Close your eyes and imagine it’s a decade-plus ago. You’re opening a mailbox stuffed with flyers, bills, and perhaps a postcard.

Among the items delivered by the postman: opt-out credit pre-approvals for a credit card and a car loan, perhaps.

Those pieces of paper, like many items once delivered by mail, come less often now due to paradigm shifts spurred by digital advancements.

However, a new way for credit unions to offer one-click loan approvals to new members and deliver perpetual credit approval is basing its approach on that old-school mailout.

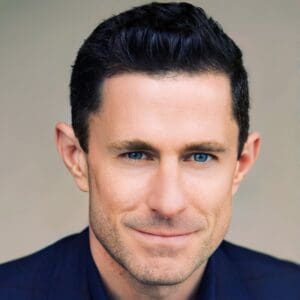

“That’s where this concept came from opt-out, pre-approved marketing,” said Dave Buerger, the CEO of fintech startup Union Credit, which launched in late January. “These are firm offers of credit that we’re creating, and they don’t require an opt-in.”

Union Credit is using $5 million in seed funding to build its digital lending marketplace, where credit unions can enter new markets with firm offers of credit embedded into purchase and financing experiences. Think of it as an embedded digital storefront outside a credit union’s digital walls in the open market.

Union Credit launched in late January

The Santa Rosa, Calif.-based firm has partnered with CuneXus in the venture. It is being led by Buerger and chief revenue officer Barry Kirby, both former CuneXus executives.

CMFG Ventures is leading the seed funding with support from Marin Sonoma Impact Ventures, Array, and others.

“Ending the guesswork of lending and financing is an important step towards financial health,” Brian Kaas, president, and managing director at CMFG Ventures, said in a media release.

“Union Credit can create real transparency via perpetual credit access. It’s a model that has the potential to completely change the way credit unions grow, allowing them to compete with fintechs and large financial institutions in their communities during the purchase experience.”

In 2007, Buerger co-founded CuneXus, which develops consumer lending automation technology for credit unions and banks. He served as its president and CEO before helping establish Union Credit in October 2022. Two-hundred-and-fifty credit unions in the US use the platform of CuneXus, a CUNA Mutual Group subsidiary that produces $27 billion in loans annually.

Buerger spent the last quarter of 2022 fundraising and laying the groundwork for Union Credit before its ‘stealth’ launch at the end of January.

“Union Credit is, instead of serving existing members of a credit union, helping credit unions attract new members,” Buerger said. “We’re going out and connecting with consumers wherever they might be. We’re providing them with the same benefit of perpetual approval but giving them options from various credit unions that want to serve them.”

One-click model bypasses the approval process

The Union Credit platform provides credit unions with new, credit-worthy members by aggregating consumer data and matching it with various credit union fields.

Once a match is made, the consumer can move forward with one click, essentially bypassing the approval process, said Kirby, who joined Union Credit in January from CuneXus, where he worked as senior vice president of sales, marketing, public relations, and business development.

“We’re saying we already know who you are, we understand that you take care of your credit, and would you like to bypass that process and just be told exactly that this is your capability,” Kirby said. “We’re bringing a level of transparency to consumers that’s never existed and leveraging the existing credit union market that we built at CuneXus as the facilitator of that transparency because they are consumer-focused.

“They have the best rates, the best options, and they have a local presence. It’s taking local institutions as a flavor to a national stage focusing on the consumer and that transparency layer.”

Finding audience for lending services

Now Union Credit is working to establish an audience for its service by enticing customers to enroll directly as a member or through their embedded partners.

“We have partners that want to embed our marketplace into their property, whether that be an app, a financial app, or a merchant app,” Buerger said.

“Either someone has something that they’re trying to sell that requires financing a big ticket item, or they’re maybe a financial app that wants to provide a value-added service to people who are maybe checking their credit in their app or doing other financial transactions.

“If they come to us from one of those sources, they’re coming in mass. Their whole user base is being screened through our process.”