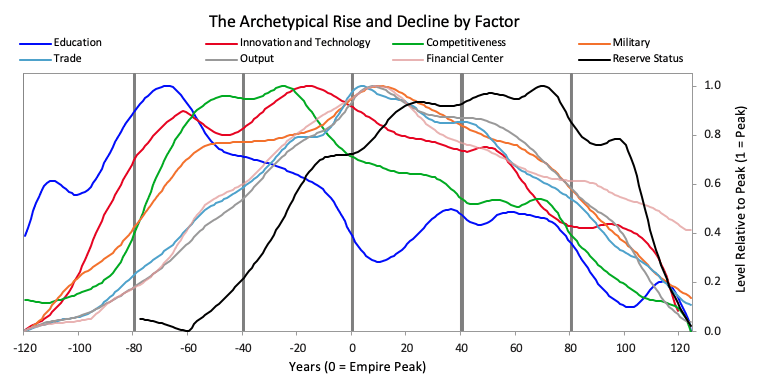

This week, we engage deeply with Ray Dalio's economic research about American Empire, capitalism, and the structure of money and credit. His clear ideas and model of the macro economy help connect the dots between emerging schools of thought, like Modern Monetary Theory and Market Monetarism, and the scarcity-focused philosophies of Gold and Bitcoin. This exploration will give you tools for understanding the $2 trillion printed by the US government, as well as potential associated impacts on finance and society.

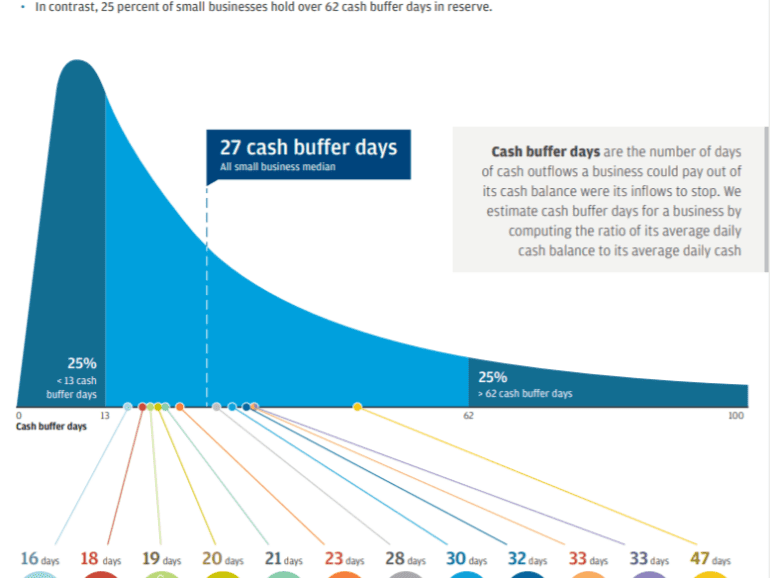

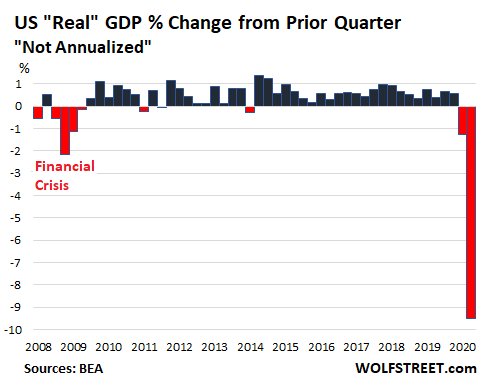

Another heavy week. It is hard to find the right, or even the interesting, thing to say. I look at why the $2 trillion in US bailouts may not even be enough to stave off the economic damage. In particular, I am alarmed by the large and fast rise of unemployment claims (higher than 2008 peak), estimates that GDP may fall by 20-30%, and the broad impact on small business. Small businesses have 27 days of cash on hand, and power half of our economies through both employment and output. So how do we meet this challenge? What strength should we draw on in the moment of doubt to become the artists of tomorrow?

This week, we look at:

The spectacular price increase in crypto assets, hitting new records for Bitcoin, as well as the comparable statistical situation around Covid cases

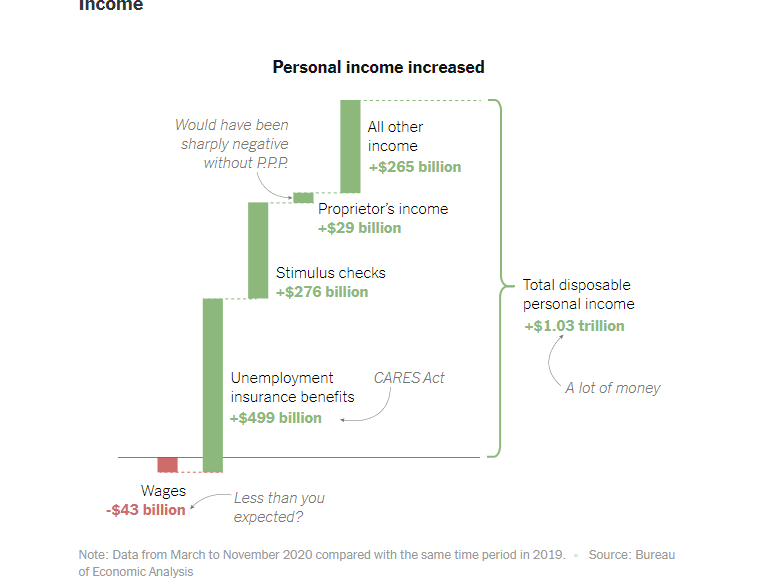

An explanation of the $1.5 trilion income effect in 2020, and how it has led to both capital acumulation and inequity (thanks NY Times!)

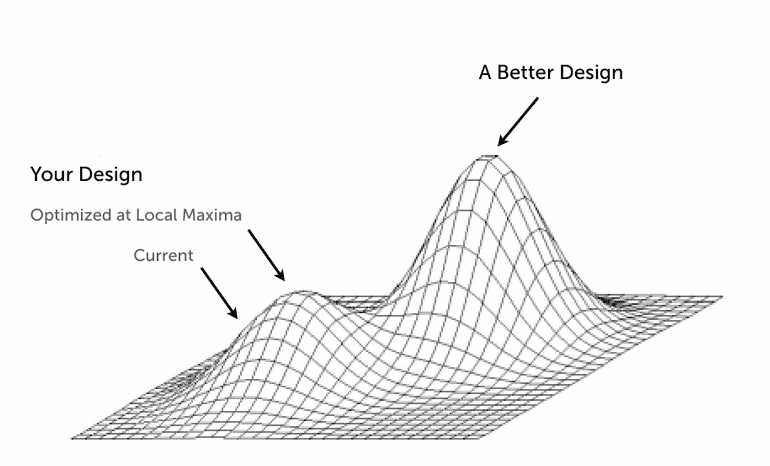

A discussion of all-time-highs and all-time-lows, why we need them, and their connections to the macro-economy, computer code, music, and the universe itself

One wonderful takeaway from Watts, which of course is not his, but beautifully plagiarized into the English language, is the duality of experience. The need for polar opposites, in a clock-like cycle. To have black, you must have white. To have the top of the wave, you need the bottom of the wave. To have a melody, you need equally the presence of the notes, and their absence in silence. To breathe in, you need to breath out. It is meaningless to have a data point without the context in which it exists.

This week, we dive into the social, economic, and financial implications of data in a post-COVID world. As Apple and Google work to build out the government's contact tracing apps to combat pandemic, what Pandora's box are we opening without consideration? As Plaid reaches into payroll data to accelerate small business bailouts, what power do we hand to aggregators? Will dignity-preserving solutions come to market in time? The opportunity for decentralized identity and data storage is clearer than ever. Or will fear drive us to make permanent compromises?

big techChinacivilization and politicsfixed incomegovernancemacroeconomicsnarrative zeitgeistphilosophySocial / Community

·I've seen a whole bunch of headlines this past week about how Facebook is launching its version of the "Supreme Court", as if that were an app feature. The oversight board is meant to police controversial content decisions, and have the power to overrule Zuck's judgment on political matters. Its charter is drafted as if Facebook's 3 billion users were citizens of an Internet nation. Add to this the insanity over WeWork's failing IPO plans, where the CEO has been personally named in the amended filing documents with clear checks on demonstrated abuses of power. We are drifting into a Twilight Zone episode where modern corporations act as if they were feudal states run by divine kings negotiating with their nobility over a Magna Carta. Which is actually sort of where we are.

This week, we look at:

The 10% collapse in GDP across the US & Eurozone, and how it compares with China's second quarter

The geopolitical battle over TikTok, its alleged spying, and understanding the winners and losers of the Microsoft deal

A framework for how to win in open source competition, explaining both Shenzhen manufacturing success and decentralized finance growth to $4 billion

central bank / CBDCcivilization and politicsenterprise blockchainmacroeconomicsnarrative zeitgeistphilosophyregulation & complianceSocial / Communitystablecoinsthings that are not true

·We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.

This week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

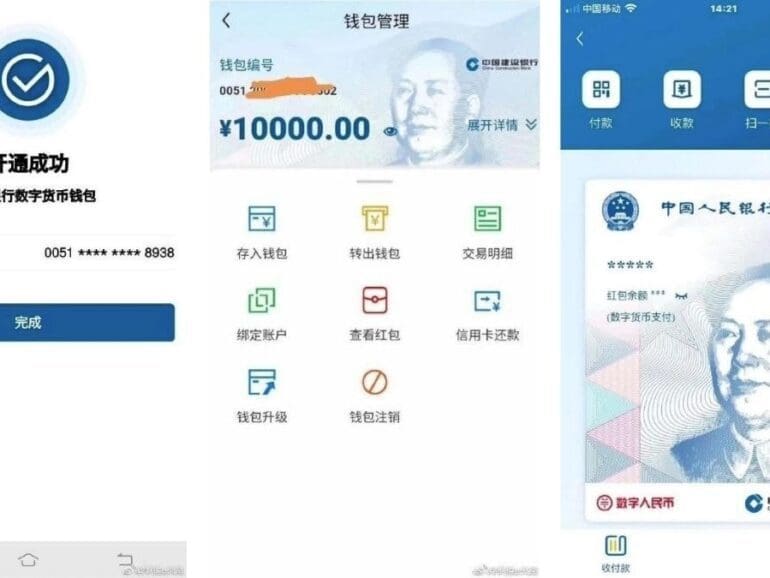

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

This week, we look at:

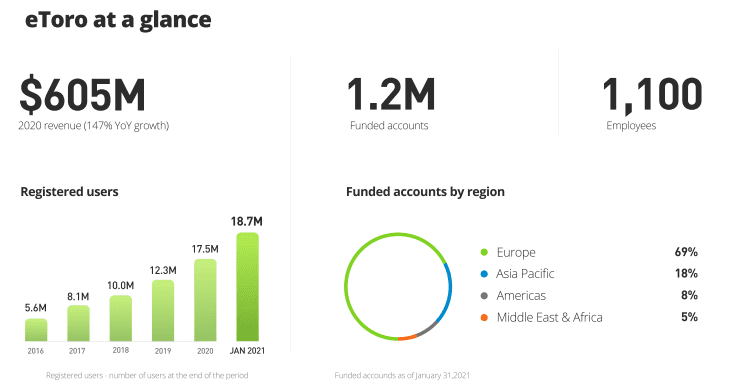

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competition, and in particular the impact on money in motion vs. money at rest

Broader financial product penetration and an anchoring in how the technology industry was able to get more attention that we had to give