Kueski, a BNPL fintech in Mexico, broke its loan disbursement record this month as it hit 10 million loans and $1.6 billion in transactions.

Exclusive interview with Andrew Seiz, head of finance at Kueski, on the 2024 outlook for consumer lending and Buy Now Pay Later in Mexico.

Fintechs are targeting the huge LatAm remittance market, as increased digitization paves the way for more affordable money transfers.

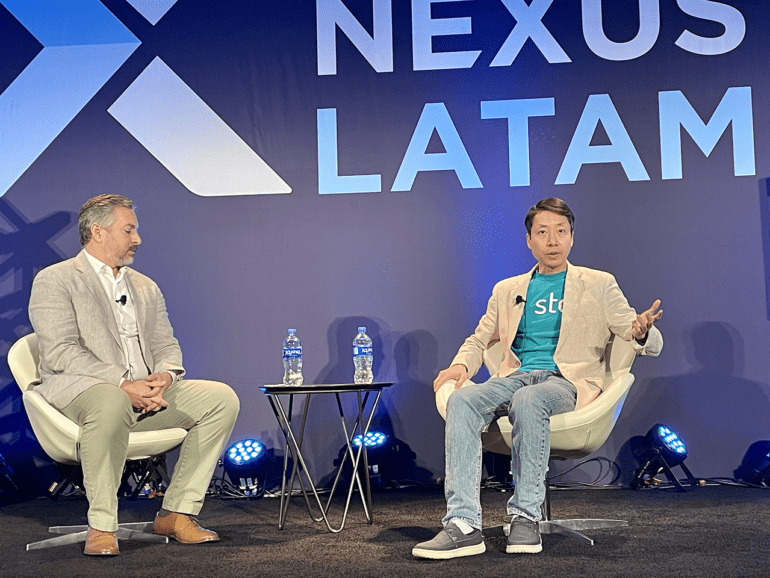

The rise in interest rates has led to banks and fintechs cutting down on lending. For companies like Stori, that is an opportunity.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

Nearly a full year after purchasing RadiusBank, LendingClub boasted revenue of $262.2M and diluted earnings per share of $0.27.

LendingClub reported Q4 earnings today and their recovery from the depths of the pandemic continues. Loan originations were up 56%...

LoanPro’s credit platform integration with Visa DPS helps brands tackle shrinking interchange fees while providing unique personalization.

A new report from Open Lending and TransUnion dispels the myth that many thin-file consumers, especially younger ones, are more risky.

The canary is now 10+ years old as prominent platforms like SoFi and Upstart launched in the early 2010s, and Freedom Financial (now Achieve) has been around for two decades.