A few weeks ago, Lending Club investors received an email notifying them that Lending Club would be introducing a new feature for borrowers on October 6th. We learned yesterday that the new feature allows borrowers to apply for a joint application Lending Club loan. As part of this feature, there are four new fields that are available in the downloaded notes csv files and the API which we have highlighted below. As for information for borrowers, Lending Club posted a knowledge base article on joint applications.

Lending Club Joint Application – Borrower Information

From the Lending Club Knowledge Base:

To qualify for a joint application loan, a number of factors of either or both applicants are considered, including but not limited to, information provided on the joint application, information provided by credit bureaus, credit score(s), income, debt-to-income (“DTI”) ratio, credit history length and recent credit history.

The maximum DTI ratio for join application approval is 35%, while individual applications have a maximum of 40%. As you would expect, each co-borrower is obligated for the loan payments related to the loan. If one borrower files bankruptcy or passes away, the other borrower is still obligated to pay. These loans are also subject to the Servicemembers’ Civil Relief Act if one of the borrowers is an active duty service member. This offers them several financial benefits and protections. At this time joint application Lending Club loans are only available to borrowers coming through the direct mail channel although Lending Club plans to roll this program out over time.

We reached out to Lending Club to get answers to some of our questions:

Q: When did you start offering joint loan applications? Is this a trial program or something you are rolling out broadly now?

A: Starting today. We will start small and roll it out over the next few months as we refine our operational processes.

Q: How will these loans be graded – using the best credit or some combined credit? What did you have to do to your credit model to accommodate this?

A: Initially pricing and underwriting will be more focused on the ‘primary’ applicant.

Q: Will they be available to all investors or just institutions?

A: All.

Q: Will this allow Lending Club to go deeper into the credit spectrum?

A: Maybe eventually, but that’s not the focus for launch. This is first about fulfilling a top customer request and enabling us to grant slightly larger line sizes through the commitment of two incomes liable for the loan.

Q: Are you using new marketing channels to acquire joint borrowers?

A: Not initially. We’re focused on rolling out to existing channels, and optimizing process before attacking new channels.

Q: Does the joint borrower need to be a family member?

A: No, they just need to be willing to accept responsibility for the loan repayment. That said, our past data would indicate that family members represent the majority case.

Q: Will the expected loss rate be lower given there are two parties on the loan?

A: Our experience would indicate that we will likely see a benefit in credit performance given there are two parties on the loan. The ‘expected loss’ shown on the site will be based only on individual performance, until we see actual performance on joint applications at LC.

Q: What about the impact on your credit model? This seems like quite an adjustment for you and a good opportunity for investors.

A: The initial implementation of the joint credit model was built to be as similar as possible to our individual credit model, with the emphasis of the model on the primary applicant. You will see that the primary applicant meets all of today’s credit requirements (660 FICO, 3 years credit history, etc.) with the exception of DTI. People with high individual DTIs are in some cases given an increased loan amount or incrementally approved, where we find that the joint income is sufficient to cover the joint debts.

New Fields for Lending Club Investors

The new data points center around debt to income, annual income and whether or not the income has been verified. For API users, the four columns are as follows:

| applicationType | It will indicate whether loan application is Individual or Joint. Valid values are “INDIVIDUAL” or “JOINT” |

| annualIncLjoint | The joint annual income if the applicationType is “Joint”. |

| dtiJoint | The joint debt to joint income ratio. This field is populated if the applicationType is “Joint”. Calculated using the monthly payments on the total debt obligations, excluding mortgage, divided by self-reported monthly income. |

| isIncVJoint | Indicates if joint income is verified by LC. Valid valies are NOT_VERIFIED,SOURCE_VERIFIED and VERIFIED |

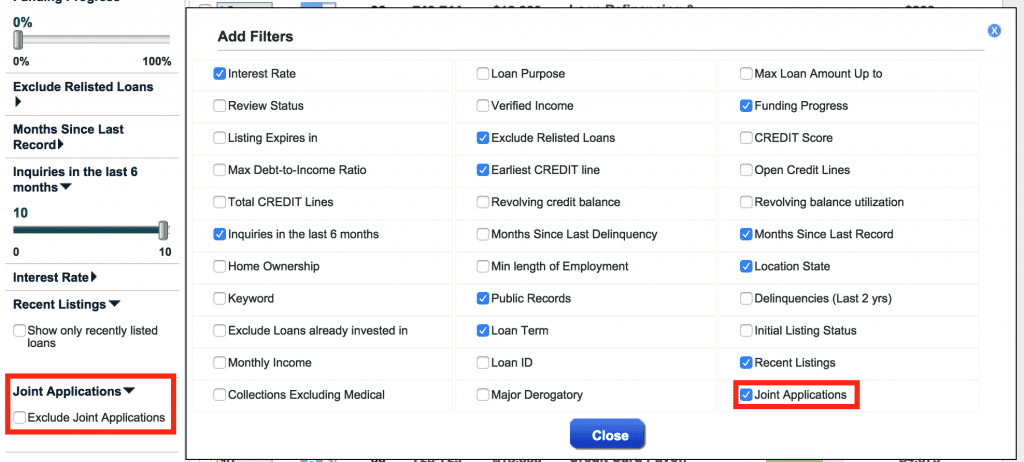

For those who invest manually, you will find one additional criteria as you browse listings which allows you to exclude joint applications. However, it doesn’t look like users will be able to sort by loans that are joint applications, which makes using a third party tool necessary to target these types of loans.

We spoke to the Chief Credit Officer of our sister company, NSRInvest to get some color on what this means for Lending Club borrowers and investors:

For borrowers having equivalent credit profiles, those with a co-signer should experience reduced charge-off rates. These loans should also see lower interest rates overall due to the decreased risk. Ultimately, time will tell how Lending Club prices these loans compared to others and further analysis will have to wait until we have historical data.

The news of joint application Lending Club loans is a natural progression of the Lending Club loan product. Borrowers will be able to get even more affordable rates if they file for a joint application and investors should be able to invest in these types of loans with more confidence.

What do you think of joint application loans with Lending Club? Will you alter your filter criteria to include or exclude them? Let us know in the comments!