Lama AI, an intermediary SMB lending exchange for banks, announced a $9 million seed round led by Viola Ventures and Hertz Ventures.

Lama AI’s technology empowers banks, fintechs, and other industry players to tap into the fastest and most efficient access to bank-rate credit opportunities, including term loans, lines of credit, ABL, factoring, letters of credit, SBA loans, and more.

Omri Yacubovich, Co-Founder & CEO at Lama AI, said that most SMEs need capital but can’t get it reasonably priced.

“Eight out of 10 small businesses that seek capital for growth, working capital, hiring, seasonality or any other reason get rejected by their primary bank, in many cases, despite being a loyal customer for many years,” Yacubovich said. “Not only are the borrowing processes required by traditional financial institutions lengthy and demanding, the industry, as a whole, struggles in assessing risk for small businesses.”

Bad at risk means a high cost of capital

Yacubovich said that Lama AI’s marketplace solution beats alternative lending because they set up providers like banks with existing demand. He said that working with banks to provide access to some lending lowers the cost of capital and the cost of funds for the business.

“Alternative lending is no solution because their cost of capital is so high, and their acquisition costs are also high, and retention rates low, and eventually they only serve a specific niche market,” Yacubovich said.

“We killed the cost of acquisition because we’re tapping on existing demand and kill the cost of capital because we’re working with banks.”

The round also includes Foundation Capital and SixThirty.

Foundation Capital is an early-stage venture capital firm founded in 1995. With over $3.5B AUM, with investments in Netflix, Solana, Current, Lending Club, and Sunrun. SixThirty is a global venture capital firm that said it works with the bold on big ideas in fintech, insurtech, and digital health.

Lama AI connects its bank partners to a wide variety of embedded lending opportunities, acting as a growth engine for their commercial lending business, the firm said in a release. Using Lama AI’s Exchange API, bank partners seamlessly lend to a broader range of existing customers without taking unwanted credit risk onto their balance sheets.

Yacubovich said it works by connecting any type of bank, like community banks, to SaaS platforms. They both need something, he said. One side can’t monetize, and one can’t underwrite.

“They have 80% rejection rates, meaning they’re behind on opportunities and can’t monetize it. On top of that, we’re connected to the SaaS company matrix, and they don’t know how to build and model data.”

For example, if they need a warehouse facility to fund, the capital is expensive and has its own criteria. Instead, Lama is bundling everything together in one place at bank rates.

“This is all made possible through our unique, collaborative approach with all of Lama’s network participants.”

AI-powered

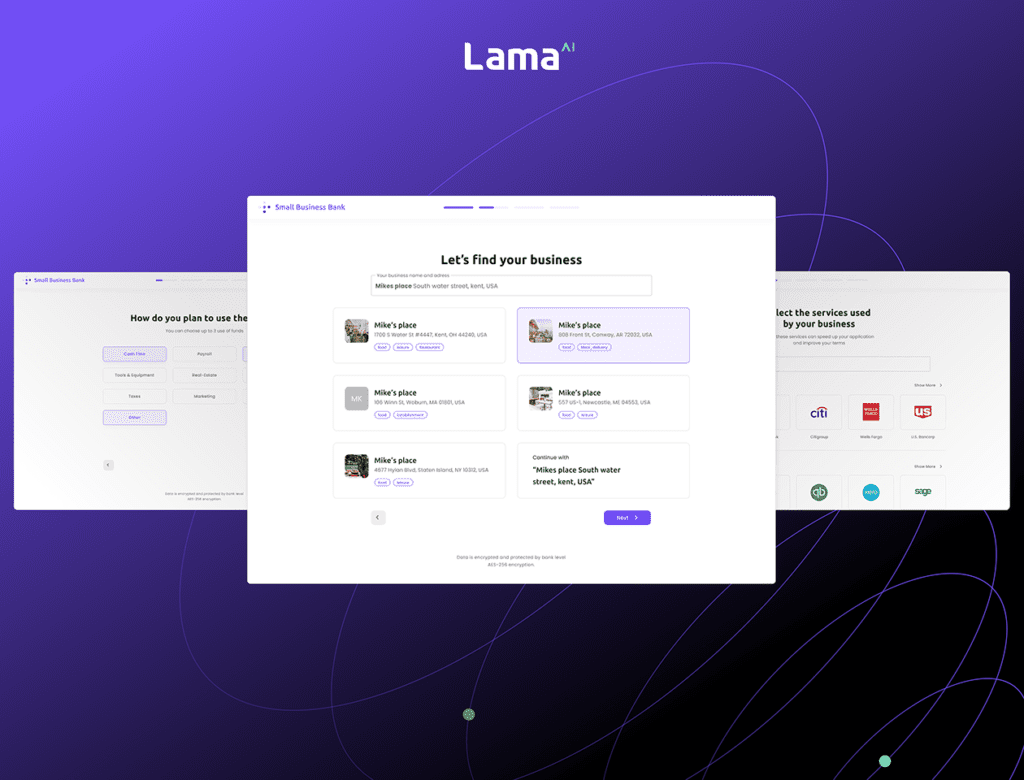

The Lama platform is AI-powered, and the company said it enables its partners to onboard customers faster than ever while offering a wider range of financial products without compromising target risk levels.

Lama AI said fintech partners avoid the need to build their lending infrastructure and models and secure credit facilities while enjoying significantly increased approval rates.

“We turn what is often ‘mission impossible’ into a simple, easy, and business-friendly approval,” Yacubovich said. “Our solution equips our bank partners with superior digital flows and streamlined processes, ensuring accurate underwriting data and insights alongside a meaningful extension to their current credit box and product offerings.”

Senior lending executives also joined Lama AI’s advisory board, including Kathryn Petralia, Co-Founder of Kabbage (acquired by AmEx), Dror Yosef, former GM, CDO & CTO of Fundbox, and Mike Persichini, a long-time banker and former VP of Strategic Partnerships at BlueVine.

Related: Fintech Franq raises $12 million in Series A extension

The investment round was also joined by senior fintech executives, including Shai Stern, CEO of Checkalt, a leading treasury management company, Nathaniel Harley, Co-Founder & CEO of Mantl, a leading provider of account origination solutions for banks and credit unions, and Elad Tsur, Co-Founder & CEO of Planck, a leading cognitive business analytics focused on the small-medium business segment.

Lama AI’s initial focus is on the U.S. business banking market. Based on pilots conducted with several U.S. financial institutions, the firm said that Lama AI’s platform improves a typical bank’s deal-flow acceptance rate by 300% and reduces the intake process from months to days.

Confidence instilled

Yacubovich said the best part of the funding was the confidence instilled in the brand by multiple industries and VC hard hitters.

“After Money 20/20 last year, with a bunch potential partners, and told a couple of potential investors ‘you know we might raise next year,’ and within two weeks saw term sheets, and within a day saw three competing term sheets,” Yacubovich said. “It took three weeks for the initial closing, but I wanted to hand-pick the strategic partners.”

Pavel Livshiz, General Partner at Hetz Ventures, said that embedded finance would soon be trillions in valuation.

Hetz Ventures is a leading Israeli seed-stage venture capital firm that said it takes a thematic approach to early-stage investing, with nearly $300M under management.

“The value of the embedded finance market is expected to exceed $7 trillion over the next ten years,” Livshiz said. “We believe that the chartered banks that will continue leading in financial services are those that focus on innovation, collaboration, and new types of synergies. Lama AI solves all of the above, with a strong focus on the success of small businesses, which is a substantially underserved market segment.”

Omry Ben-David, General Partner at Viola Ventures, said SMBs remain underserved despite fintechs best efforts. Viola Ventures is part of the Viola group, Israel’s leading tech-focused investment firm with over $4.5B AUM, founded in 2000.

“Omri, Ran, and the Lama AI team have introduced an effective exchange that optimizes and digitizes the underwriting process and increases the overall accessibility of capital coverage for SMBs,” Ben-David said. “Essentially automatically delivering the optimal capital source from endless permutations seamlessly. Win-win-win.”