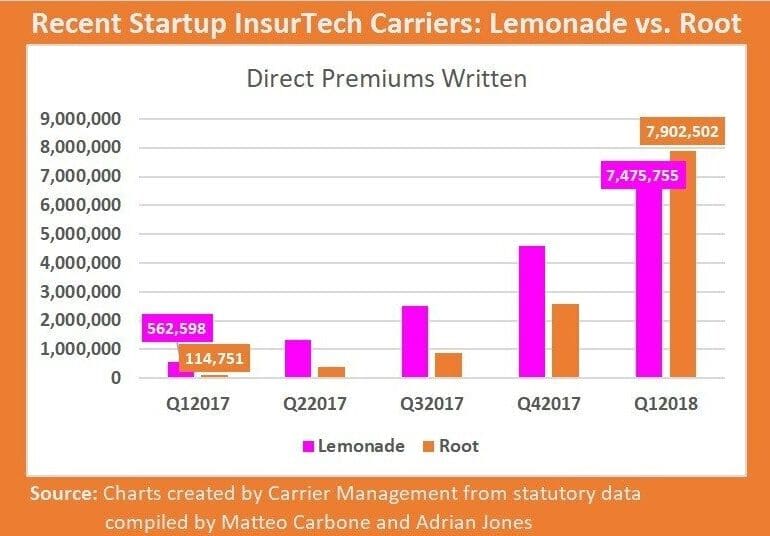

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

This week, we look at:

An overdue analysis of the SPAC structure, reflecting on the $75 billion size and stage of the market

Economics and regulatory paths of going public via investment bankers, SPACs, and direct listings

The marquee teams in Fintech looking to do deals, and what criteria for target selection look like

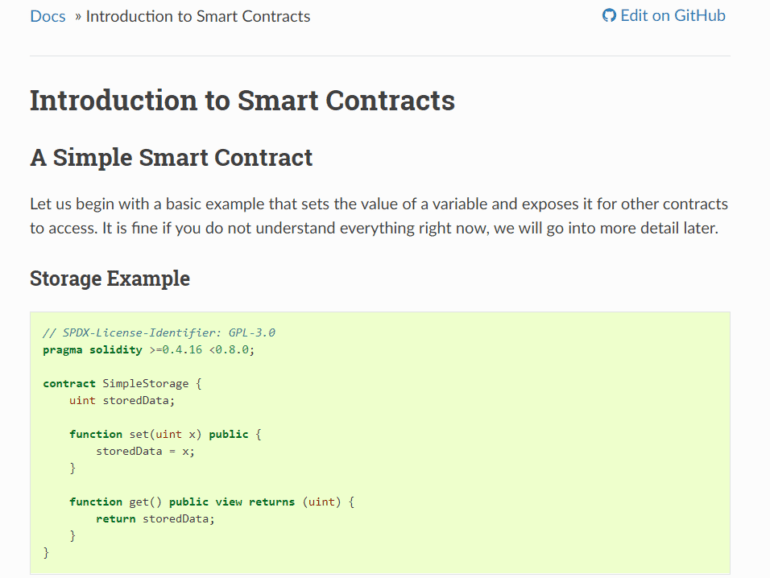

In this conversation, we go through the essentials of Decentralized Finance with Kerman Kohli, who is a serial entrepreneur and the writer of the DeFi Weekly newsletter. We discuss the mechanics of issuing stablecoins, decentralized lending, decentralized exchange, automated market makers, and the increasing complexity of synthetic assets that have grown the sector to nearly $7 billion in August of 2020.