Nubank and Banco Inter are moving away from the local stock exchange, while other Brazilian fintechs skip the market altogether.

After the FTX crash rocked the crypto world, Brazil was one of the fastest nations to adapt to the new scenario. Now what's next?

Credit granted by fintechs in Brazil reached 55 billion reais in 2021, up tenfold in the 2016-2021 period, according to Serasa Experian.

E-commerce is quickly catching up in Latin America, providing fertile ground for digital payments to proliferate.

For Aviva, this round stands out as one of the largest for this investment stage in LatAm after the difficulties of the second half of 2022.

Last month, PicPay launched peer-to-peer lending for companies, a major innovation in a bid to enhance the product suite.

AltScore is planning to use the resources raised to boost its integrated credit platform in Latin America.

Three years after a prosperous US IPO, uncertainty in global markets has taken a toll on XP, with its share down 50% year to date.

Syncfy's platform enables API access to financial data from more than 125 different financial institutions in LatAm.

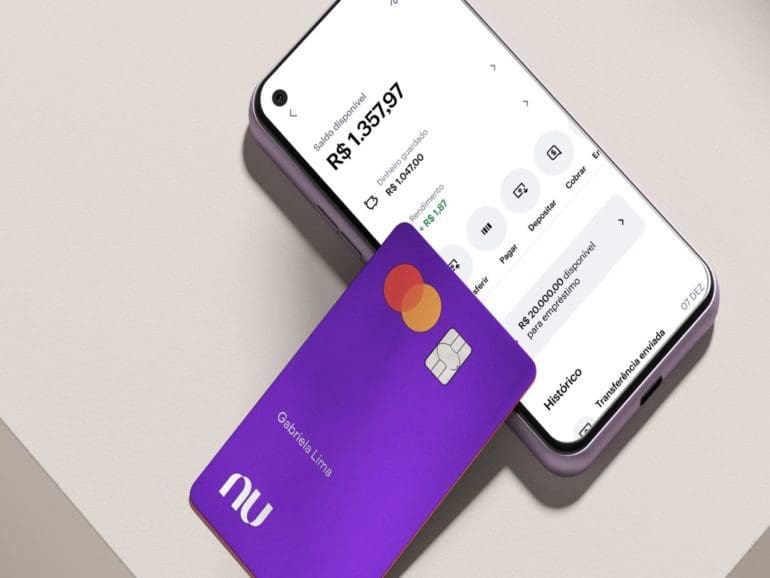

The Mexican operation represents Nubank's second-largest market and is seen as a strategic target in the company's internationalization plan.