March was a great month for Lending Club and Prosper any way you slice it. Together the two leading p2p lenders issued a combined total of $349 million in new loans, up 12% from February. Another interesting milestone crossed this month is that both companies have issued more than a combined $5 billion in loans since they began operations.

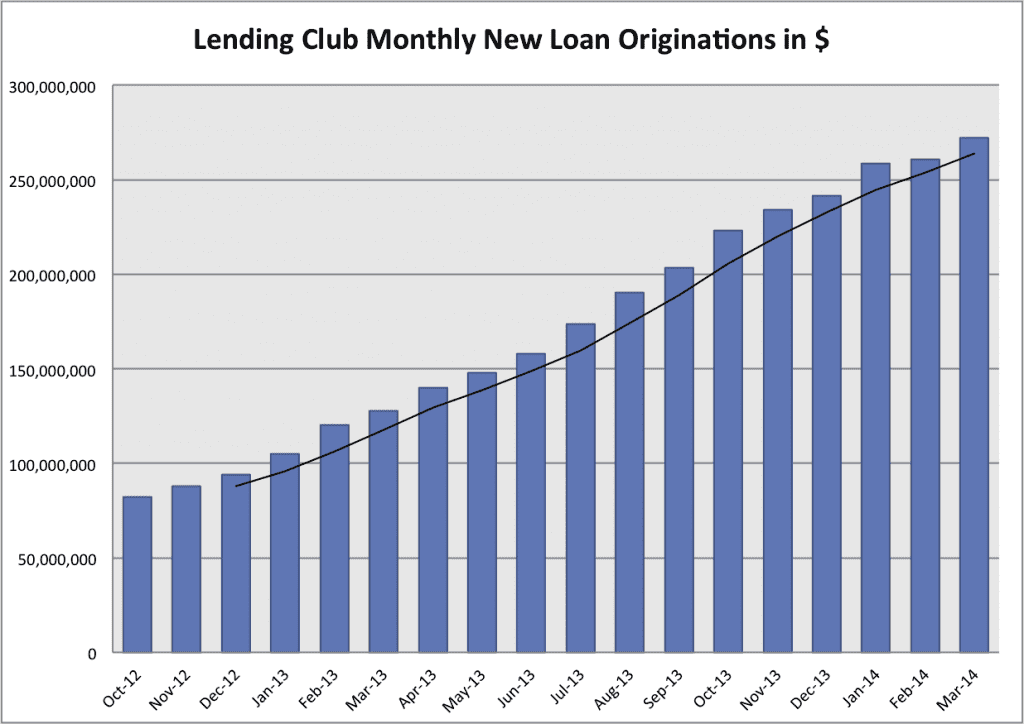

Lending Club Issues $272 million in New Loans

While we are getting used to these great months from Lending Club, March was not exactly a typical month. For a start, Lending Club announced the beginning of their small business loan program. This program is just getting going and I have not noticed any sign of issued loans appearing in the data download just yet.

What was most interesting to me this month is seeing the high volume of loans on Lending Club. Many times this month the total number of available loans was at more than 1,000. But more importantly, some of the filters I run would find loans any time during the day, not just at feeding time. Even those filters focused on grades D and below. The changes that Lending Club has made in the last few months are making a real difference now for retail investors.

Also noteworthy this month was Lending Club crossing the $4 billion mark in total loans issued. Below are the monthly stats and 18-month loan volume chart. The black line is the three-month moving average.

Average loan size: $14,030

Average dollars issued per business day: $13.2 million

Percentage 36/60 month loans: 70.8%/29.2%

Average interest rate: 14.45%

Percentage of whole loans: 50.4% (including Policy Code 2)

Total Policy Code 2 loans: $24.7 million (9.1% of the total)

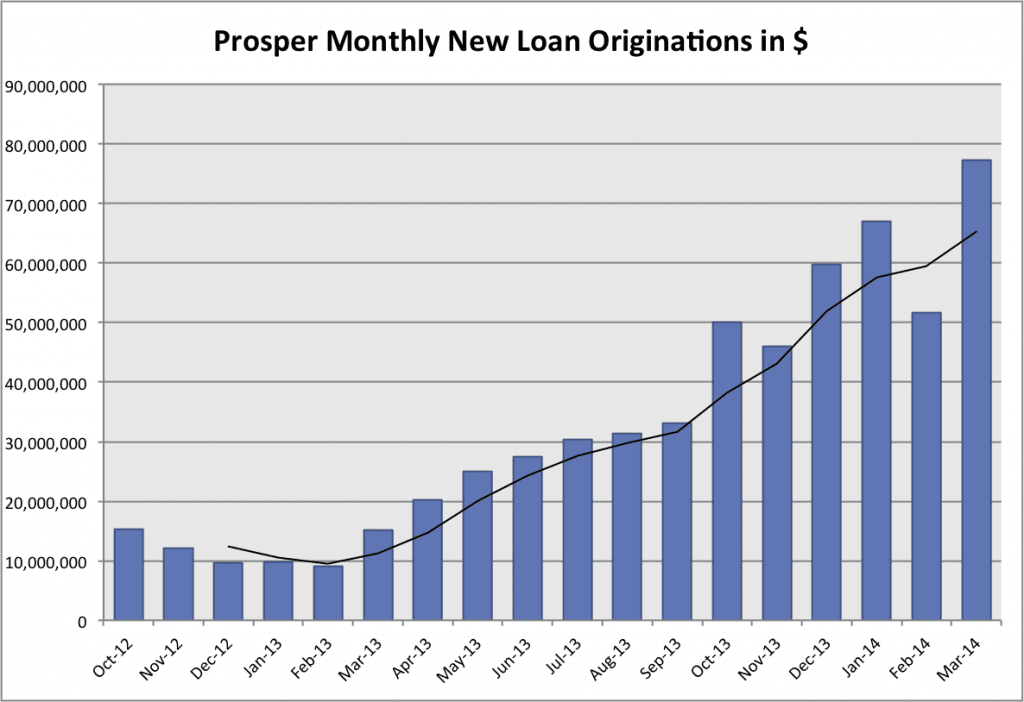

Prosper Issues $77 Million in New Loans

After their down month in February, Prosper came roaring back in March with another record month. The system problems that caused them some pain in February seem to have been resolved.

As Ron Suber, president of Prosper, said in an interview I conducted with him earlier this month (to be published on the podcast next week) Prosper has some new borrower channels that are driving much more loan volume to their site than ever before. My own filters have picked up more loans this month than ever before including the C and D grade loans, although Prosper still struggles to keep loans on their retail platform for very long.

The big news at Prosper is actually going to come this month and more than likely this week. Prosper will be crossing $1 billion in total loans issued since inception any day now. To celebrate this milestone they are giving away $1,000 a day to an investor and a borrower every day for two weeks. You can read the details of this giveaway here.

Below are the stats and 18-month chart. Despite choppy monthly volume numbers the black three-month moving average line has been remarkably consistent in recent months.

Average loan size: $12,266

Average dollars issued per business day: $3.7 million

Percentage 36/60 month loans: 66.2%/33.8%

Average interest rate: 15.21%

Percentage of whole loans: 83.7%

Average FICO score: 703