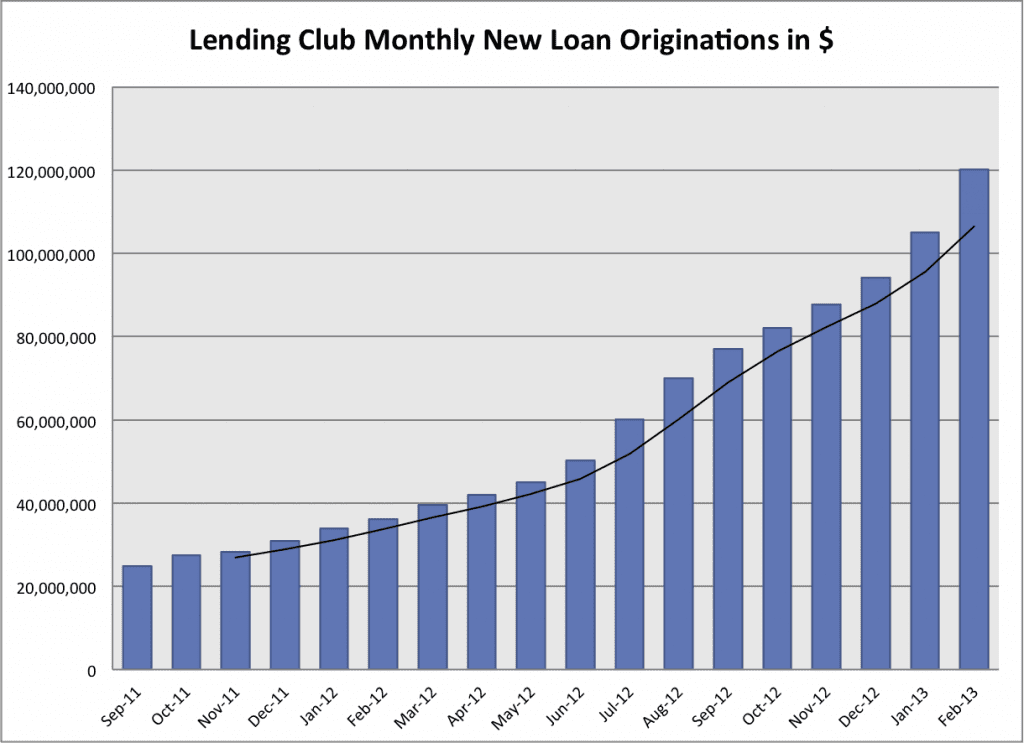

We have just wrapped up the shortest month of the year and Lending Club continues on its rapid growth upwards. It issued $120.2 million in new loans – 13 times more loan volume than Prosper who was once again under $10 million in new loans for the month.

Lending Club’s Biggest Monthly Increase Ever

I had a feeling this was going to be a very big month for Lending Club when they started off February with a $20 million day. And sure enough they were able to keep the momentum going throughout the month. With this massive loan volume the number of available loans was down from previous months as loans were being funded in hours (even minutes in some cases) instead of days.

As I reported last month Lending Club broke $100 million in a month for the first time in January, it was $105.1 million to be exact. In February they ended with $120.2 million an increase of more than $15 million, by far their largest monthly increase ever. Not bad for a 28 day month. Average loan size was also at an all time record at $15,894 as more larger loans were approved. Total number of loans issued was 7,561 or 398 loans for each working day in February.

For the first time in many months Lending Club is not ending the month with a glut of loans on their platform. As of this writing there were only 568 loans available for investors. So, I don’t think we will see the huge first day of the month tomorrow as has been typical now for over a year.

Below is Lending Club’s always impressive looking 18-month chart. The black line is the three-month moving average.

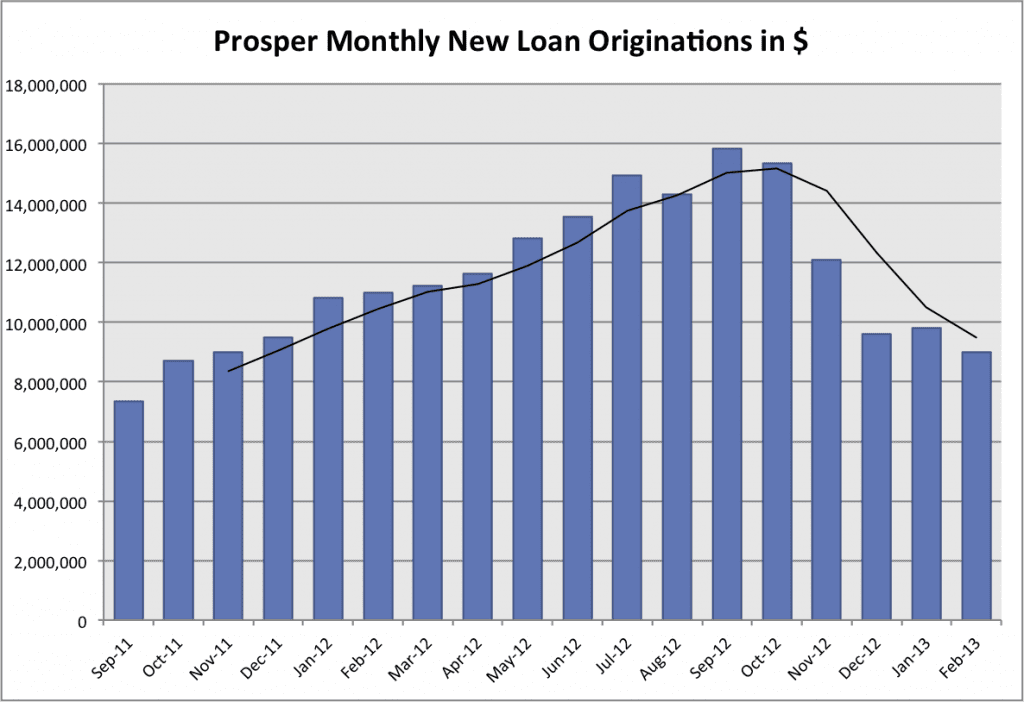

The Turnaround at Prosper Has Not Yet Materialized

The new executive team at Prosper took over in late January so it was probably a bit much to expect a sudden increase in volume in February. Although I was expecting the month to be better than what it was. Prosper just wrapped up February with new loan volume of $9 million which was down from $9.8 million in January.

The number of new loans reached an 18-month low with just 966 loans issued. The month would have been worse but for the fact the average loan amount reached an all time high of $9,326. On a personal note my filters didn’t pick up nearly as many loans as usual, particularly the last half of the month, so I invested half my usual amount.

The one piece of good news was that Worth-Blanket2 returned to the platform for the first time since November but they invested just $245,000 making them the number three investor in February behind Index_Plus and Tolerant-Responsibility051 according to Prosper Stats. And digging a little deeper into Worth-Blanket2’s account they have over $600K in pending loans right now so March is looking much better.

This gels with what Prosper said. When I reached out to them for comment today this is what Ron Suber, Global Head of Institutional Sales, said:

Considerable time in February was spent meeting with the institutional and retail investor communities and listening to their needs. We are responding to those needs with a larger inventory of borrowers based on what our investors want. March and April are the months to watch for growth.

The loan inventory is definitely growing with 221 loans available to investors as I write this. So we can expect to see some positive growth out of Prosper in March. I am not sure if we will get a record month like I predicted in January but we should see some decent growth. It will be a very interesting next couple of months at Prosper.