Mitchel Harad has been the Vice President of Marketing at Lending Club since 2011. But my history with Mitchel goes beyond that. In fact, he is the first person I ever met in this industry.

Long time readers will remember the pre-cursor to Lend Academy called SocialLending.net. I did not actually start this website, it was started by Mitchel Harad back in 2008. In 2010 when I decided I wanted to get into this business I bought SocialLending.net from Mitchel. Back then the website had about 25 articles and some affiliate income coming in from Lending Club and Prosper.

I rebranded to Lend Academy in 2012 and the rest is history. But the fact is, if it wasn’t for Mitchel I may never have got my start in this business. He went on to get a job at Lending Club in 2011 and was instrumental in building out their borrower acquisition strategy over the past few years. So, I have kept in touch with him pretty regularly.

Like many Americans, Mitchel loves Australia and we often talked about it when we chatted. But Mitchel was different in that he had already been to Australia and really wanted to go back there to live some day. So, at LendIt last year in San Francisco I introduced him to some of the Australian platforms including the market leader SocietyOne.

I had no idea anything came of this until I was visiting Lending Club a couple of months ago when I ran into Mitchel and he told me the news. He was leaving Lending Club and going to work at SocietyOne in Australia.

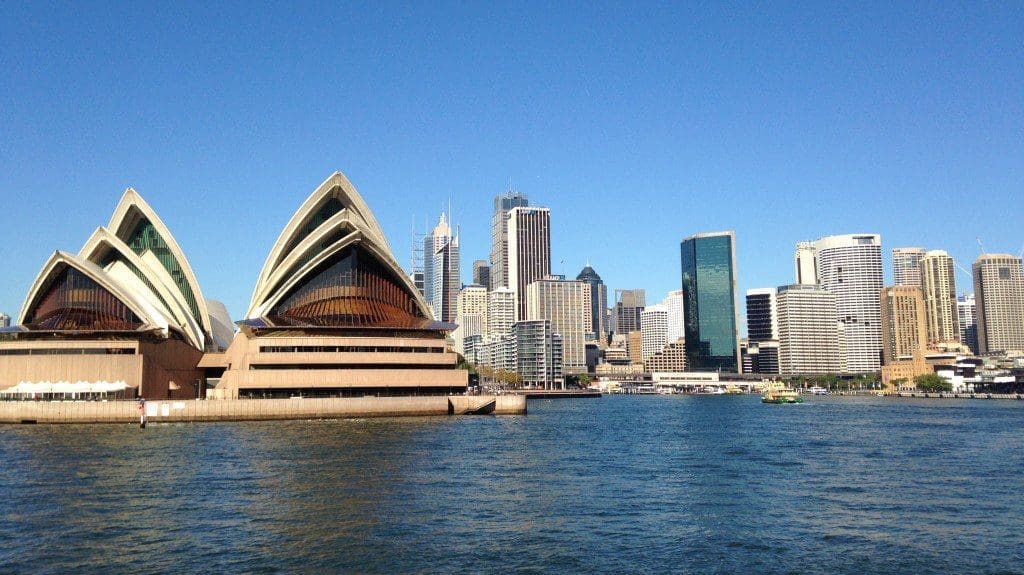

I caught up with Mitchel and Matt Symons, the CEO of SocietyOne, on the phone from Sydney yesterday to get the scoop. Mitchel had just been appointed the new Chief Marketing Officer for SocietyOne and he had been in Sydney for only two weeks.

Mitchel was quick to point out that he left Lending Club on very good terms and that it was really about him and his family wanting to live abroad. He feels very lucky to have landed at such as great company that has many things in common with Lending Club. Here is how Mitchel describes it:

When I arrived at Lending Club in 2011 there was about 60 people. They had just begun an era of rapid growth where the need to scale borrowers was paramount. SocietyOne is in the exact same position today here in Australia.

The Australian market is quite different from the U.S. market and Mitchel acknowledged that. But he said most of the differences are in SocietyOne’s favor. Australia has a banking oligopoly, with four big banks controlling 95% of the market, and they are widely acknowledged as some of the most profitable banks in the world.

But with these huge profit margins lies an opportunity. Matt Symons pointed out that there is no risk-based pricing in Australia, this is something that SocietyOne has pioneered. The banks all offer a similar product with high interest rates. As Mitchel puts it:

The lending business is hyper-competitive but everyone offers the same flavor of vanilla. That is what makes me so excited about SocietyOne and the opportunity here in Australia. We can save consumers more money and be more profitable than we could be in the U.S.

Mitchel is under no illusions that it is going to be easy but I could tell in his voice that he is super excited about this opportunity. For SocietyOne, they are getting someone who not only knows this industry intimately but knows how to scale a platform from just a few million dollars to several hundred million dollars a month. This is going to be extremely useful for them as the industry begins to scale in Australia.

Here is coverage of this news in the Australian press.