MIAMI, Fla. — One of the biggest challenges for a fintech is to develop the technology needed to outperform the incumbents in the financial chain.

For Gerry Giacomán, Co-founder and CEO of Clara, it’s all about choosing the right path for the company to take its product.

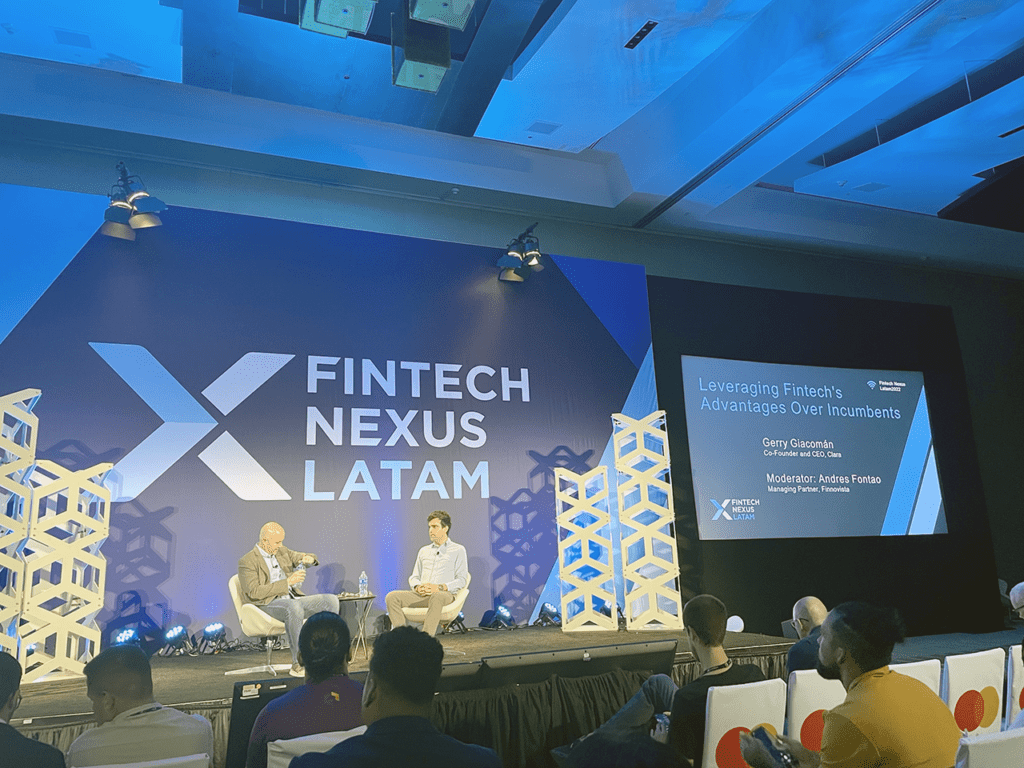

“There are intermediaries in the supply chain, such as MasterCard, that have enough money to control the chain, that is relatively hard to replace. But there are several other intermediaries with which you have to make a decision if you start putting your engineering bandwidth at some point,” Giacomán said at fintech Nexus’ LatAm 2022 event. “Do you start processing yourself? Do you start using an intermediary to Make ACH transfers? Is it a matter of doing it yourself?”

A path to reducing transactional expenses

According to the executive, these decisions have an essential impact. Although it does not make life easy for fintechs in an initial period, they tend to pay off in the long run, as building a transaction product with a solid architecture, for example, enables companies at a certain point to cut out several intermediaries from their operations and reduce their transactional expenses, to subsequently scale the margin for growth.

“At the end of the day, that is what we need in this environment,” said Clara’s CEO.

“If we haven’t made architectural decisions from years ago, it’s very unlikely that we could have said, like, ‘hey, let’s set up an engineering column’ or ‘let’s take integrity seriously’. We made the very painful choice of taking it very seriously early on, which doesn’t make your life as a CEO super easy most of the time. Still, now I believe that we’re in that position of reaping the benefits and knowing that those folks (the intermediaries who helped architect Clara’s system) are capable of delivering in that integration,” commented Gerry Giacomán.

Democratizing credit for an underrepresented sector

Founded in March 2021 in Mexico, Clara is a fintech that offers small and medium-sized companies in Latin America a comprehensive expense control platform accompanied by a corporate credit card with no cost, no commissions, and no handling fees.

In eight months since its creation, the company became a unicorn, the faster Latin American startup to obtain this designation. This after raising a $70 million Series B round led by Coatue, an investment firm behind companies such as ByteDance and Bitso.

And just one year after being born and reaching a valuation of more than $1 billion, the Mexican firm started operations in Colombia and Brazil – one of the largest regional markets for the type of services that Clara offers – in the last few months, while its expansion plans already point to other Latin American territories, such as Argentina, Chile, Panama, Peru, and Uruguay.

Related:

Clara offers corporate credit cards, a solution based on the Interbank Electronic Payments System, and a platform for managing payments to suppliers, as well as expense control and short-term financing for the companies that use its services.

Clara has become a revolutionary technological solution with enormous potential in a vibrant developing continent.