Every quarter we check in on the public online lenders. This includes LendingClub, OnDeck and GreenSky. LendingClub and Greensky reported today and we’ll review some general highlights from OnDeck who reported last week.

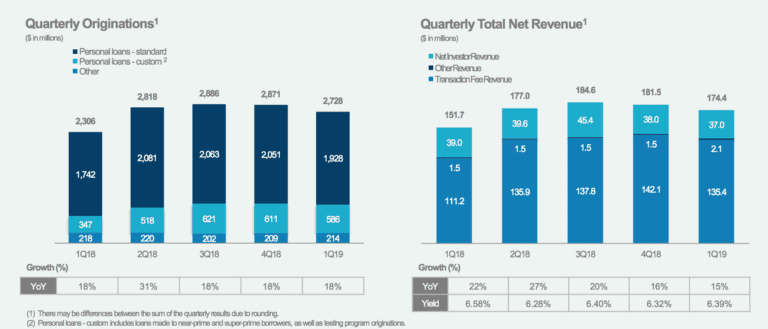

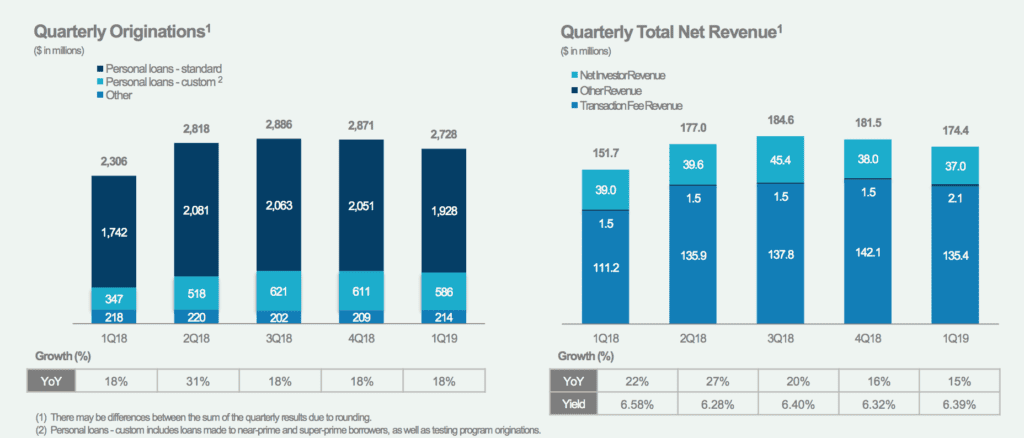

LendingClub rounded out 2018 originating the most loans in the company’s history at $10.9 billion. With their Q1 2019 results, the company is off to a great start in 2019. Originations were $2.7 billion, up 18% year over year. The company reported that application growth was 31% over the same period.

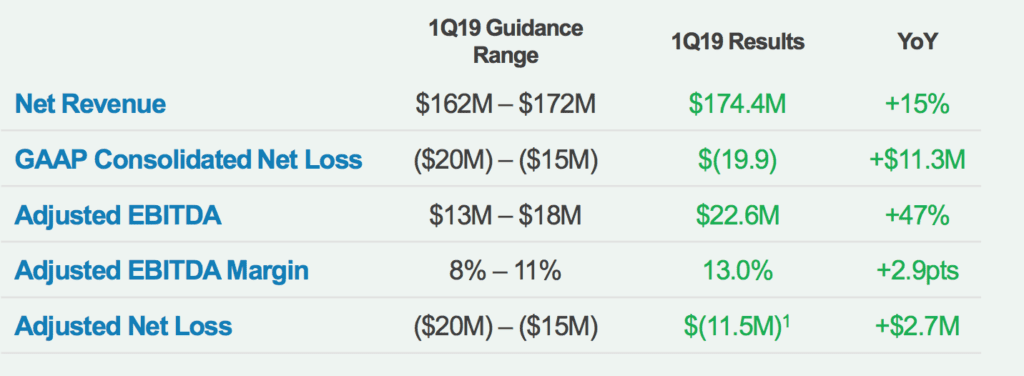

Net revenues came in above high end guidance of $172 million at $174.4 million for the quarter, up 15% year over year. GAAP Consolidated Net Loss was $(19.9) million, compared to $(31.2) million in Q1 2018. Finally, the company delivered adjusted EBITDA of $22.6, up 47% year over year and well above their projections of $13-$18 million. LendingClub is on track to become adjusted net income profitable over the second half of 2019.

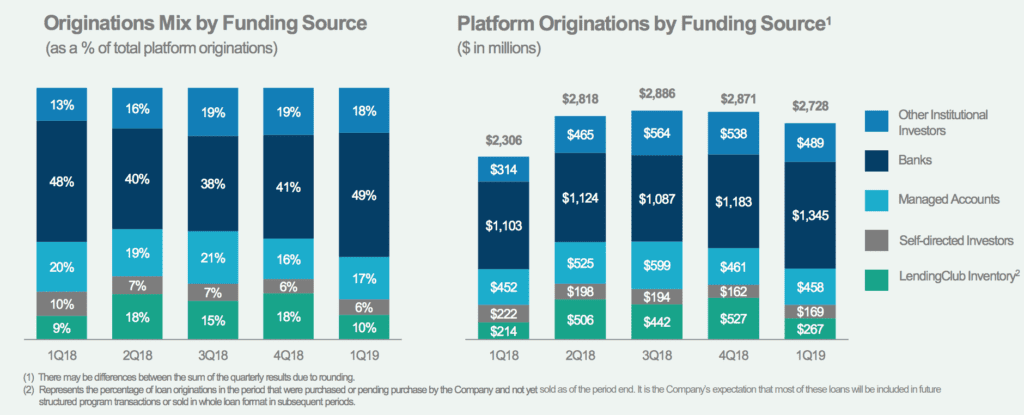

As always, it’s always interesting to look at the investor mix over time.

There were a few interesting news items from the quarter as well as some comments from CEO Scott Sanborn on the earnings call. The most significant news was that the company announced a shift to the way they serve small businesses. LendingClub is no longer originating small business loans themselves and is instead opting for a partnership approach. The co-branded offering is made possible by Funding Circle and Opportunity Fund. In addition, small business loans will no longer be funded by LendingClub investors.

Beyond the small business operation, Sanborn discussed that the company is working towards their vision of not just being a “lending club” but a financial health club. To date we’ve seen little progress in realizing this vision, but clearly they want to do more. They envision moving from simply a product focus to a platform focus in areas where it makes sense. The decision to make the change in their small business operation is the first example of this.

In the personal loan space LendingClub is also looking to offer a unique opportunity for their investors. The reality today is that the company receives 40,000 applications a day but only a small fraction of these borrowers get approved and subsequently take a loan. LendingClub realizes that there is a lot of expertise in their broad investor base and they may give investors the opportunity to provide their custom models to underwrite a subset of these applicants. This would also result in higher satisfaction on the borrower side as more borrowers would be approved. In my opinion this gets back to LendingClub’s original promise of being a true marketplace, offering a wide range of loans to every type of borrower.

Interestingly, Sanborn commented on the opportunity of a bank charter, something that would be hugely beneficial for a company seeking to offer a wider range of products. Other potential benefits include margin improvement, more resilient funding and giving the company more regulatory clarity. While this would certainly change many dynamics in the business, Sanborn noted that this is a massive undertaking that will come with significant time and costs and they will update investors as their thinking evolves.

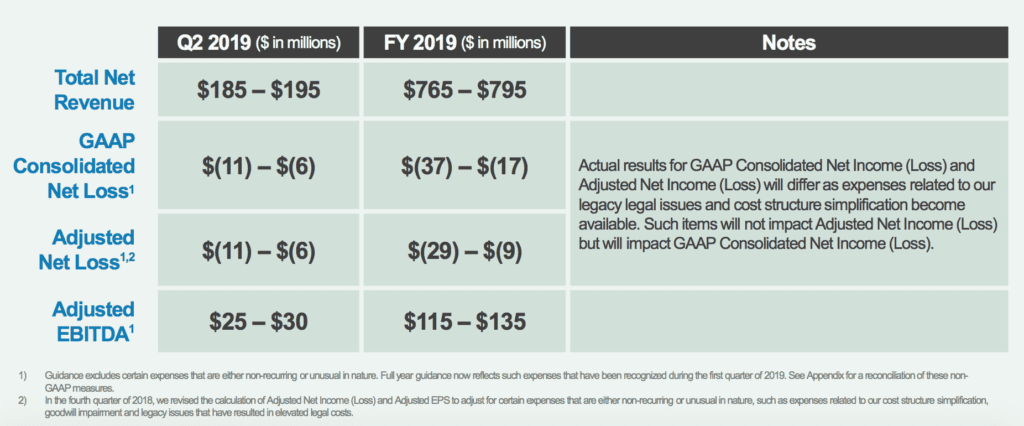

LendingClub is also very much focused on cutting costs as part of their simplification program. Last week Bloomberg published a piece on LendingClub’s plans to move employees to Utah from their expensive San Francisco office. The cost savings are significant as they decrease their footprint by around 41% in the city as leases expire and they sublease their open space. Below is LendingClub’s Q2 2019 and full year guidance.

GreenSky Q1 2019 Earnings

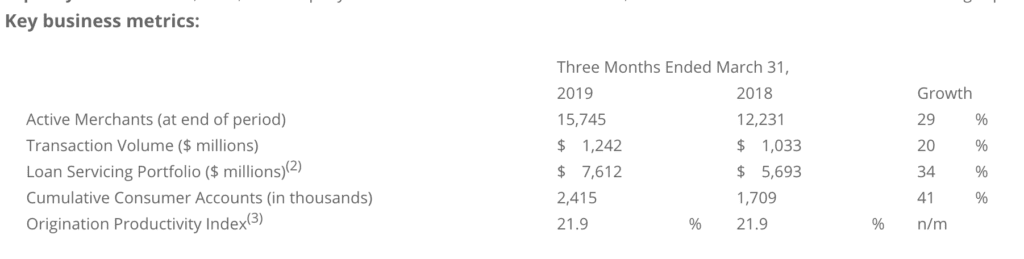

In Q1 2019 GreenSky increased transaction volume on the platform 20% to $1.2 billion. They also grew revenue 22% to $103.7 million form the prior year period. GAAP Net Income in Q1 2019 was $7.4 million. The company had aggregate commitments of $11.8 billion from nine bank partners of which $4.5 billion remain unused. The company ended the quarter with $268 million in cash.

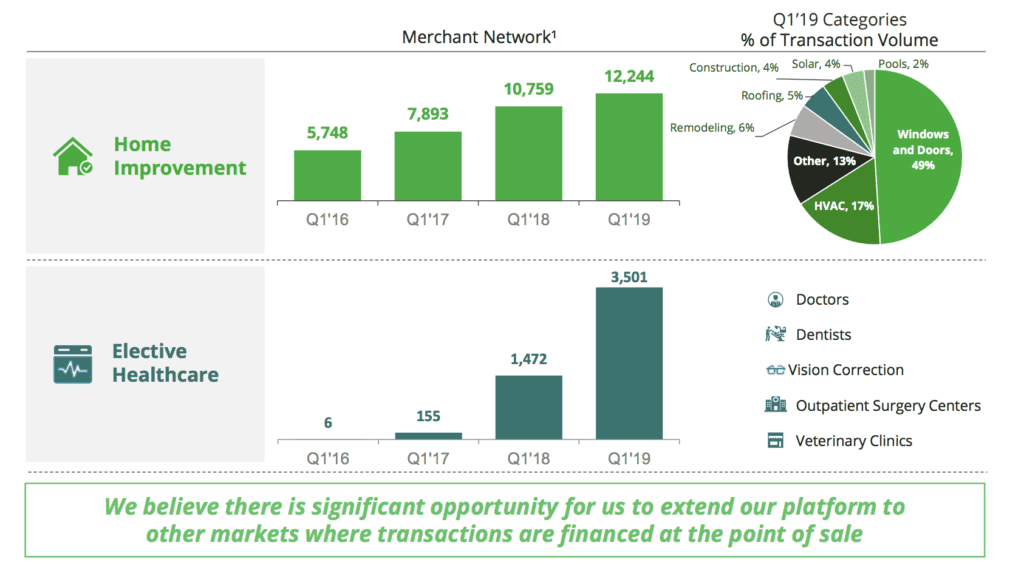

Last year we reported on the potential of the company’s partnership with American Express. GreenSky shared that since the alliance launched 3,600 merchants have been referred to GreenSky for enrollment evaluation. In February 2019, the program was extended to include elective healthcare.

Below is a look at how their merchant network has grown over time and the verticals they currently serve.

GreenSky also noted new relationships with a field services software company, a dental practice management software company and an HVAC home services software enterprise. In all of these relationships, the GreenSky financing platform is integrated into the software. These types of relationships and the market GreenSky focuses on is what makes them different from many of the fintech companies around today.

In Q1 2019 GreenSky also repurchased 4.3 million shares at a cost of $50.9 million which is part of their $150 million share repurchase program. Since then the company has purchased more shares and in total has repurchased 9.1 million shares.

OnDeck Q1 2019 Earnings

OnDeck reported Q1 2019 earnings last week. Originations fell for the quarter to $636 million compared to $658 million for the previous quarter. This was attributed to OnDeck tightening their credit box during the quarter. The company shared that their line of credit product reached an all time high of $150 million for the quarter. Further information on their quarter is available in their press release.