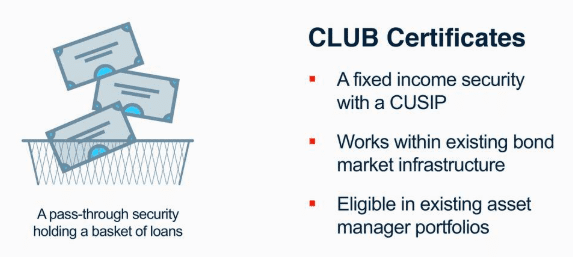

LendingClub has seen issuance of their new CLUB Certificate reach $1bn in less than a year after first announcing the pass-through security product last December at their investor day. The CLUB Certificate was created to make it easier for institutions to invest in LendingClub originated loans.

“We continue to innovate for investors and diversify our investor base,” said Valerie Kay, Chief Capital Officer of LendingClub in a press release. “By continually innovating on products, LendingClub expects to further deepen and broaden investor access in 2019 and beyond through a variety of new products and structures.”

At LendIt Fintech Europe 2018 Kay went on to tell Crowdfund Insider that the online lender essentially created their own ABS program and they’ve been able to grow the CLUB Certificate product to $1bn without the help of any big banks.

“Our Club Certificates are a result of direct conversations we had with buyers of our securitization deals. We listened to their feedback and delivered a structure that suits their specific needs. The result is incredible demand for the product from some of the top names in asset management.”

CLUB Certificates are traded over the counter with a CUSIP and cleared by DTCC. CLUB Certificates can be seen on dv01, Bloomberg and Intex with the “CLUBC” ticker.