Banco Bradesco, a massive player in Brazil's loan market, announced plans to expand in Mexico, Latin America's second-largest economy.

Facing tighter financing conditions, several financial technology companies in Latin America have accelerated mergers and acquisitions plans.

Ebanx announced the expansion of its operations to the African continent after acquiring an essential presence in 15 Latin American nations.

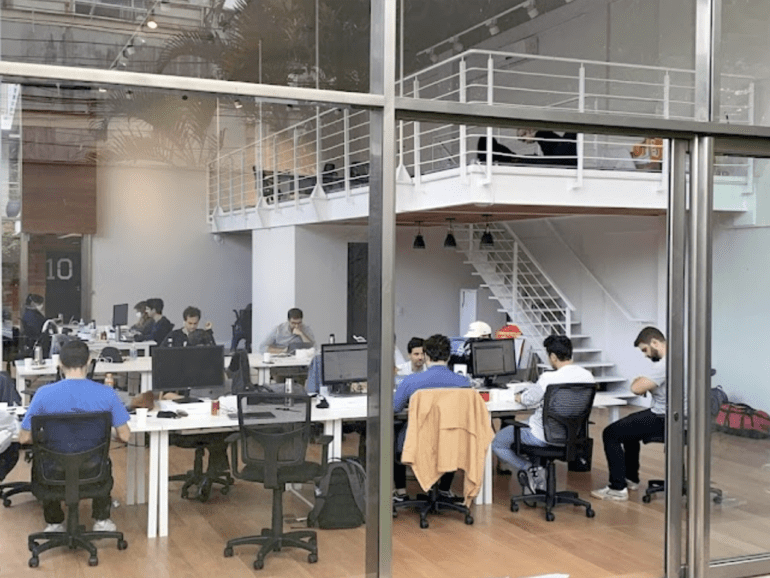

Companies around the South American country are driving a movement towards the "fintechtization" of the sector.

Across Latin America, fintech lenders are accelerating profitability strategies amid growing pressure from markets to yield profits.

Mercado Libre launched Mercado Coin, its first-ever token that will be initially available in Brazil as part of its loyalty program.

Last month, Citi Ventures, the U.S. bank's VC unit, announced an undisclosed investment in Belvo, a Mexican open banking infrastructure firm.

Creditas made a bold acquisition in the context of uncertainty, as valuations for many fintechs plunged amid rising rates and volatility.

After almost three years of operation, Ank, Itau's digital banking enterprise in Argentina, is moving closer to a shutdown.

Nubank announced it had expanded its customer base sixfold over the past year, reaching a total of 2.7 million customers from 0.4 million.