The third quarter has drawn to a close and another great month is in the books for Lending Club and Prosper. Between the two companies they issued $236.5 million in new loans this month. I think it is safe to say that number will be over $250 million next month. To put some perspective on this growth – the two companies combined in September 2012 for $92.9 million in new loans.

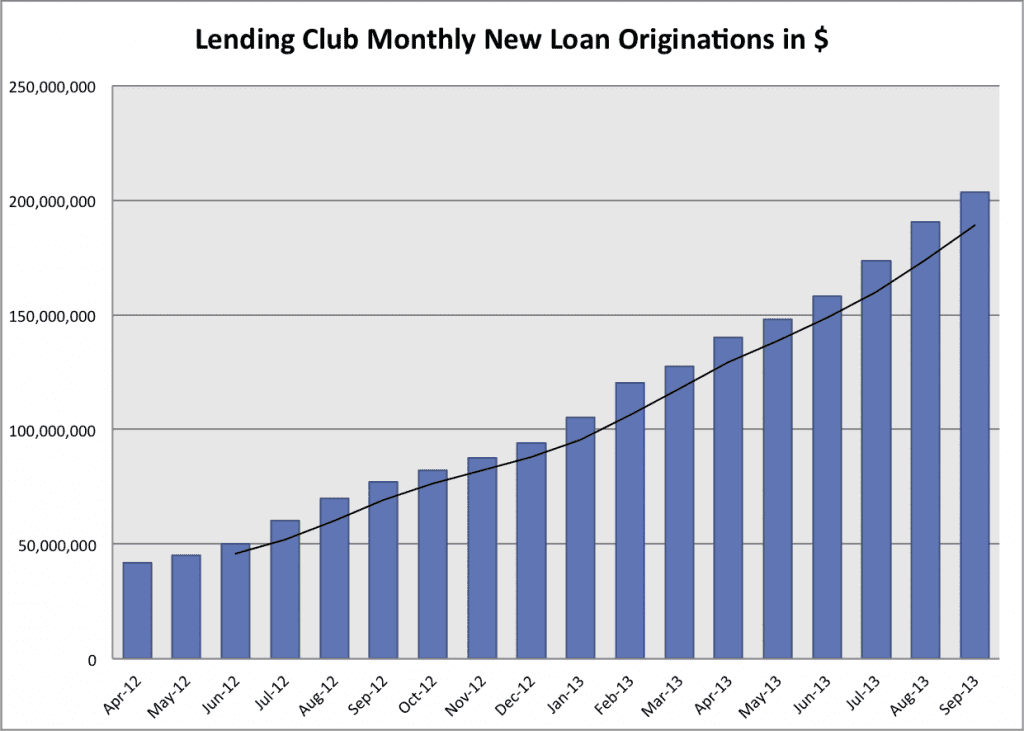

Lending Club Issued $203.4 Million in New Loans

Lending Club crossed the $200 million mark for the first time ever as their steady but rapid growth continues unabated. This was up from $190.3 million in August. As Renaud Laplanche said in my visit with Lending Club earlier this month they continue to control their growth as they add steadily to their capacity.

The milestones keep happening for Lending Club and one that almost went unnoticed this month was crossing $2.5 billion in total loans issued since inception. At their current growth rate they will pass $3 billion some time in early December.

Below are some stats from September for Lending Club as well as their 18-month chart. The black line in the chart below is the three month moving average.

Average loan size: $13,800

Percentage 36/60 month loans: 74.2%/25.8%

Average interest rate: 16.0%

Percentage of whole loans: 24.3%

Average FICO score: 699

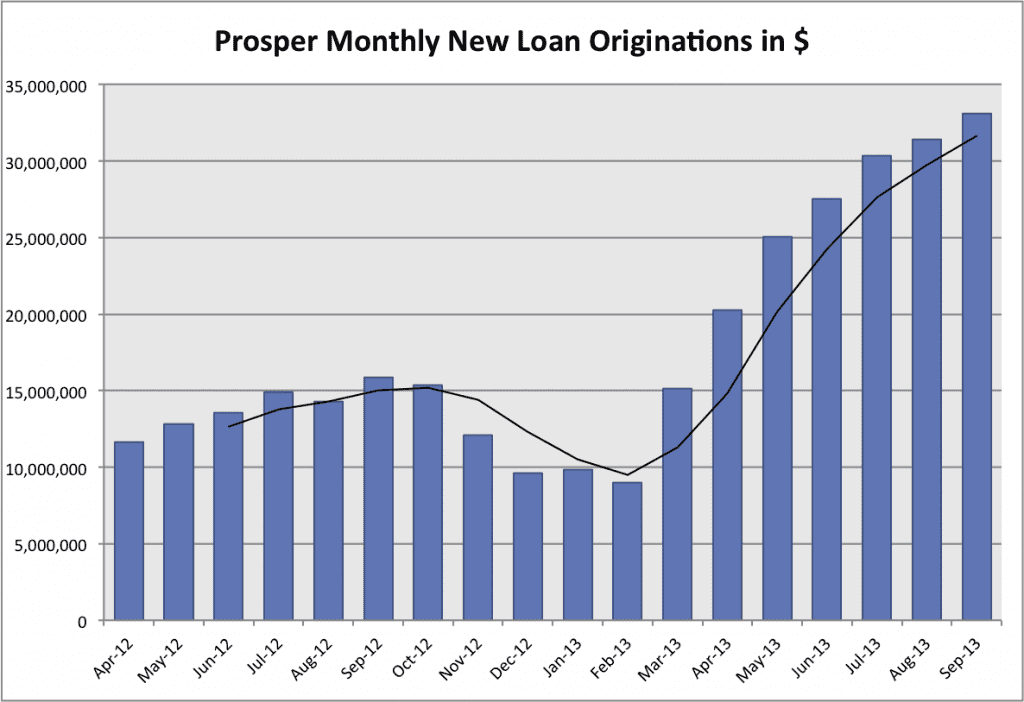

Prosper Issues $33.2 Million in New loans

Hot on the heels of their $25 million funding round Prosper closed another solid month in September. Total new loan volume came in at $33.2 million up from $31.4 million in August. After being on a growth tear earlier in the year the rate of growth has slowed at Prosper over the summer.

This was part of the plan according to Aaron Vermut, Prosper’s president. He told me in our regular end of month call that there were some infrastructure changes that needed to be put in place before they could enter the next phase of their growth. The good news is that the changes implemented earlier this month for the borrower funnel have been a resounding success. In the last two weeks conversions of borrower visitors to the website were roughly double what they were before the changes.

What this means is that Prosper can now get more borrowers on their platform for a much lower cost. This will certainly bode well for them as they continue their journey to profitability.

Below are the statistics for Prosper this month as well as their 18-month chart.

Average loan size: $10,517

Percentage 36/60 month loans: 63.6%/36.4%

Average interest rate: 19.0%

Percentage of whole loans: 58.1%

Average FICO score: 694