Kredito was founded in 2018 to create a solution that would provide "fair interest rate" loans to startups and small-cap companies.

Franq's Series A extension was led by Quona Capital and had the participation of Globo Ventures and Valor Capital Group.

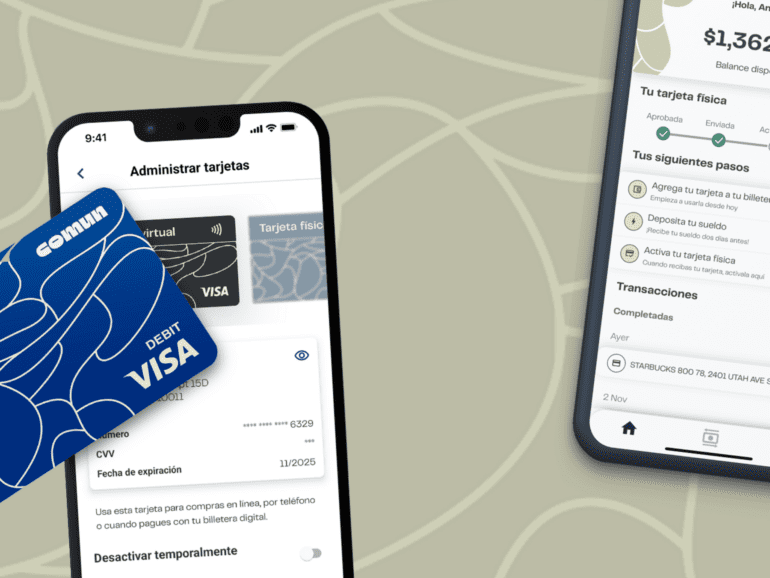

Comun's seed round was led by Silicon Valley fund Costanoa Ventures and included participation from South Park Commons and FJ Labs.

By December 2022, PagSeguro had 28 million customers, making it the second-largest digital bank in Brazil.

Brazil and India are leading instant payment growth, with Pix and UPI accounting for over a third of total instant payments worldwide.

The Mexican operation represents Nubank's second-largest market and is seen as a strategic target in the company's internationalization plan.

A report reveals that 9 in every 10 SMBs in the region are currently underserved. This presents an opportunity for Latin American fintechs.

In Buenos Aires, presidents Lula da Silva and Alberto Fernandez said a trade common currency would help reduce dependency on US dollar.

After almost a year in the back seat, the fintech law in Chile is now approved in Congress.

Founded in 2021 by Shanxiang Qi and MengKe 'MK' Li, Liquido recorded more than $300 million in transactions since its launch.