Nubank accelerates its Mexican expansion with personal loans, tapping into the country's promising growth prospects.

Transfeera, a banking-as-a-service provider in Brazil focusing on B2B transactions, raised $ 1.3 million this month in a series A round.

Binance parted ways with Mastercard in Latin America, marking the end of one of its most popular products in the region.

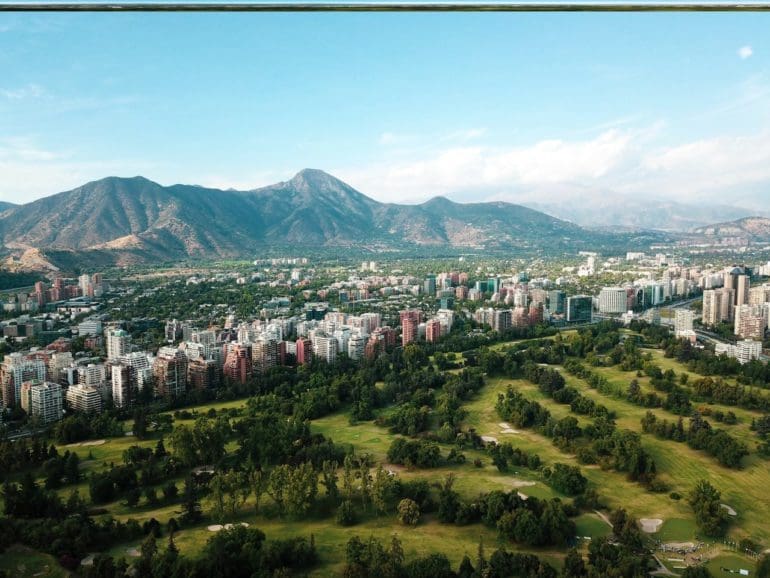

As Chile await for the fintech law to come into effect, experts spoke to Fintech Nexus on its likely impact in the financial sector.

Digital bank G10 is the first of its kind in a Brazilian favela, low-income areas which together account for roughly 17 million citizens.

Revolut, one of the largest digital banks in the world, has announced plans to expand its business to Latin America’s largest markets.

Latam regulators show growing interest in the technology that powers cryptocurrencies. Brazil is to begin pilot tests for its CBDC this month.

In a complex scenario for Latin American startups fintechs in Argentina push forward with plans for international expansion.

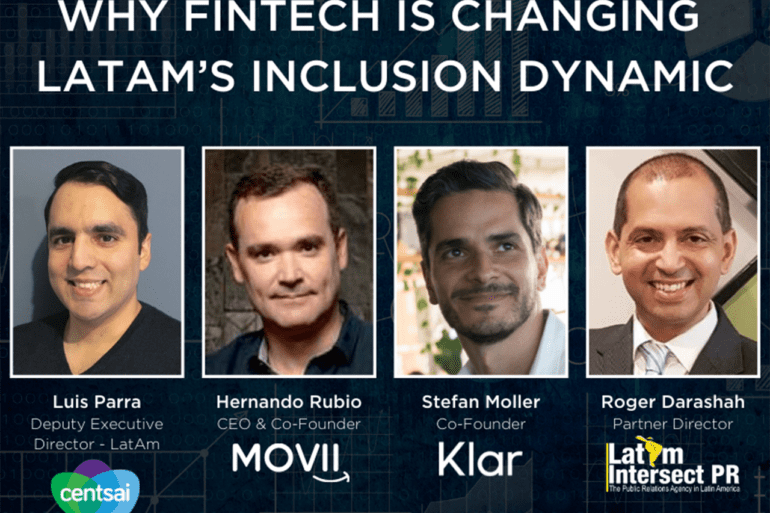

The report found that the traditional playbook of developing branches and building relationships may count "for little in a world where a mobile phone is the principal' real estate', and word-of-mouth – often via social media – becomes the most powerful form of validation."

Last year, 16 fintechs were authorized in Mexico. Among them, Albo, Belvo, Todito Pagos, Mercado Pago and Femsa's Spin by Oxxo.