Embedded lending provider, Momnt, won Fintech Nexus' 2023 PitchIt crown. Here's what swayed the judges vote.

·

Mexican fintechs Klar and Konfio tap $100 million credit lines from U.S. firms to boost lending in the country.

The microfinance movement began in south Asia when Muhammad Yunus started Grameen Bank in Bangladesh in the 1970’s. He was...

Microloan facts: Kiva, MyC4 and MicroPlace Kiva.org MicroPlace.com MyC4.com Launched November 2005 Summer 2006 May 2006 Who can become a...

Every quarter I share in detail the returns I am receiving from my p2p lending investments at Lending Club and Prosper....

Nav announced a partnership with Marcus by Goldman Sachs to offer SMB owners lines of credit through machine learning on the platform.

Neofin goes live in the US with Stately Credit for their no code lending platform.

Neu’s path to success will produce financially literate college graduates and a strong bottom line. The journey began in late 2023 with the release of the Neu Card, whose attributes include no late fees and interest charges, a maximum $1,000 spending limit, no Social Security number required, and no credit history or cosigner required.

The SBA is making updates to its lending program opening the door for fintechs. But much more needs to be done.

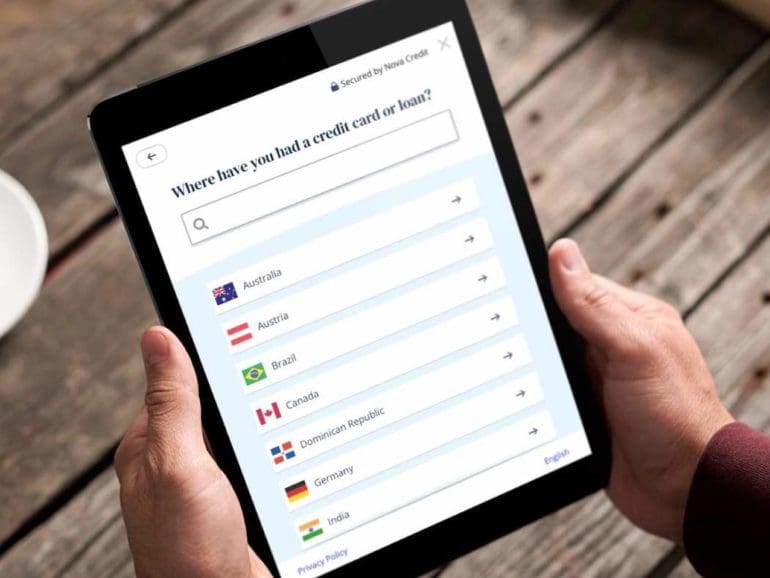

Nova has created products to assist migrants in gaining access to credit across borders. Their partnership with HSBC brings new capabilities.