What the long-awaited IPO means for late-stage fintech

Though its Form F-1 filing with the US Securities and Exchange Commission (SEC) came at an unusual time, Klarna’s IPO intentions have been far from secret. The Sweden-based Buy Now, Pay Later (BNPL) giant, founded in 2005, has crawled in fits and starts toward a place in public markets.

That slog toward an exit has involved painting a compelling growth story—one that can convince investors of Klarna’s long-term viability, despite frightening market overhang, Succession-esque internal turmoil, and some high-profile down rounds. In addition to Klarna founder and CEO Sebastian Siemiatkowski’s incessant and empirically debatable pro-AI rhetoric—which taps into market enthusiasm for artificial intelligence—the company has made a deal with an Elliott Investment Management subsidiary to offload BNPL loans in the UK to free up capital, made public overtures to President Trump with the goal of obtaining a banking license, and, on Monday, announced a major tie-up with Walmart (to BNPL competitor Affirm’s chagrin).

In aggregate, these strategies may suggest to investors that Klarna is forward-looking, technologically savvy, managerially clairvoyant, regulatorily sound (if not lucratively in cahoots), and tapped into varied pipelines and partnerships.

That narrative has played a growing role in Klarna’s long-term prospects since 2022, when rising interest rates and attendant investor expectations caused Klarna’s valuation to plummet from $45.6 billion to just $6.7 billion.

The filing comes at a time when fintech’s public market favorability has been in question, despite signs of green shoots. Just last week at a Fintech Meetup panel in Las Vegas, Arvind Purushotham, Global Head of Citi Ventures, commented that fintech had been “a little bit more badly hit than the rest of the tech sector” since interest rates began to rise, because rates affect lending in addition to “all kinds of equity.” At the same time, Purushotham said “a long-term point of view” and a “sustainable business model” can let “good things happen.”

Well, complemented by its growth story, Klarna’s numbers may suggest it’s holding onto a sustainable business model:

- Total revenue: $2.8 billion (+24% YoY)

- Gross merchandise volume (GMV): $105 billion (+14% YoY)

- US revenue: $850M (+39% YoY)

- Take rate (revenue/GMV): 2.7% (up from 2.3% in 2022)

- Net profit: $21 million

- Net profit margin: 0.7%

Klarna’s strong year of top-line growth and accelerated revenue are a far cry from the nine-figure losses it posted in prior years. This kind of pivot reflects and drives rebounded private-market valuations. But why go public—especially now?

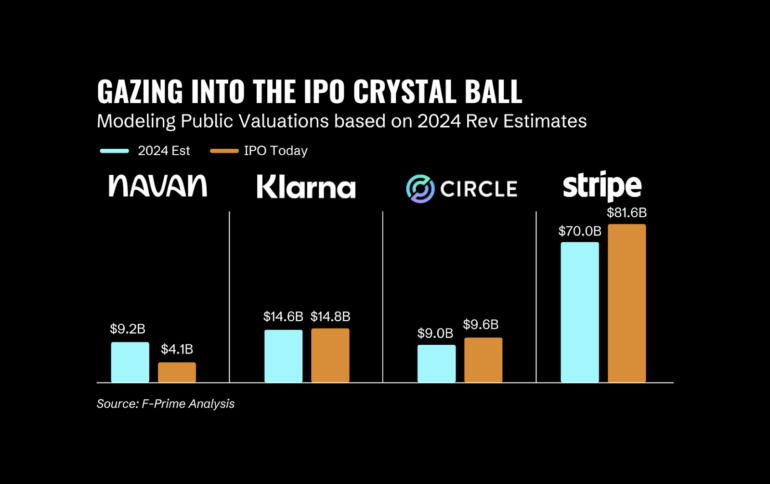

“Klarna’s IPO filing comes at an interesting moment—on one hand, market volatility remains a challenge, but on the other, fintech investors see this move as long overdue and are eagerly anticipating its outcome,” Sarah Lamont, Senior Associate at F-Prime Capital, told Fintech Nexus. “A successful IPO could renew confidence in the fintech sector and potentially open the door for other long-awaited fintech IPOs, such as Chime, Circle, and Stripe.”

According to Heather Gates, Managing Director with Deloitte & Touche LLP, “momentum is starting to build” in fintech investment. “Late-stage fintech deal sizes surged by 25% for VC and 109.9% for venture growth investments in 2024, signaling investor focus on more mature, IPO-ready companies,” Gates said. “If those early IPOs perform well, it could open the door for others.”

Klarna’s IPO isn’t just about Klarna’s long-term prospects. VCs are using the BNPL giant as a bellwether for their other investments and their practices writ large, gauging whether the multiples they use to gauge value possess the fidelity they think they do—including in volatile markets.

“One key performance indicator VCs may watch is whether Klarna can surpass its last private market valuation of $14.6B in the public markets,” Lamont said. “Klarna’s public peers in the lending sector were trading at 6.6x EV/LTM revenue at the end of Q4 2024. With Klarna’s estimated revenue at $2.8B, a comparable multiple could put its public valuation at $18.5B—a ~$4B premium over its last private valuation.”

Klarna’s intentions to become a bank in the US—the way it is in the UK, for example—may further buoy its valuation. If a coming wave of fintechs secure banking licenses, as many market experts predict under Trump deregulation, Klarna has another revenue stream and growth story to pin to its narrative as it sits on the cusp of public trading. Whether fintech ebullience can sustainably break away from larger macroeconomic gloom remains to be seen.