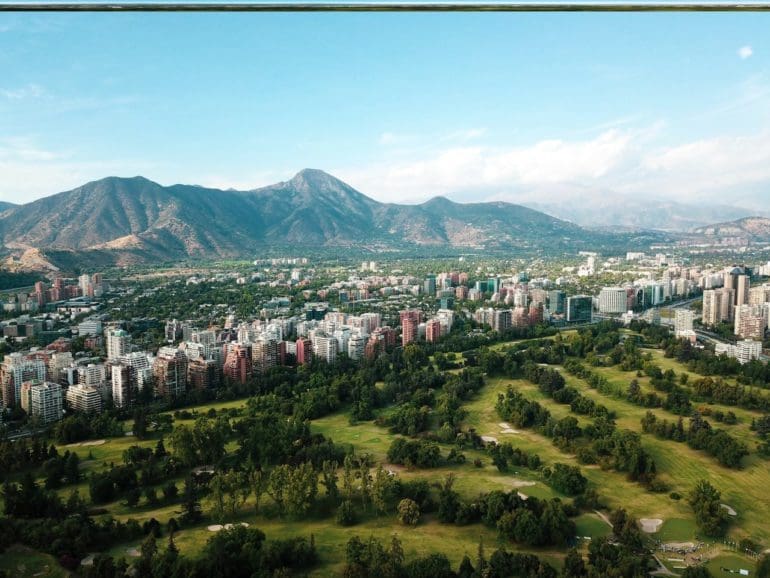

As Chile await for the fintech law to come into effect, experts spoke to Fintech Nexus on its likely impact in the financial sector.

Fintechs are diversifying to survive, adding solutions to monetize their customer base and reduce dependence on riskier lines of business.

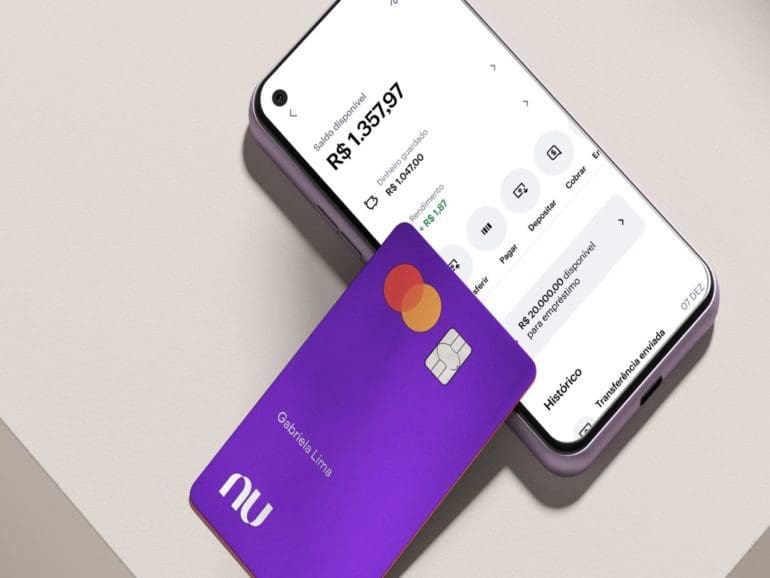

The Central Bank of Brazil announced a new string of regulations that would demand higher capital reserves for large-scale fintechs.

By the end of 2020, the Central Bank of Brazil launched its own instant payment system, called PIX, with the ambitious goal of speeding up and facilitating transactions.

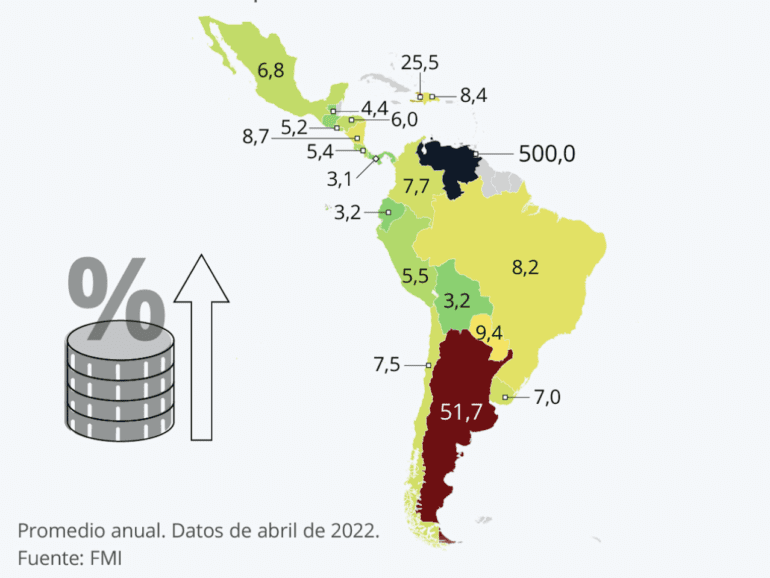

LatAm is seeing skyrocketing inflation and DeFi could mean survival for many citizens, but how can adoption be maximized?

iCred will use these resources to expand its operations and enter the payroll loan market for the beneficiaries of the social security fund.

The IMF said Brazil's Digital Real could reap the benefits of blockchain technology and compete with privately-issued stablecoins.

Nubank and Banco Inter are moving away from the local stock exchange, while other Brazilian fintechs skip the market altogether.

The fintech industry urges the government to expedite the procedure, contending that the current legal framework is impeding growth.

Instant payment system Pix has overtaken credit and debit cards as the most used means of payment in Brazil.