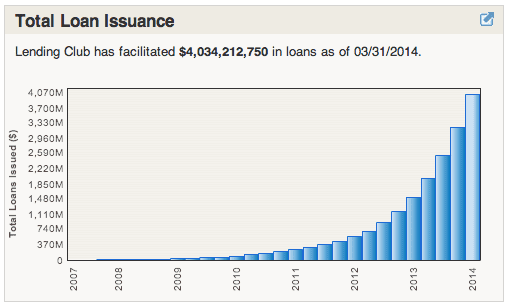

For three and a half years now I have been keeping close track of the lending volume at Lending Club and Prosper. Regular readers are used to seeing my end of month updates with the loan volume charts. Well, that is all about to come to an end, at least where Lending Club is concerned.

Astute observers will have noticed already that the Lending Club loan volume numbers on their home page and their statistics page have not been updated since March 31. And the total loan issuance graph shown above now shows loan volume by quarter and not by month and has also not been updated since March 31.

New Loans Will be Added to Lending Club’s Site Once a Quarter

Yesterday, Lending Club quietly published this blog post announcing the change. What is changing is the frequency of updates to the main download file that contains details of every loan, including the payments, issued since day one. The crux of the change is this. This file is changing from being updated with new loans every day to being updated with new loans once a quarter. What is not changing is that the payment information will continue to be updated every day, but only on loans that are in the existing file.

Here is how Lending Club describes the change:

Instead of posting new issuance data daily, we’ll now post new issuance data quarterly within 30 to 45 days after the quarter ends. We will, however, continue to provide daily data updates on payment and performance in our downloadable file for loans issued in prior quarters.

When I called Lending Club to discuss this change they would not provide much in the way of additional information. But it is not difficult to read between the lines here, particularly when considering this change in the light of their impending IPO. And I believe this is 100% related to the IPO.

No public company that I am aware of provides daily updates on their sales numbers. And that is essentially what Lending Club is doing by providing their loan volume numbers every day. It is not difficult to extrapolate the loan numbers into a sales number and know how sales are trending on a daily, weekly and monthly basis. Without this daily loan volume information their stock price will be less volatile and they will be able to “manage the message” with Wall Street every quarter.

When is this Change Happening?

The last complete update of the downloadable file will be on April 15. After that no new loans will be added until 30-45 days after the end of the quarter. However, as I said above payment information will continue to be updated daily for existing loans.

This is going to be a difficult change for many of the statistics sites such as Nickel Steamroller that offer detailed analysis of the Lending Club loan history. I spoke with Michael Phillips, the founder of Nickel Steamroller, yesterday and he said the change will certainly be challenging for his site and he will have to adapt. He will have to get to work over the next two weeks to make sure Nickel Steamroller is ready when the changes to the download file happen.

There is Some Good News

Lending Club tried to soften the blow by making a long awaited change to portfolio downloads. I have always thought it was strange that Lending Club provided the complete credit data in their download file for all loans, but when you download your own portfolio you get virtually no credit data.

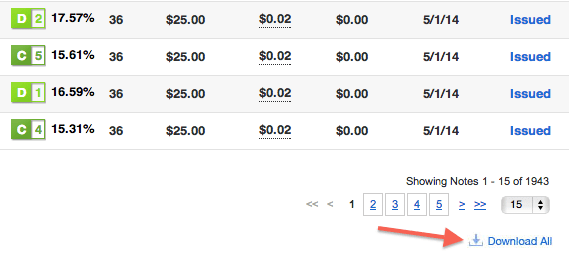

Before I get to this change let me explain how to download your own portfolio on Lending Club. From the main account page click on Notes and then scroll down to the bottom of the screen and click the Download All link that you see highlighted above. This will download all the notes you own into a CSV file that you can open in Excel.

Starting April 16 the portfolio download file will have some major changes. All the fields that have been on the data download file will be included in the portfolio download. This will be hugely helpful for serious investors and is a long overdue change. This is something I first asked them about three years ago and it has finally come to pass.

And one final change that was announced yesterday. The minimum for Lending Club PRIME accounts has been reduced again – this time to $2,500. Good news for investors who want to automate their investing and have Lending Club handle it for them.

Overall These Changes are Bad News for Investors

There is no way to sugar coat this. The change to remove loan volume is bad news for investors. It is one more step in the direction of reduced transparency and I don’t like it. This comes on the back of the removal of loan descriptions as well as the Q&A with borrowers. For those people who have been around a while the environment is very different now than it was just a year or two ago.

Having said all that, I understand where Lending Club is coming from. Renaud Laplanche, the CEO, has said on numerous occasions that his vision for Lending Club is as a mainstream financial services company involved in all areas of lending. One that will eventually rival the household names of today. To achieve that vision some things have to be sacrificed. And one of those things is the level of transparency.

When Lending Club becomes a public company, which could well happen before the end of the year, it will have to act differently. I accept that, because I want this company to grow and realize its potential. But I will also agree with the many of you who will be angry at this move.

So go at it. Share your thoughts in the comments.