Last Monday night, in the upstairs of Ludlow House in the Lower East Side of Manhattan, ARK Invest‘s Cathie Wood and the Co-Founders of the Titan investing app hosted a celebration to launch the ARK Venture Fund. The fund enables retail investors to participate in a mix of private equity and public investments for a buy-in of $500.

Wood, a long-time champion of innovation investing, said the idea came primarily from ARK’s loyal investing customers, who have shocked Wall Street by sticking to her premier ARK Innovation ETF through a meteoric rise and dramatic fall. She spoke during a small fireside chat with Clay Gardner and Joe Percoco, Co-founders and CEOs of TItan, to an invitation-only crowd of ARK employees, finfluencers, and industry friends.

“Our clients have been asking us, and their feelings are: ‘Why don’t we have a shot at these companies that are 10 baggers 100 baggers, just because we don’t need an income or asset threshold,'” Wood said. “‘We know more about these technologies than probably most institutional investors; if accreditation were based on knowledge, we would be the accredited investors.’ So we’re responding to requests from our clients.”

Most Venture Captial Funds gatekept buyers, like the venue that night gatekept guests on the street before a restaurant worker let them in. As only accredited investors or institutions, and Wood said often, the capital requirements are over $5M. The new venture fund offered exclusively through the Titan app, will provide exposure to a 70-30% split of private and public companies, with a 2.75% management fee, to retail investors only.

She said ARK’s retail investors didn’t have the cash for accreditation but believed more and knew more about innovative tech and startups.

Averaging down with us

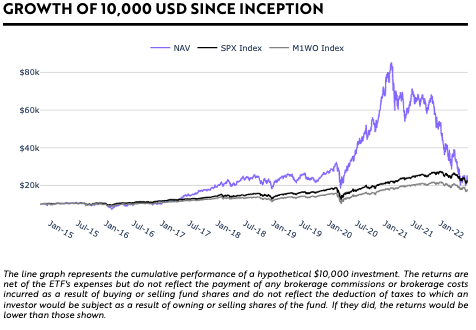

ARK and Wood are well known for betting on tech innovation across multiple funds that quickly won investor favor. As the pandemic raged, tech stocks like Tesla exploded, sending ARK up 360%. Wood said at the time, they could do no wrong, the media loved them, and traditional managed funds hated them, and as the fund returned from orbit this past year, the anger set in.

Drawing eyes to her on the small stage, Wood sent gazes back two years to the beginning of the pandemic, when the market crashed more than 40% in a month. Meanwhile, she said her team was beating the drum, marketing their funds on the tube, with the tagline “innovation solves problems,” and soon they looked like geniuses.

“We’re up 360% in less than a year: Innovation did solve problems,” she said. “From that point, after our peak in February 2021, we could do no wrong; everyone wanted to talk to us. I told my team to watch out; this usually means we’re going to underperform for a time. Today we can do nothing right.”

The fund’s top holdings, now at a cool $7.9 billion AUM, are in tech stocks like Zoom, Tesla, and Roku, biotech like CRISPR Therapeutics, and cryptocurrency firms like Block. Favorites of the stay-at-home economy and trendsetters in 2020, but underperforming today, with the rest of the down market.

Though planning to launch the ARK Venture fund through Titan in February, she said the media called the partnership a money grab due to ARK’s down performance, “I mean, talk about low expectations,” she said. “If we do anything right, we’ll get publicity for it, but we’re not changing anything. We are researching every day and picking companies that will change the world.”

Titan Venture with Momma Cathie

Still, investors love the product, she said, and stick to the ARK funds with a tenacity that eschews traditional finance and a world of outdated metrics. Many investors of the superstonk and Wallstreetbets short-selling craze call her “Momma Cathie.”

“We’re responding to requests from our clients, and I’ll also say we are so grateful to our clients who have been averaging down with us,” Our net retention, I think, has astonished the industry.”

The fund launched in 2014 but ballooned to over $50B AUM in 2021., Wood said it was a level beyond Fidelity, closer to Schwab ETFs, and faster than any other firm has raised money before. Though retreating since then, she said the new platform is a type of fan service for anyone who believes in American innovation and wants in on the action.

Gardner said they partnered with ARK because of that shared vision. The pair founded Titan in 2017, a curated investment app for stocks, credit, and crypto backed by Andreessen Horowitz. Titan built a VC retail product styled as an interval fund that allows users to invest and cash out 5%-25% of their money at a time.

Other Interval funds are ‘ugly’

Gardner said there are funds like it on Schwab and Fidelity, but they’re ugly and unintuitive. He described private equity and stocks as offerings on a restaurant menu and different types of funds as a way to “plate” those complex offerings in a liquid way. While other interval funds exist, none were built with retail in mind, Gardner said.

“We’ve learned that you have to build the product with the retail investor in mind for anyone to adopt it,” Gardner said. “It’s been great the last six to nine months building this venture product.”

VC is not an income product or a trading product, but a buy and hold for five or ten years product, Garnder said, and he thanked the Titan team for successfully transforming that lithic model into an invisible fund.

He said they were laying the underwriting groundwork for competitors to come into the space after them but welcomed the challenge.

“We are not concerned about it now; I would welcome more people to democratize these sorts of vehicles,” he said. “But I would caution folks; really, if you’re going to build a product like this, you have to think from first principles in the shoes of a user because it’s been tried and failed before without having that perspective.”

Launching a fund in the year of our lord 2020+2

“There could be no weak link in the launch,” Percoco said. “With the state of the markets, how often do loved ones or friends come up and ask, ‘what should I do with my money?’ That turbulent, recessionary market that saw a splurge in tech investing a year ago now has the retail consumer running for the hills with their capital, Percoco said. “They’re going to stick it in their bank account if anything makes them worried,” he said, so the fund launch had to go off without a hitch.

“It’s knowing how to get the fintech plumbing right,” Percoco said. “How to make sure you balance that performance technology, that deep understanding of the regulator environment Katy was sharing about, and understanding retail psychology.”

Percoco said the thinking of Titan products is with the contemporary apps that end retail actually uses. Working with the ARK team, they went to the whiteboard and designed an intuitive process like using TikTok or Insta stories, he said.

“With present financial products, you go to Schwab or a different account, you literally type a four-letter ticker,” he said. “Theres a number, there’s a chart, that’s it. It’s a black box, while we have an entire team working hard to identify how to create a user experience that is not just a black box.”

Why start something new now:

Going back to the founding of Titan in 2017, he said they got 100 no’s in the initial seed round before they heard a yes, and the first was from one of their grandmas. Their pitch was always the same, he said, that today is the revolution of financial instruments. Plotting over the hundreds of years of technology, financial instruments went from Phoenician ships sailing on the Mediterranean to high-net individuals using pen and paper for IOUs.

“You can summarize it as we’re involved in 3.0 right now,” he said. “Without boring people on history, wealth 1.0 was high net worth individuals using pen and paper, investing in anything they wanted want in the world. 2.0 was high net worth individuals, not pen and paper. 3.0 Is everyone using technology on everything in the world.”

He said that financial institutions had been left behind in the tech revolution compared to every other category. Media has Facebook, commerce has Amazon, but fintech is stubbornly behind, Percoco said.

“We’re super excited as we see the seven or eight trillion market cap in financial institutions today that have not yet been disrupted,” he said. “It’s one of the largest major categories where the technology player hasn’t yet won the category. But for some reason, financial technology remains stubbornly behind, and there are reasons for that, like regulations, and it should move slightly slower. But for us, if you’re a long-term investor, as Cathy was saying, We’ve never been more bullish.”

Where does the optimism come from

A question from the panel hosts, “Where does the optimism come from,” Wood said in her experience, “the best time to start a business is during the bad times.”

“I think the tech and telecom bust and the ’08-’09 meltdowns have caused a shift away from research and toward benchmarking and quantitative analysis, not fundamental research, but quantitative research,” Wood said. “The inefficiencies now in the market are incredible. I have never seen a wider gap between truth, between where the market is and where reality will be in the next few years.”

ARK’s research team is the pride and joy of the entire firm, led by futures Bret Winton, Wood said, and predicts immense growth in the market for innovation. They believe that in 2030, disruptive innovation will make up 60% of the global equity markets, with a value of $210 trillion.

“We expect mass market opportunities out of about five innovation platforms, and many of you probably know: multi-omics sequencing in the life sciences; space; robotics; energy storage; artificial intelligence, and blockchain technology,” she said. “I think the most powerful thing that’s happening that the markets are missing is that these platforms are converging.”

That’s one expensive fund.

Compared to other funds, the venture fund from ARK is expensive. It has a higher management fee of 2.75%, and additional costs bring the fee closer to 4.22%. Standard ETF funds, like S&P trackers, are closer to 0.1%; Vanguards is 0.03%. Even among interval funds, it’s an expensive product, but the ARK and Titan team said it is because their research, investing network of VC funds, and ease of purchase make it worth it.

The fund also has no “2 and 20” management fees, the 2% AUM and 20% of profits most firms charge, that ARK does not. Wood and the team also said they are getting to deals that normal institutions can’t get.

“We are in the top quartile of venture funds, but the two and 20 would be 40% more expensive than the 2.75. We’re partnering with venture capital firms, which other institutions and family offices cannot access.”

Gardner said historically; retail did not get these products.

“How do you take an industry historically locked off from retail, open it to retail and have incentives aligned,” Gardner said. “And so I think Cathy’s getting a fee structure where there’s no carry; otherwise, you couldn’t have successful retail. That’s the higher nominal fee, but you don’t have to make heroic assumptions from a return standpoint to make it great value for the investor.”

Macro with Cathie

As the audience started to squirm after an hour of fireside talk and making glances at the soon-to-be-open bar, the listener questions came in. Between questions about Elon Musk (Wood’s “renaissance man”) and overvalued stocks, Wood talked about where the market is going and when the Venture Capital spending spree of ’21 may return.

She pointed to her economics research background and said that compared to other inflationary times like the 70s, what the US economy feels right now is supply chain crunch inflation.

“We believe there is a greater risk of deflation in the next few years,” Wood said. “In the seventies, inflation built up over 15 years, starting with the Vietnam War and the great society; all kinds of new social programs in the 1960s. Then we went off the gold standard in ’71, which was a fraction of discipline: we lost that, and then all hell broke loose, and we ended up in double-digit inflation and interest rates: That took 15 years.”

Inflation is young

Today’s inflation started with covid supply imbalance, she said, and wartime issues. If you look at monetary policy, it is a night and day difference from other inflationary periods in the past. The Money growth rate peaked at 27% at the height of the pandemic, she said, but in the past few months this year, it’s around two and a half percent.

“Everybody’s saying ‘they let fiscal and monetary policy go crazy,’ And yes, they did, because we’re trying to prevent a depression, which we did,” Wood said. “And now they’re unwinding it very rapidly. I wrote a letter to the Fed, an open letter saying there’s so much deflation in the system, commodity prices are falling, and inventories are overwhelming. We already see discounts at 70%.”

She said she is one of the first, but other voices are coming to the same conclusion, even within the Fed, that raising rates is getting old fast. She said other economies worldwide, from the UK to Japan and China, are trying different strategies to fix supply inflation, but it will take a Fed pivot.

“I think that’s a leading indicator for the Fed to change, and if it does, you just wait and see what happens to this market; it’s going to be very exciting,” she said. “They don’t even have to change right away: that’s not their style. The rhetoric will change. And I think Esther George started it on Friday by saying, I don’t think we should be raising rates as quickly.”

When will the venture start funding again?

With the public markets down and awaiting a lead from the Fed, she said it was natural for private and Venture Capital markets to follow. In 2022, VC firms have sat on more cash than ever, with less deal making and more piggy banking, funds put over $500B on hold until markets clear up. Woods said private markets are more sensitive, but when the Fed changes its tune, and public markets wake up, venture capital will torrent.

“I think the private markets are more correct in their innovation valuation. “I think when we get a Fed pivot, which will influence the public stocks, you’ll start seeing some,” she said. “And I think when the public market starts turning around, it’ll turn around think furiously.”

She said that furious investing is why Wood founded ARK because she called it the future.

“When I started the firm, someone not in the business said, ‘the reason you are starting ARK is that the future of investing is investing in the future.’ I said you got it,” Wood said. “Everybody’s on these benchmarks very backward-looking, and we are fulfilling an unmet need out there.”