The fintech will operate in Panama, El Salvador, Guatemala, and Mexico, where it plans to become an ally of the region's underbanked population.

Plurall, a Colombian Fintech firm that's focused on enhancing the financial inclusion of Solopreneurs, finalized a pre-seed round by securing $1.5M.

Four months after launching, Colombian fintech Plurall raised $20 million in debt from Fasanara Capital, a London-based global fund.

Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.

The investment, which was made in two parts, will serve to expand Kala's commercial and engineering team, as well as lay the groundwork to take its operations to other parts of LatAm.

Druo's technology creates an ecosystem that enables B2B users to charge or pay directly to any bank account without having to go through the complex network of financial intermediaries.

Nomad, which offers dollar accounts to Brazilians, will now allow its customers to pay in installments for purchases made abroad.

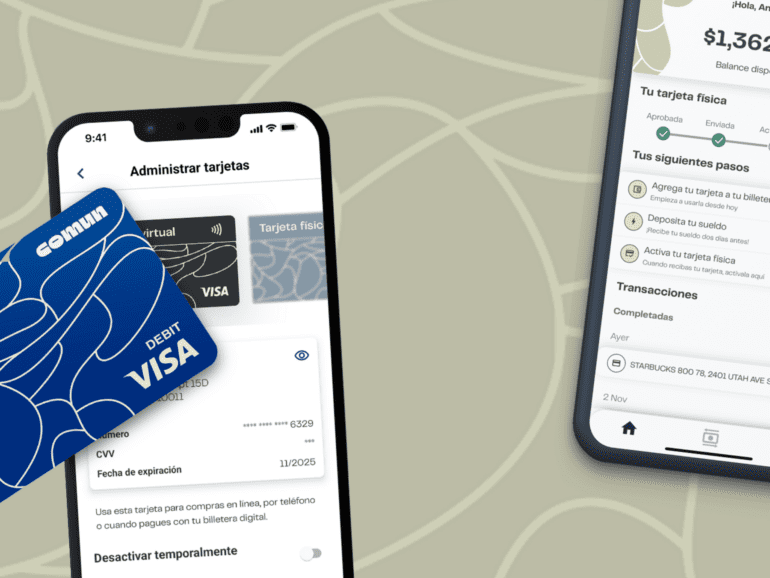

Comun's seed round was led by Silicon Valley fund Costanoa Ventures and included participation from South Park Commons and FJ Labs.

Both Tencent and SoftBank have invested in the company called Ualá which is seeing massive growth during the coronavirus crisis;...

After several months developing, leading financial group Credicorp launched its digital banking unit iO to cater to young Peruvians.