Thirteen years after launching as a community bank on Long Island in 2009, the word in the industry is that Quontic punches above its weight.

Over more than a decade, the bank went from in-person branches and loan sheets to online-first mobile banking.

According to Aaron Wollner, CMO, staying ahead and alive in the ever-competitive space of neo banking, community banking, and mobile banking chimeras means keeping up with tech culture while staying close to your roots.

“We’ve got these humble roots in terms of what makes a community bank tick. We did some things right with the individual one-on-one relationships,” he said. “How do you make that scale online? You’re talking about Web2. In the past years, Quontic.com has been our storefront.”

As Web2 becomes Web3, the storefront is ever-changing.

The team opened the doors of a virtual bank “outpost” in the Decentraland metaverse in the past 12 months.

Exemplifying the duality of the times, they soon launched a wearable payment ring to tap and pay in the regular verse.

Live, from Decentraland

Wollner said that the virtual bank, a 3D landing page near a Pikachu Statue and an NFT portrait museum, is a monument to what Quontic Bank was, is, and could be. He said that the entire goal was to create a fun, playful experience you could jump into.

After eschewing most in-person bank branches, the community bank by AUM class added a virtual bank as a virtual landing page that links to their home site to inspire the next generation of banking, Wollner said. Customers that click the link and connect Web3 wallets to jump in, donning virtual outfits like digital Crocks, will not find banking services.

There are no free pens, deposit slips, or drive-in suction can tubes at this “outpost.” A representative said regulators would not allow the firm to call the location a branch because customers can not perform banking actions. Instead, users find a marketing art project, a remote-access brand identity. As Wollner explained, it is not the complete picture but an invitation to enjoy a snapshot of what may come from the future.

“We’ve spent the past 10 years or so transforming, becoming the digital bank that we are today,” he said. “Instead of 1,000 branches, we have Quontic.com, but people have come to enjoy in a community bank type setting, so we think about and try and deliver on that. I’d say it’s a part of our success, is our humble roots as a community bank, that that that still means a lot to us, even though I would say we’re not a community bank.”

Let traditional roots grow into digital trees.

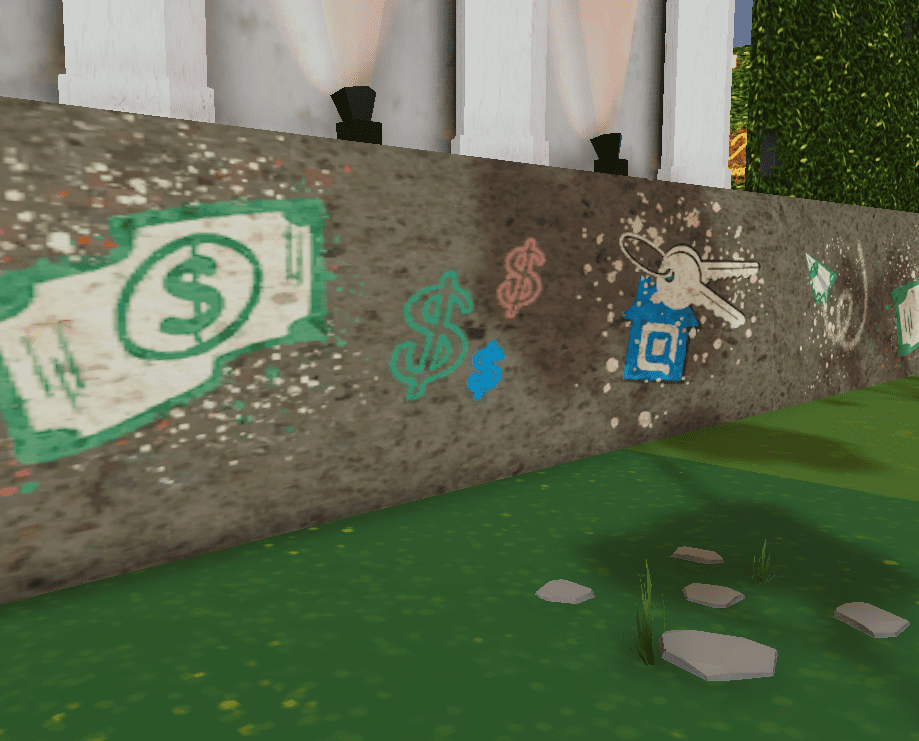

The intentionality of leading an online first bank brand means sticking to roots but growing from them. The virtual bank form represents this, Wollner said. Some brand identity that was already there took shape when the team built the virtual bank.

“For example, the foundation is built on is this graffitied concrete. It’s built on this edgy, fintech-forward foundation, metaphorically,” He said. “On top of that is a very traditional, almost Greek-style bank structure, and this fun play area behind that. Our identity took the shape of this thing we built in the metaverse.”

Users can open a bank vault in the back of the bank, revealing a pool party and a DJ where there would typically be a vault filled with customer deposits. Wollner said the project took about three months, a little push but one of many the team focuses on each year. American Banker reported that the cost to acquire the land and build in Decelantraland was about $40,000.

“There’s this ancient bank vault, and if you interact with the ATM, you open the vault, and there’s a DJ playing music,” Wollner said. “And if you go to the DJ, he talks about NFT wearables, and you can get wearable Quontic sunglasses and a hat.”

That is another point of the activation, he said, to make it easy for customers to get their own NFTs and in-game wearable NFTs. By providing many customers with their first NFTs, they connect them to the space and leave them at least with the opportunity to be part of the conversation.

“They can now be a part of that conversation of these big, nebulous, new things that can be hard to wrap your head around,” he said.

If new is nebulous, old is slow.

Wollner came from agency work for traditional banking, with time at American Express, Bank of America, and National Bank. He said he left that world for the same reason many fintech workers do: it was boring and slow.

“I was never happier not to be in-house at one of those big stodgy, boring, slow financial institutions,” he said. “I loved helping them but never wanted to work directly for them. You witness instances where big institutions want to pass up good news and prevent bad news from going up the food chain.”

Not interested in fake internal news, Wollner said after an internal debate, the team decided to build an experience for the crypto curious to lead people to the digital frontier. They have ventured forth in the past, launching a crypto rewards card a couple of years ago, Wollner said, the first to market with a crypto rewards card, with 1.5% back in bitcoin.

What is the metaverse, anyway?

“‘Metaverse’ is something you hear about, but if you ask five people what it is, you will get five answers, right?” he said. “So pushing forward and creating a fun simple way to invite our customers to invite became an essential keyword for us. And going customer first going out from there, felt true and authentic.”

He described the virtual bank as a journey. The team welcomed customers to join them in the metaverse, and he said many did.

“We invited all of our customers into the metaverse, and a huge percentage of them joined us there because we made it so easy, and we made it real,” he said. “Another decision-making factor along the way; this is something that we want to figure out ourselves. The best way to figure something out is to just do it.”

The team, with Web3 fanatic members, Wollner admitted, chose the Decentraland metaverse to build with. Decentraland company offers 3D space to buy and build structures on, and Wollner said they decided to work with them because it is the most professional option out there.

“We talked to a couple of friends and peers who had more experience with the metaverse, and we heard their opinions of where the companies in the space are going, where’s the best place to put your bet,” Wollner said. “But the best advice we got was ‘jump in,’ and that’s the call to action we have on our email landing pages: Jump in.”

The next push: IRL wearable payment

In stark contrast to the setting of their 3D bank, but a sign that metaverse means physical world upgrades as well, Wollner said the most recent activity was the creation of wearable payment rings. Similar to hotel key cards, nonelectronic mediums can hold a magnetic signature. The pay experience puts debit transactions literally at customers’ fingertips, like the smartphone chips that allow for Apple and Google tap pay, but with no need to charge batteries.

“The idea is quite simple. We didn’t reinvent the core technology. We took the core technology and just gave it a different format, and the result is something joyful,” Wollner said.

The goal is always to bring joy into otherwise joyless things, Wollner said. Wearables generally are not on the map in the financial world, and when the product testing results and data came in, the firm saw it as a precise fit.

“The data indicated an opening, but on top of that was a gut instinct of ‘wait a minute, this is probably going to be a lot of fun,'” he said. “It took a while to execute, the backend stuff to connect into a bank’s core. But at the end of the day, when we started to trial this thing earlier this year, we had 12 rings on for the leadership team to try out.”

Wollner said that when testing the ring by going out for a cup of coffee, it started conversations immediately, and sometimes that’s all a conversion needs.

“More than half of the time, it’s a literal conversation starter for the person behind the register and the people behind you in line,” he said. “It was the juxtaposition of coming out of the pandemic and people being a little bit more hesitant than they used to be probably in public spaces.”

Due to the startup-like culture, fresh ideas come all the time, he said, and talked about implementation. Wollner said you follow an arc when you do something innovative, from the moment of inspiration, through research, to developing a launch plan.

“And then you just sort of hit a low, right? When you’re in the nitty-gritty, you’re dealing with ‘how do we connect this to our integrations’ and fighting your way through the details. But if everything goes right when the beta launches, that means you had a good idea to begin with.”

Wollner said good ideas, like virtual spaces or physical tap payments, lead to fresh customer conversations out of thin air. In an age of viral marketing, eye-catching tech brings natural hype and traffic from content creators across TikTok and Youtube. He said that traffic could make all the difference for competitive digital banks.