According to TransUnion Insights, in Q3 2022 consumers turned to unsecured personal loans and credit cards for breathing room.

Cion Digital's new Advisor Lending Platform connects wealth professionals and firms with lenders in a more efficient process than was previously available. They also now offer their product suite to a more significant portion of the financial services and retail sectors.

Between the Public Service Loan Forgiveness deadline and the end of the student loan payment moratorium, borrowers are flocking to Candidly.

Gone are the days of selecting your bank because it’s nearby; now, small businesses want to bank with someone who understands them and has the digital products they are looking for.

Several factors are contributing to rising rates of BNPL fraud, Sift's trust and safety architect Brittany Allen said. Through its end-to-end Digital Trust and Safety Platform, Sift helps clients proactively stop fraud at crucial transaction points while fuelling growth.

Pinwheel released a consumer finance survey that showed 75% of respondents wished consumer finance relied on more than just credit scores.

Save now, pay later capability as an embedded e-commerce service is Accrue Savings' response to the waves of credit forced on consumers.

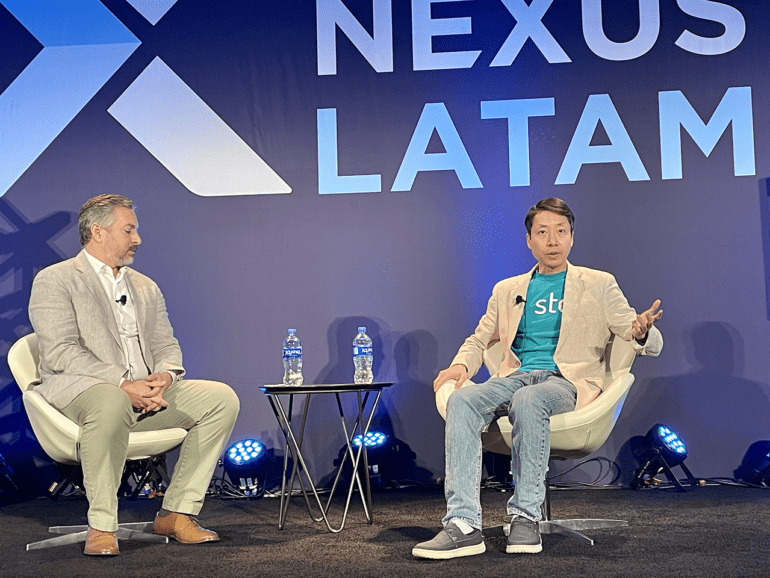

The rise in interest rates has led to banks and fintechs cutting down on lending. For companies like Stori, that is an opportunity.

TransUnion's latest quarterly study found most Americans could be experiencing a 'personal recession' with 54% stating their incomes were not keeping up with inflation.

John Tomich, CEO of Credit Key, said he sees evidence of credit washing and wants to bring awareness to the recent trend.