This is the first acquisition in the history of the Open Finance platform, which was created in 2019 by Pablo Viguera and Oriol Tintoré.

Brazilian Nubank reached 79.1 million customers in Latin America by early April. That is up almost 20 million compared to a year ago.

The resources from the new investment, according to the fintech's CEO, will be used to reinforce the team of engineers and invest in the development of new products.

The fintech will operate in Panama, El Salvador, Guatemala, and Mexico, where it plans to become an ally of the region's underbanked population.

Mercado Libre will hire 13,000 new jobs this year, bucking a lay-offs trend. Most of the new employees will be based in Mexico and Brazil.

PicPay stated that, before reaching the market, the solution went through tests for eight months with 10,000 company and partner employees.

Pix achieved the milestone of 3 billion monthly transactions in March, up from a previous record of 2.8 billion by the end of last year.

After several months developing, leading financial group Credicorp launched its digital banking unit iO to cater to young Peruvians.

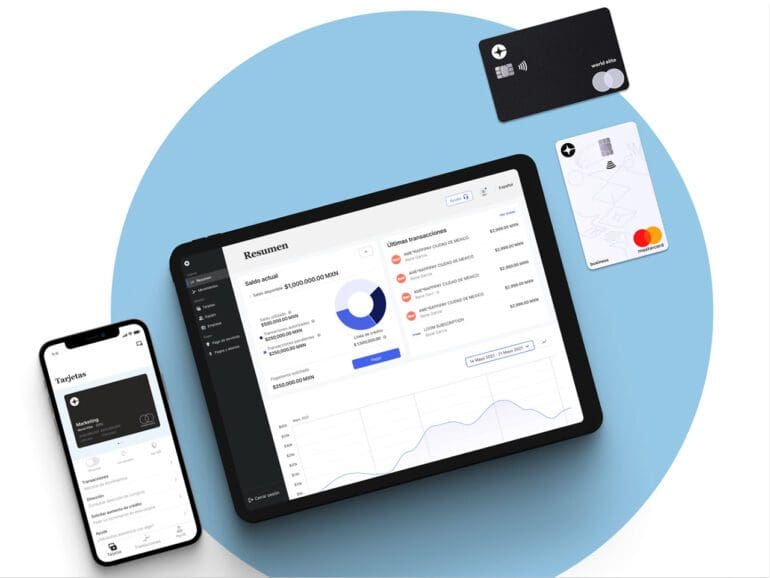

Belvo will provide access to employment data at the Mexican Social Welfare bureau. It could be a key driver for lending to the underbanked.

Driven by fintech revenue, Mercado Libre booked $201 million in net income in the period, up from $65 million in the year-ago quarter.