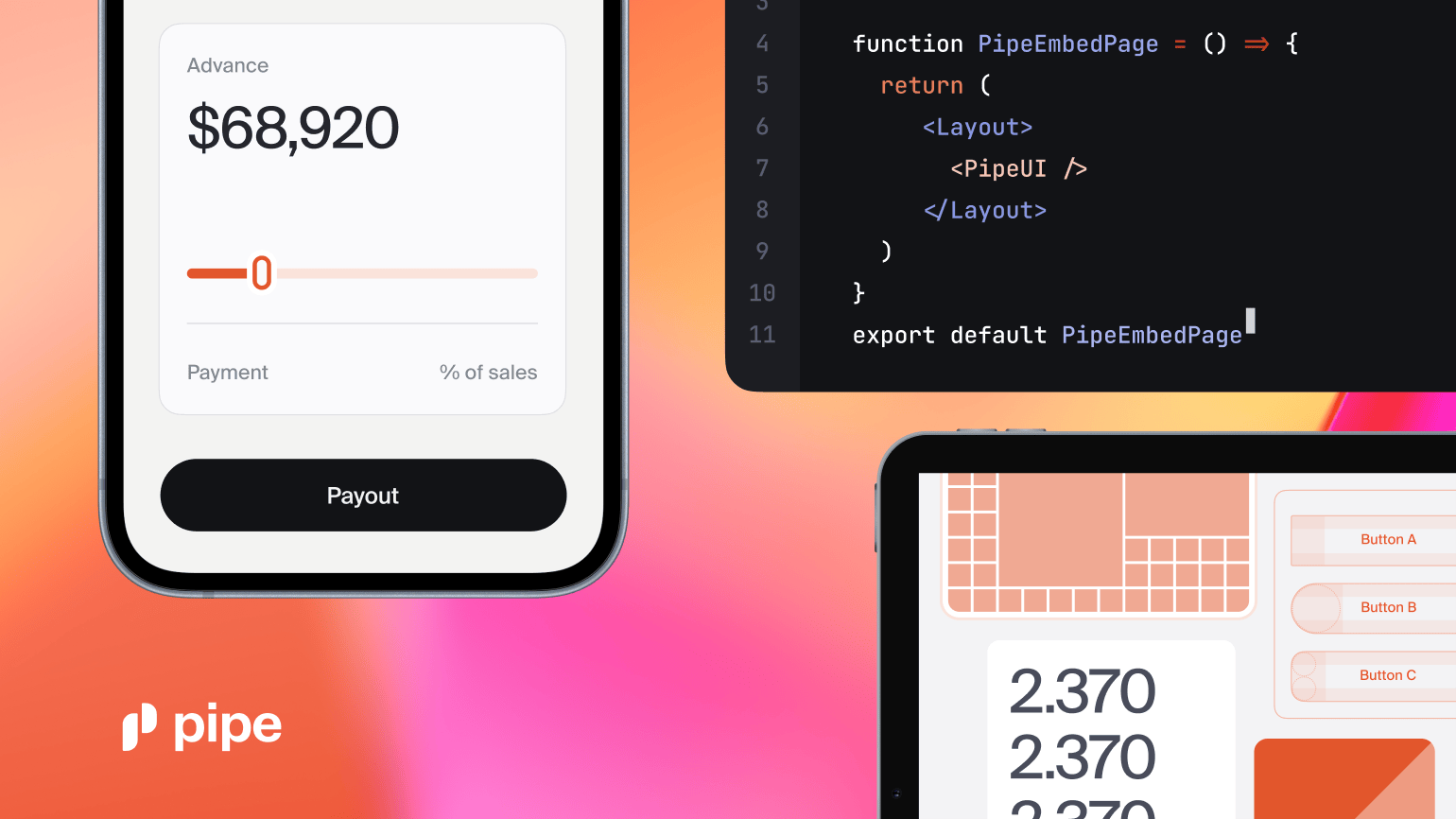

Pipe is launching a new embedded finance product to help small businesses. Their Capital-as-a-Service product has three launch partners.

A new report from Open Lending and TransUnion dispels the myth that many thin-file consumers, especially younger ones, are more risky.

For digital lenders economic uncertainty comes with additional risk. One way to mitigate this risk is with Digital Lending Insurance.

Neither the lender nor the borrower want a loan default, now with this innovative new solution from TruStage the risk of default can be removed.

A liquidity crunch can be devastating for a digital lender. Here are some ways for lenders to prepare and combat these difficult times.

TruVision Consumer Property Insights for Portfolio Management protects borrowers and lenders through a holistic view of property value fluctuation risks.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

Upstart reported Q4 2023 earnings yesterday with $140m in revenue for the quarter and a loss of $47.5m.

Bank lending is often the least expensive form of financing but it is not often a consideration at the point of sale. Advances in embedded lending now makes this possible.

Beem is partnering with U.S. insurance, investment and technology provider TruStage to offer the latter’s Payment Guard Insurance as an additional layer of financial security for its members.