Today, Lending Club announced their Q2 2016 earnings. This is their first earnings release since the news of the resignation former CEO Renaud Laplanche that rocked the industry. While we all knew this would have a dramatic impact on the company we now can see this impact through the numbers Lending Club shared today.

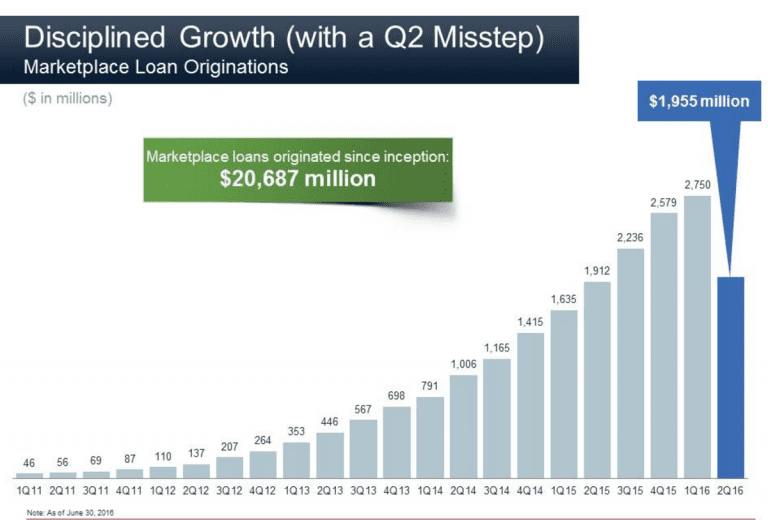

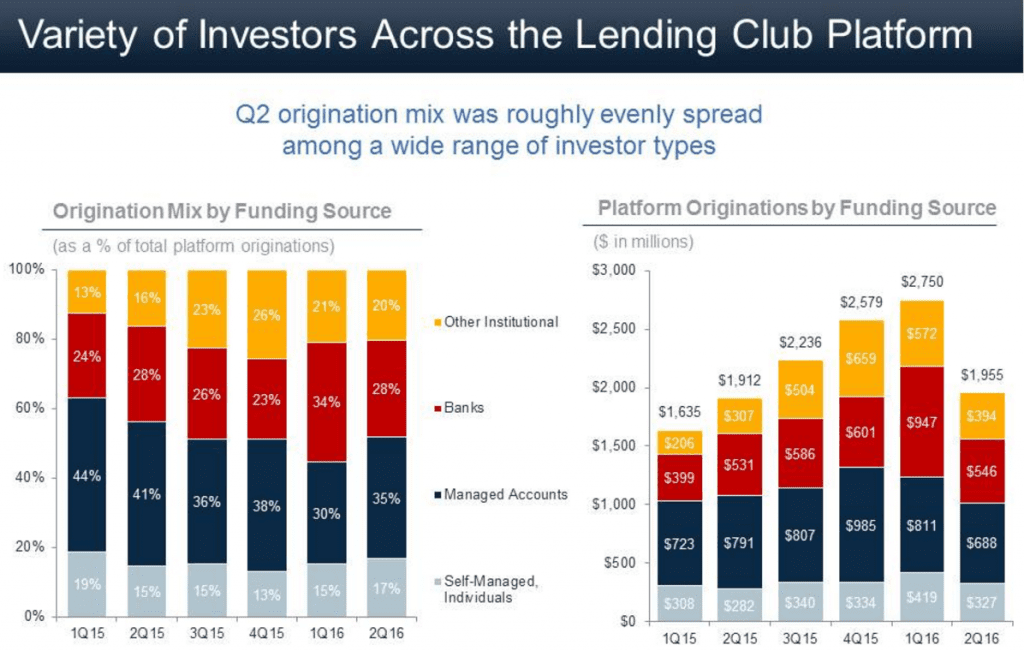

One of the most important metrics is Lending Club’s quarterly originations. Total originations for Q2 2016 came in at $1.96 billion, down from $2.75 billion in Q1. This marks the first time ever (other than 2008 when the company was going through SEC registration) that quarterly originations have declined. This number, however, was an increase from the $1.91 billion originated in the same period last year. Also, in this most recent quarter Lending Club officially crossed the $20 billion mark in originations since inception.

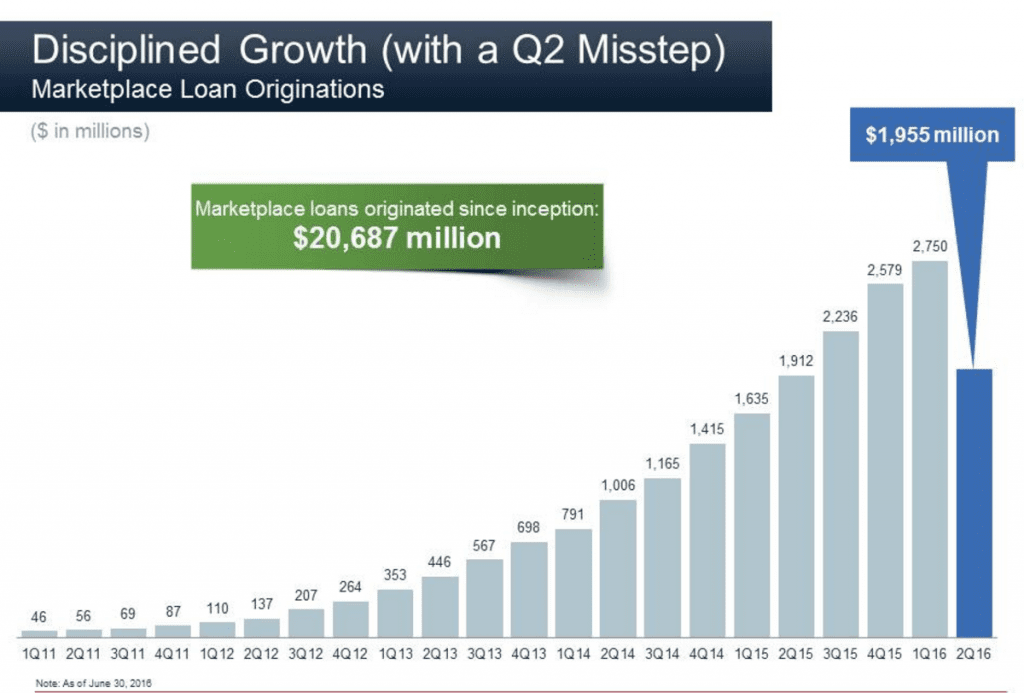

Below are the financial highlights from the press release:

While Lending Club exceeded most people’s low expectations on originations given recent events, earnings took a significant hit in the second quarter. Some of this is due to an increase in one time unusual expenses due to the May 9th news.

Lending Club still holds $832 million in cash and equivalents with no outstanding debt. They leveraged a portion of this cash to purchase $135 million in loans in the second quarter with a majority of these loans being resold at a later date.

Lending Club also had some positive news as of late, including their first ever securitization that closed this month that was three times oversubscribed as well as rumors of new significant loan buyers. Scott Sanborn, CEO and President of Lending Club outlined their progress in bringing back existing investors:

Our efforts to reengage investors are working, with fifteen of our top twenty largest investors back on the platform today. Despite the unusual disruption to our supply of capital in May, we facilitated nearly $2 billion of loans to nearly 170,000 borrowers. While we still have a lot of work ahead, the value that we bring to borrowers and investors is stronger than ever, and we believe we have the resources and resolve to execute on our mission.

Scott Sanborn did note on the call that some bigger investors came back albeit at lower amounts with some exceptions. On the retail investor side 135,000 self-managed retail investors invested over $327 million in the second quarter. Lending Club now has a borrower base 1.5 million strong.

Lending Club also announced several leadership changes. Most significant of these changes is the resignation of current CFO Carrie Dolan who plans to pursue a new opportunity. She has been with the company since August of 2010. According to the release she had notified Lending Club earlier in the year about her future plans but was asked to postpone given the departure of Renaud Laplanche in May so she could help with the transition. Lending Club has already begun a search for a replacement CFO.

Lending Club Earnings Call Review

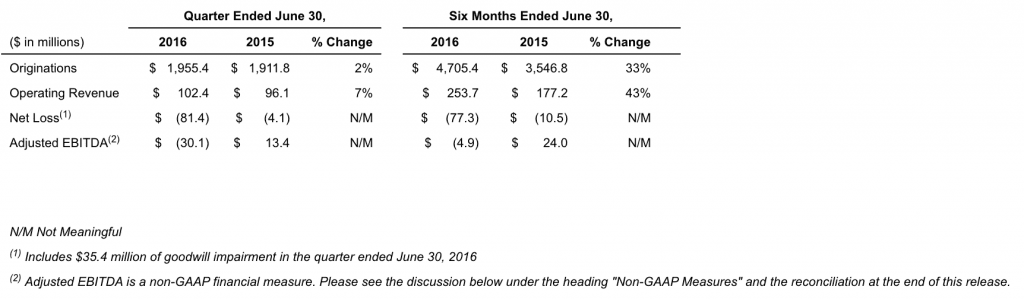

For the first time ever, Lending Club broke out several of their different products as shown below. The products, which fall outside of their standard A-G loans we see as retail investors are available to accredited and institutional investors.

The breakout for “Personal loans – custom” includes their near prime and and super prime loans. “Other” includes their patient finance and small business line products. For Q2 2016, approximately 74% of the loans fell into the standard loans category.

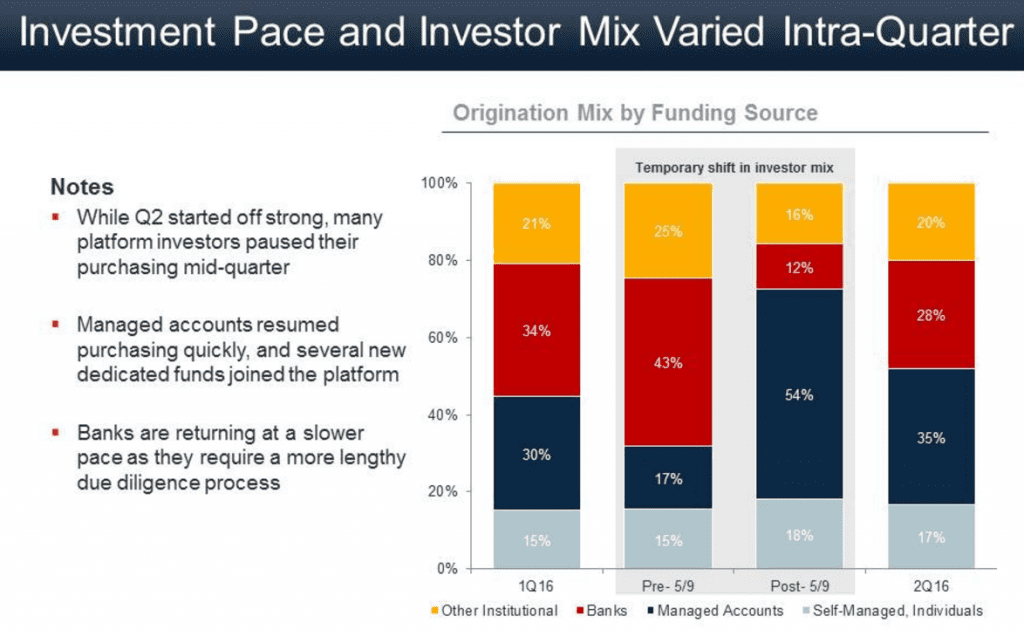

Lending Club also provided information on the different types of investors in Q2 2016 as well as pre and post May 9 numbers. According the the earnings call 51% of originations occurred before May 9 and 49% occurred after. The below chart shows the shift of investors from Q1 to Q2 2016 and you’ll notice that banks dropped by 6%. Self-managed accounts, individuals increased 2% which highlights the importance of a retail base and just how resilient they can be as an investor class.

The intra-quarter chart below highlights the time before May 9 when the news hit as well as after. The drastic pull back of banks is even more apparent here. Managed accounts post May 9 made up over 54% of the investor mix and banks dropped from 43% to 12% of the total.

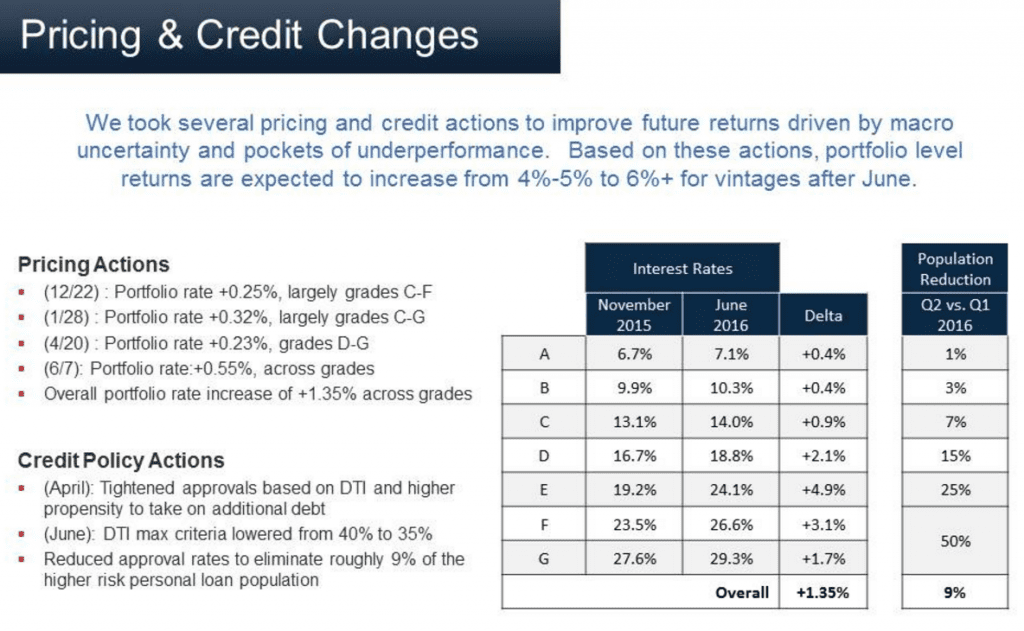

Lending Club broke down the recent pricing actions that they have taken since December, 2015. Rates have been raised 4 times with an overall portfolio rate increase of 1.35% across grades. They have also highlighted the credit policy actions they took which mainly affected the higher risk loans. Compared to November, 2015 you can see the substantial interest rate increases, especially in the lower grade notes.

Below are summaries of a few questions that were asked on the call:

Q: You mentioned that expenses will remain elevated. How much of this would you consider is unusual and what do you anticipate this dropping to throughout the year?

A: We do an anticipate that these unusual expenses will fall through the end of the year down to 80% or so. What’s to be determined is what that run rate will be going forward. Lending Club has spent time looking at compliance, legal and support and has subsequently made a number of changes as a result.

Q: The press release shared that 15 of the 20 largest investors were back. What is the magnitude of now versus before?

A: The level of investment varies as a whole. In general at lower levels then pre-Mother’s Day. Although there are some exceptions. Incentives were useful in kickstarting platform activity and we do anticipate those will end at the end of this quarter. The incentives were volume based and for smaller volume investors, some incentives have already ended. These investors have continued to invest into August.

Q: Any update on SEC, DOJ investigation timelines?

A: No new news on that front.

Q: Give us a sense as to how you are establishing more stable funding sources. Can you give us an idea of where the strategy could go longer term?

A: The immediate focus is re-engaging and we are making good progress there. Going forward we are exploring adding additional funding sources and structures to increase resilience and diversity. That would include committed capital that might be a beneficial addition to the mix, but will come at a cost. We are being thoughtful about the size and scale of that and will explore it actively once pre-existing investors are fully engaged.

Q: Marketing efficiency is continuing to go down. What does it look like when you take the noise out and what is your expectation going forward? Will this stabilize?

A: In Q2 there was quite a bit of noise which is harder to read. There were a number of expenses in sales and marketing that were not directly related due to severance cost, etc. Second and third quarters are usually more favorable as far as momentum so take that into consideration. As we adjust rates that has an impact as well on sales and marketing.

Q: Help me understand what gives you conviction that the banks are returning to invest in loans as they previously were especially without incentives.

A: The banks have not been as motivated by incentives. They have clear and lengthy diligence requirements unlike third party funds etc. that can respond much more quickly. Banks have a longer process and go through internal risk processes and they must deal with their own regulators. We have confidence that we have a clear working plan with banks including diligence lists, going through and ticking each requirement, timelines on each side of the equation and have seen many banks back already. The larger the institution the longer it is going to take for them to invest again.

Q: Investors are more aware of the events of May 9th, but has there been any impact on borrowers to choose you versus a competitor? How that might be filtering through? Can you talk about the under performing tranches? Will you re-establish them?

A: Borrowers are less likely to be exposed to recent events and we have seen no impact at all on the borrower side. Our NPS remains strong and have received no questions on the topic. Our response rates remain solid. The way to think about this population is really around the normalization of credit. As the recovery gets longer, credit is more available. These [under performing] borrowers had the propensity to build debt into the loan and continuing to build debt as opposed to leveraging the loan to pay it off. Is it permanent? It’s pretty organic, these changes reflect the current environment. There are things Lending Club can do to manage this population differently like with direct pay where loan proceeds go directly towards paying off the debt. Given modest near term ambitions and attractiveness it was the right decision for now.

Q: Where are things with LC Advisers?

A: Across all categories we saw a pullback of investors and with LCA, the way they do that is with a redemption. We have been taking a number of steps to improve management, governance over LCA funds. We believe in the value LCA provides, in its index format and are confident we will be able to grow it over time.

Conclusion

This was certainly a tough quarter for Lending Club and Q2 2016 will no doubt go down as their most challenging as a public company. Losing Carrie Dolan, an experienced CFO who has been with the company for six years will also hurt. However, we have seen some promising news as of late and it seems as though Lending Club has made good progress on the investor front, better than we expected here at Lend Academy. While guidance for next quarter is mostly flat and we may see this extend into subsequent quarters, the company did tease that future products are still in the works. We also learned that their technology teams were less affected by the recent layoffs which shows that Lending Club is still investing in its future.

The full earnings call and presentation is available on Lending Club’s website.

Disclosure: Peter Renton, the founder and CEO of Lend Academy, and Ryan Lichtenwald, Senior Writer at Lend Academy own LC stock.