If you have more than $10,000 in your account then you have likely received an email from Lending Club promoting their new PRIME service. You may have also noticed a popup message on the main account screen. So what is this all about?

PRIME is a service provided by Lending Club that allows you to invest in an automated way. I started using Lending Club PRIME when I rolled over my wife’s IRA account back in early 2010. Back then PRIME accounts were very simple – you just decided on a target interest rate and Lending Club did the rest. It was a set it and forget it process. You can read my initial review of Lending Club PRIME here and also why I decided to take my accounts off PRIME.

A New and Improved Lending Club PRIME

A lot has changed since then. Lending Club still provides investors with an automated investing option but the new Lending Club PRIME has three key advantages over the old PRIME:

- PRIME can execute your own saved search for you – This is huge in my mind. I have some saved searches on my accounts that I run regularly but I have to login every single time to run them. Now, if I miss logging in for a while Lending Club can run one of these saved searches for me.

- It is not all or nothing – The original Lending Club PRIME was an all or nothing deal. You let Lending Club invest for you completely and if you made an investment they would take the account off PRIME. Now, you can have PRIME enabled and continue to invest manually while the automated investing continues to run.

- It is free, at least for now – PRIME accounts have had a 0.8% setup fee and through the end of December they are waiving that fee for new accounts. There have never been any ongoing fees for PRIME.

The Main Disadvantage of Lending Club PRIME

So, the first question many investors have about PRIME is when will it run. And unfortunately, it will not be run at “feeding time” (when new loans are added: 6am, 10am, 2pm, 6pm Pacific) so this is not going to be a way to automate your investing if you are focused on hand picking loans during those times.

Here is what Lending Club says as to when PRIME orders will be run:

Your PRIME account will be reviewed each business day to determine its amount of available cash. Accounts with the most available cash as a percent of the overall account size will go through the PRIME allocation service first. Overall account size and target investment allocation are NOT used to determine which PRIME accounts go first.

So, if you have let your cash build up in your account you will be first in line for a PRIME order. But Lending Club says their goal is to make at least one investment order every week on all accounts. Obviously, whether or not they can do that will depend in part on how you set up your investment criteria. There is a help page dedicated to PRIME where most questions are answered.

Who Should Switch On PRIME?

The avid Lending Club investors who login every day at feeding time are not the target of PRIME. But there are many investors who want the flexibility of choosing their own criteria but who only login once or twice a month to reinvest. These are people who should consider converting their account to PRIME. When they login they can still go ahead and make their own investments as they usually do but they can rely on Lending Club to keep their cash drag to a minimum during the times they don’t login.

Of course, for new investors who do not want to do any of the investing work themselves PRIME is a good option. You do need a minimum of $10,000 to sign up for PRIME so it is not suitable for small investors.

Also, if you have setup complex saved searches with multiple filters then PRIME is probably not a good idea. You should have fairly broad criteria otherwise PRIME will never find any loans.

How to Sign Up For Lending Club PRIME

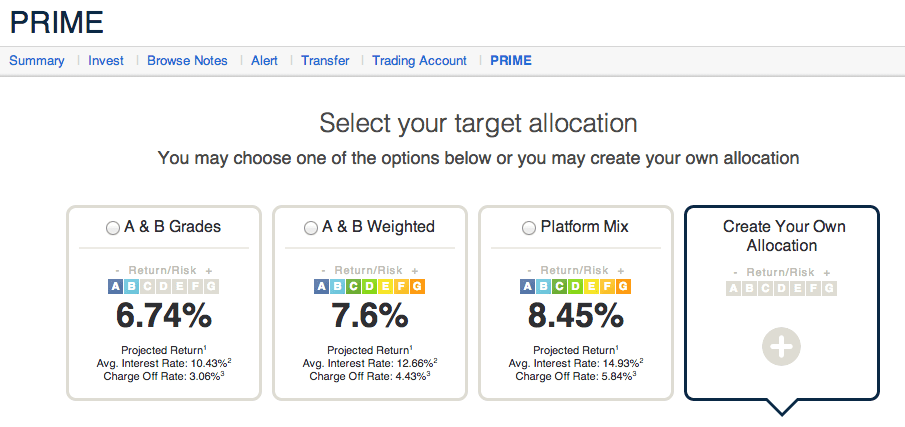

The first step in the process of setting up Lending Club PRIME is to choose your allocation. You can choose from Lending Club’s three preset allocations with an average interest rate of 10.43%, 12.66% and 14.93% respectively. Or you can create your own allocation. This is the selection I recommend if you want to use one of your own saved searches. If you can match your target allocation to the typical target of your saved search you have a much better chance of PRIME orders being executed when using a saved search.

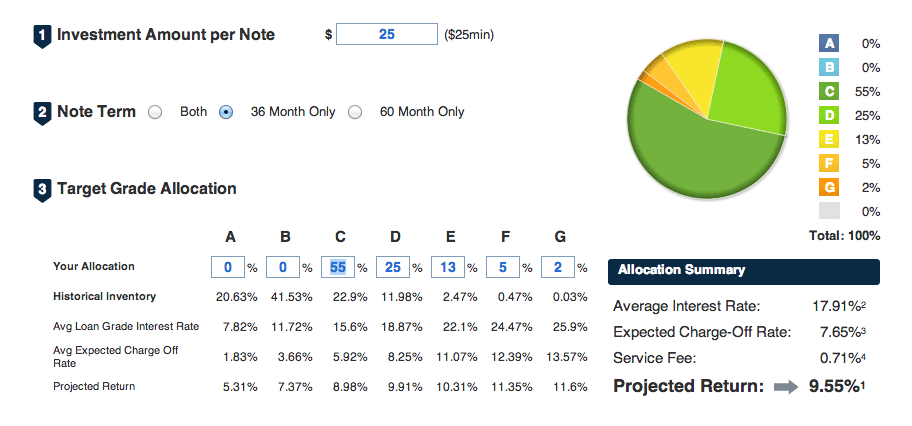

There are three steps to set your allocations as you can see above. You enter the amount to invest per loan, the loan term, and then your target allocation breakdown by loan grade. Lending Club tells you their historical inventory breakdown but you can enter any numbers you like as long as they add up to 100%. Keep in mind if you choose, for example, 100% G-grade loans for your target then you will probably never reach your target allocation given that just 0.03% of all loans are G-grade.

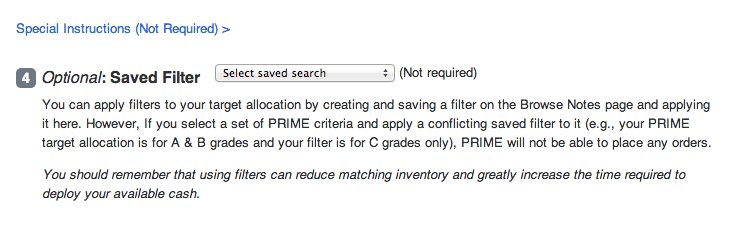

Finally, there is an optional fourth step in the setup process – that is selecting a Saved Filter. Here you can choose any saved search that have setup through the Browse Notes screen. This, to me, is the only reason active investors should consider converting to PRIME. One word of warning, though. The saved search you select here will be removed from your list of saved searches when you go back into the Browse Notes screen. You can always setup a duplicate of this search if you want to invest in loans manually using the same criteria. Also, you can only use one saved search with PRIME. So it is not like Prosper’s Automated Quick Invest where you can have multiple searches run.

My Old PRIME Account is Now My New PRIME Account

A few months ago I converted my wife’s Roth IRA account from PRIME to a regular account. Now, I have converted it back to a PRIME account again. I will, however, continue to invest in some loans manually but I will also be using one of my Super Simple filters here that has a relatively broad criteria. I will report back on how this goes some time next year.

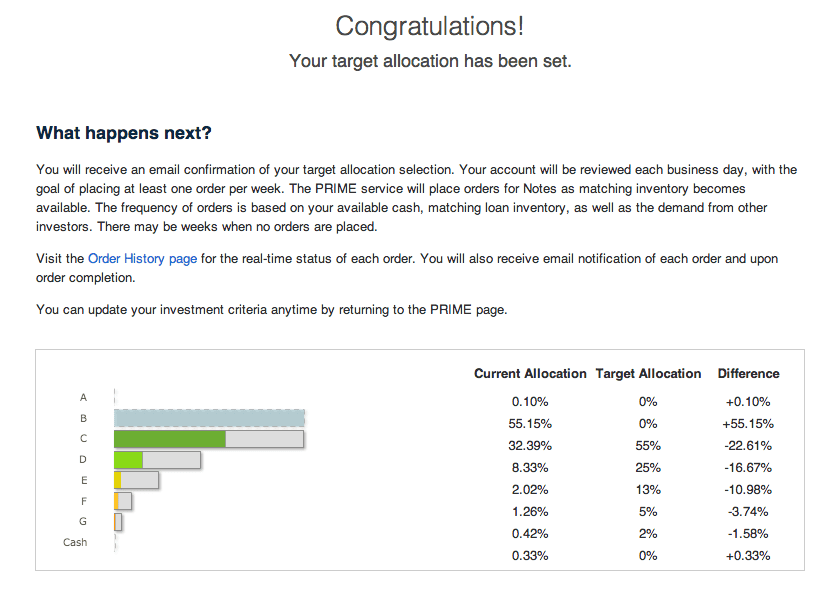

When you have completed the four steps you are greeted with the screen above showing the differences between your current allocation and your target allocation. You can go back in and edit your allocations or choose a different saved search at any time.

A Better Option for Hands Off Investors

While the new PRIME is not perfect, it is a better option for investors who want to get decent returns for minimal effort. I like that Lending Club has given a new commitment to PRIME investors. Several people have emailed me over the last few months saying that Lending Club was letting their cash build up in their PRIME account. With the new PRIME service that should no longer happen.

PRIME was launched last week so I pinged Lending Club today to ask how it had been going so far. They said that PRIME signups have been strong, a 50% increase in enrollment in the first week. They were also getting lots of positive feedback from investors.

I think it is a good move. But I know it won’t satisfy the many investors who want an automated way to invest at feeding time. With so many retail investors today that feature is probably not going to happen any time soon. But PRIME is a solid alternative for investors looking for a simple way to invest at Lending Club.