Lending Club has come blasting out of the gate in 2013. They have started the year with the first ever $100 million month. Prosper is still in the winter doldrums with another sub $10 million month and their market share has slipped to less than 10%. But together the two U.S. p2p lenders issued $114.9 million in loans in January.

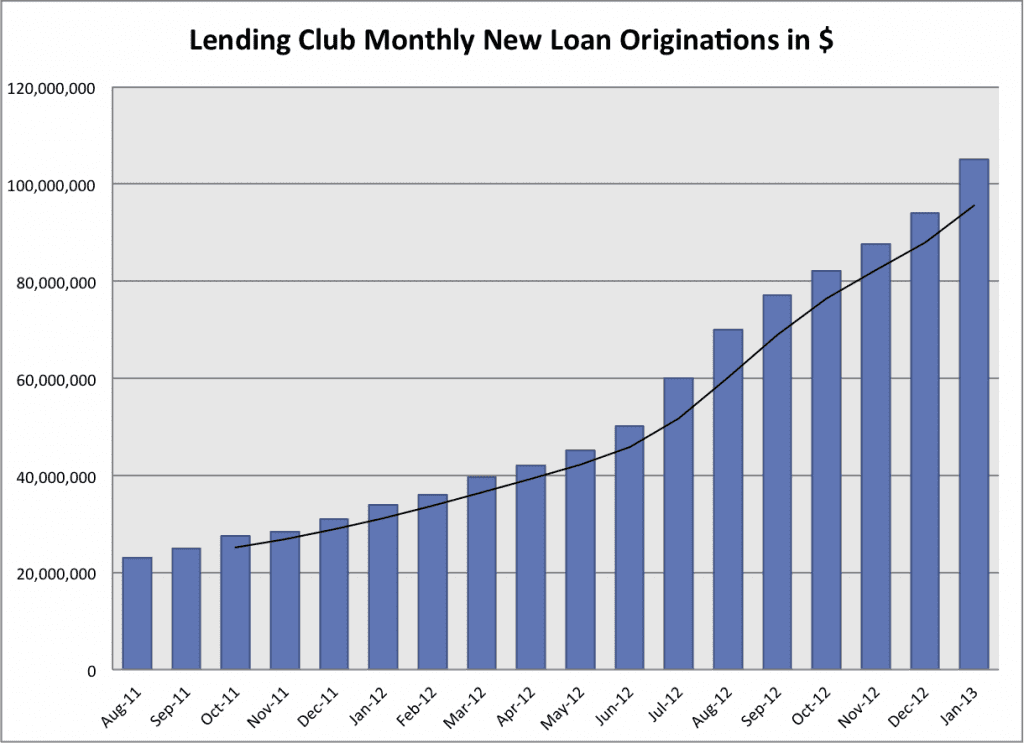

Lending Club Issues $105.1 Million in New Loans in January

It was expected that Lending Club would break through $100 million in new loans in January and they didn’t disappoint. The $105.1 million is up $11 million from December, their largest monthly increase ever. To put their phenomenal growth in perspective Lending Club issued $34 million in January 2012, this month they more than tripled that number.

Around the middle of the month Lending Club started to ramp up the available loans on their platform. The last half of the month regularly saw more than 2,000 loans available as a big marketing campaign must have taken off. With more than 1,900 loans available as I write this they are looking good for February as well.

Digging in to the numbers a little we see that the average loan size stayed above $15,000 for the second month in a row. With 6,872 loans issued (that is 312 loans issued every business day) in January Lending Club passed 100,000 loans issued since inception. Below is their always impressive 18-month chart – the black line is the three month moving average.

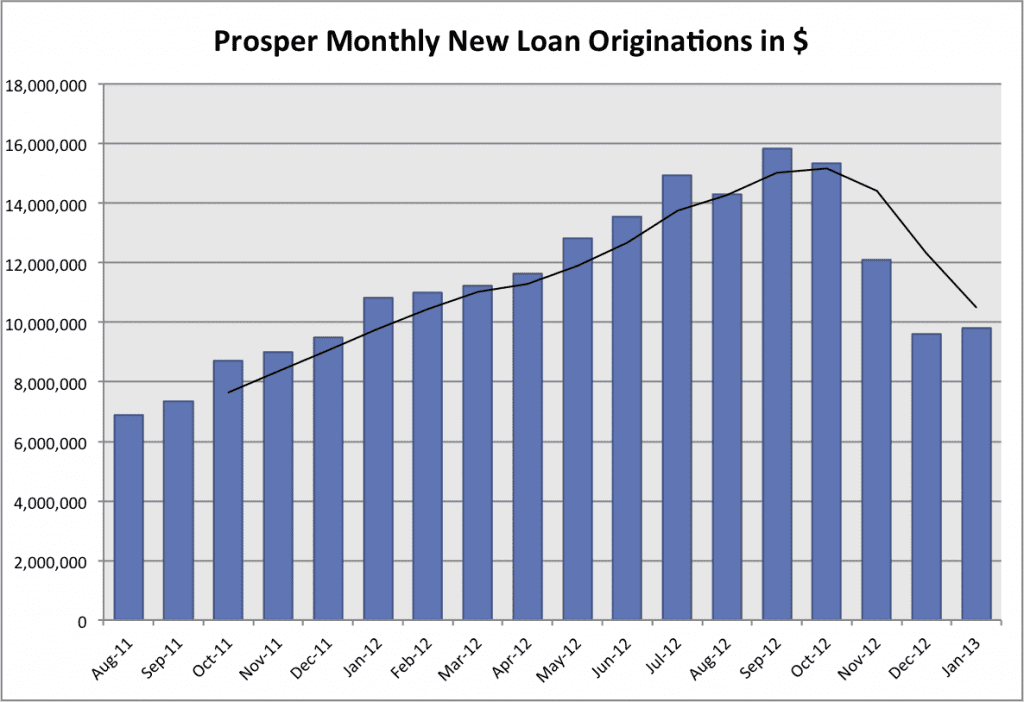

Prosper Stops the Bleeding But Has a Long Way to Go

January will go down as a transition month at Prosper. A new CEO, a new board of directors, new round of funding and getting ready to implement their bankruptcy remote vehicle. But the numbers are in and Prosper still had a very ordinary month. The only good thing you could say about their $9.8 million in total loans is that it was an improvement from December.

When we check out Prosper Stats we see that for the second month in a row two of their top investors Worth-Blanket2 and MI2 stayed on the sidelines. The top investor in January was Tolerant-Responsibility051 with $350,000 invested. There were only five investors who kicked in more than $100,000 in January so once again most of the volume came from the retail investors.

Tomorrow, February 1, marks a new beginning at Prosper. Their bankruptcy remote vehicle will be in place and all loans will start transitioning from Prosper Marketplace Inc. over to Prosper Funding LLC. So, it will be very interesting to see whether this brings back the large investors again. I think it will and February will be a good month. I am also going to go out on a limb here and predict that March will see another record month at Prosper as they get back to a rapid growth trajectory. It will be interesting to see if I am right.

Below is Prosper’s not so pretty 18-month chart.