[Disclaimer: I am not an accountant nor am I qualified to provide tax advice. This post merely shares how Lending Club and Prosper are presenting their tax information this year. You should seek professional advice before taking action on any of the ideas presented here.]

I know I am late with the tax post this year and I apologize. I am filing an extension and have only just got my own tax situation sorted out. I also want to give a big shout out to Lend Academy intern, Nick Armstrong, who did a lot of research for this post and helped put it together.

It was Albert Einstein who said, “The hardest thing in the world to understand is income taxes.” This seems to be especially true with regards to p2p lending. Pairing an extraordinarily complex tax code with a burgeoning young investment model that is not specifically addressed by the IRS can make filing taxes challenging to say the least. This post attempts to bring a little clarity for investors in Lending Club and Prosper.

Lending Club Taxes

A welcome change at Lending Club this year was the introduction of a five-page tax guide. This helpful guide provides a general overview of the documents LC provides. It explains which investors will receive which forms, what information is included and lays out what information is reported by LC to the IRS. This information is helpful both to individuals filing their own taxes as well as tax professionals who might not be familiar with Lending Club.

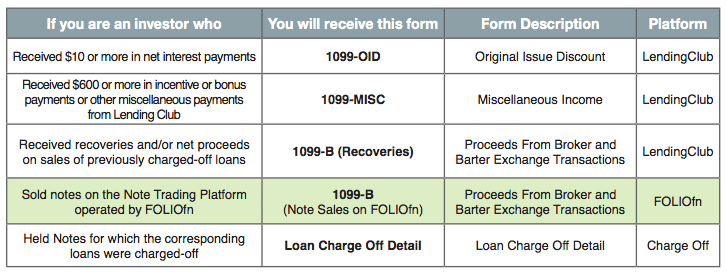

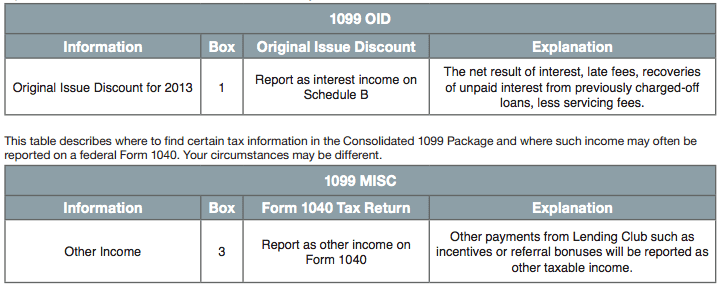

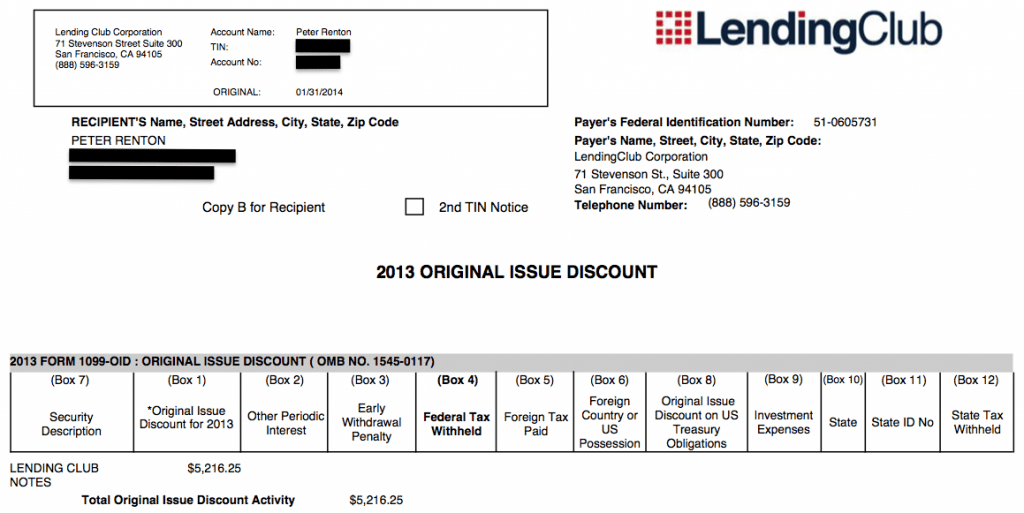

Lending Club does a good job presenting the pertinent information succinctly in the following tables. If you want to know what forms you should have received take a quick look here (click on any of the graphics below to view a larger image).

Lending Club also discloses what information they are reporting to the IRS

Lending Club breaks down the difference between the 1099-B they furnish (and report to the IRS) regarding recoveries and sales of charged off loans and what FOLIOfn supplies to the investor and IRS if there is participation in the secondary market. Essentially, the difference between these boils down to whether money was recovered by LC’s collections or if the loan was sold through FOLIOfn.

Finally, LC discusses cost basis in terms of tax implications. There are multiple approaches available to taxpayers to treat discounts and premiums when buying notes through FOLIOfn. According to the guide, “some taxpayers may have elected to take an alternative treatment to the embedded Note discount or premium. In any circumstance, we recommend that you consult with your tax advisor to determine your specific tax basis in such a Note.”

The Changes for 2014

The biggest change this year is that LC has consolidated all of the 1099s together in one PDF package, which makes referencing or mailing your statements easier than in years past. Again, 1099s are only available online and hard copies will not be mailed to investors. If you do not have a link to your tax statements, this means you have tax-free account such as a Roth-IRA or other retirement account.

Last year LC sent out revisions of investors’ 1099s toward the end of February. This year they made one minor change but captured it within a day or so. And they notified everyone who had downloaded the incorrect 1099 so if you didn’t hear from them you are ok.

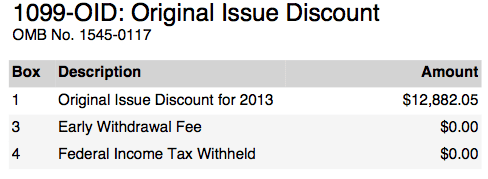

1099-OID – In 2012 LC itemized the Original Issue Document (Interest Earned) on a note-by-note basis. For the 2013 tax year they have consolidated the investor’s OID into one amount on the 1099-OID. The “Total Original Issue Document Activity” amount should be reported on your income tax return as interest income.

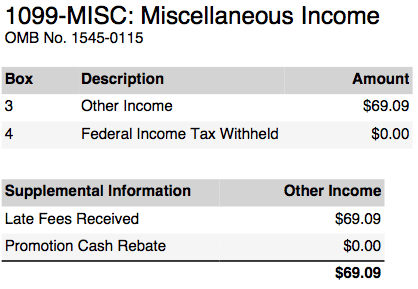

1099-MISC – This is the same as last year and only investors who have received payments, incentives, or bonuses from Lending Club will receive this form in their tax statement. There have been no investor bonuses for some time so you probably did not receive this form as part of your 1099 package.

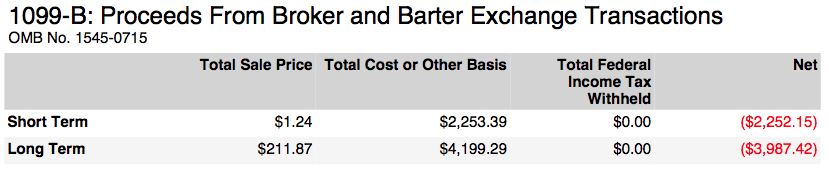

1099-B – This form indicates any recoveries from charged-off loans or any proceeds from the sale of such loans. See the information on FOLIOfn below.

Loan Charge Off Detail – This information is not reported to the IRS, but is helpful in completing your 1040. Loan charge offs were a hot topic of discussion on the Lend Academy forum last year as every investors wants to deduct all of their charged off loans.

Notes that have been charged off are treated as capital losses on your 1040. For those of you who took advantage of the bullish market in 2013 and are reporting capital gains from the sale of assets can deduct the losses from charged off notes. According to §1211 and §1212 of the tax code, if once the investor has gone through the capital gains/loss netting process, there are remaining losses, those can be used as a deduction against your regular income up to $3,000 (or $1,500 in the case of a married individual filing a separate return). This is especially of interest to those investors who invest in higher risk-return notes and typically have a higher default/charge off rate.

Prosper Taxes

To find your Prosper tax statements you need to login to your Prosper account, click on the History Tab and then Statements. If you do not see a link to your Consolidated form 1099 then you have a non-taxable account at Prosper, so you can ignore all the Prosper tax information below.

Prosper’s tax document package differs in a few ways from Lending Club. First up is the 1099-MISC. This is where Prosper records the late fees that you have received throughout the year. This is additional income so it must be reported to the IRS. Above is my form 1099-MISC.

Next is the 1099-B. Where LC splits long-term and short-term losses up into different pages, Prosper consolidates everything on the same form with long-term and short-term totals at the top of the first page. Now, the title of the columns in the above graphic are IRS standards, this does not mean your loan was sold. The Total Sale Price actually includes payments that were received by Prosper after your note was charged off.

The difference between the short-term and long-term amounts is while both are reported on the IRS form 8949, short term gains are reported in Part I with Box B checked and long term proceeds are reported in Part II with Box E checked. After the 1099-B summary, you will see a list of all the charged off loans that occurred in 2013 – keep in mind that same $3,000 limit applies to deducting your losses.

The last document from Prosper is the 1099-OID. Prosper and LC are in alignment on their 1099-OIDs. Keep in mind that the term “Original Issue Discount” is a standard IRS term and there is no “discount” in play here. This number just records your total interest earned for 2013. The amount included on your 1099 is net of service fees and collection fees.

If you sold more than $10 worth of notes on Prosper’s trading platform then you will receive a FOLIOfn 1099-B. This form typically comes later than the regular Prosper 1099, it was available by late February this year.

FOLIOfn consolidates almost all the information the tax payer needs on the first page of their tax sheet. Information for the 1099-DIV, 1099-INT 1099-B, and 1099-MISC are concisely displayed, although most of those won’t apply to secondary market investors. The primary information comes on subsequent pages where FOLIOfn lays out proceeds from sales of notes and what gain and loss you have realized. There is still no consensus on how these numbers should be reported on your tax return so you should consult with a tax professional for guidance.

A Word About Deducting Losses

Many investors complain about the undesirable tax treatment for p2p lending. This is true to an extent which is why a non-taxable account, such as an IRA, can be preferable to many investors.

Here is the kicker about unfavorable tax treatment that I touched on earlier. You can only deduct $3,000 in capital losses, in our case these are called charge-offs, each year regardless of how much interest you made. You can however deduct more than $3,000 if you have capital gains elsewhere.

In my own situation, I had a total of almost $10,000 in charge offs in 2013 and I am able to deduct all these losses because I also sold some stocks last year which resulted in significant capital gains (more than $10,000). But if you have no capital gains elsewhere then you are stuck with this $3,000 limit. It is my understanding, though, that you can carry the losses in excess of $3,000 into future tax years.

Hope this information is helpful. Keep in mind, though, as I said at the beginning of this article that nothing here should be considered tax advice – you should always consult with a tax professional before taking action on anything in this article.

Useful Links

Your Lending Club Tax Statements (must be logged in to your Lending Club account)

Prosper Statements (must be logged in to your Prosper Account)