Earlier this week I was down in Sydney Australia for the first ever AltFi Australasia conference. When organizer Glenn Hodgeman emailed me about this conference several months ago and asked me to speak I couldn’t resist doing a quick visit to my hometown and being a part of the first ever P2P lending conference in Australia.

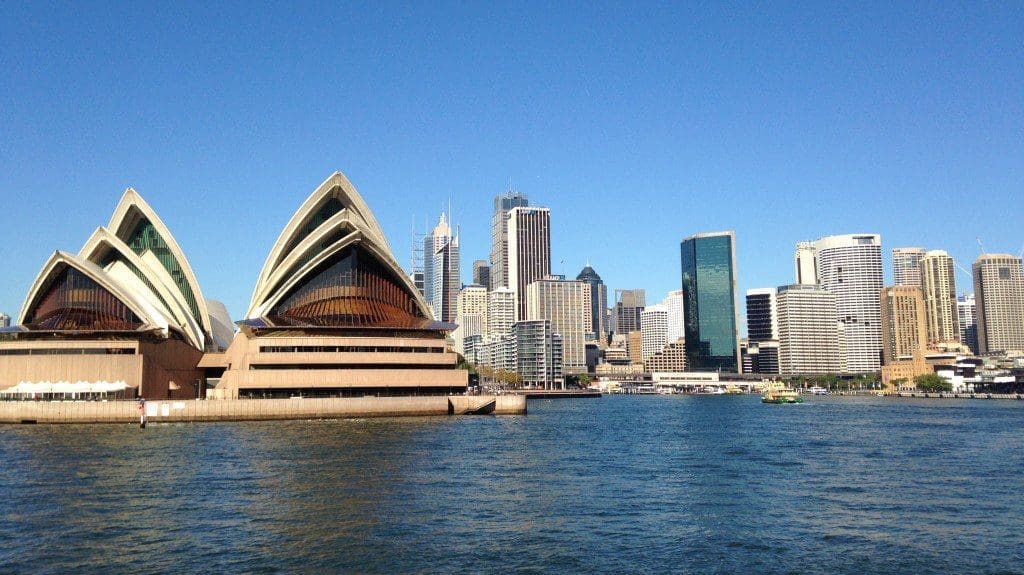

The setting was a beautiful conference center right on Sydney Harbour and it was standing room only when Noah Breslow, CEO of OnDeck, gave the opening keynote. He talked about how in Australia, just like in the United States, small business lending actually looks a lot like consumer lending. It is very much focused on the credit of the small business owner. OnDeck believes they have discovered a much better way to analyze the credit risk of a business with their OnDeck Score. Noah said that there is $2.4 trillion in unmet small business lending demand globally and OnDeck is aiming to help reduce that number.

In a fireside chat session, I sat down with former Lending Club executive Mitchel Harad who is now the CMO of leading Australian P2P lender, SocietyOne. We talked about the many differences between Australia and the United States. Mitchel is one of the few people who has deep experience in both markets when it comes to P2P lending. Mitchel explained how in many ways the opportunity for this industry in Australia is far greater even than that in the of the US with banks enjoying such high margins down under.

One of my favorite sessions of the day was an entertaining presentation by Paul Clitheroe, Chairman of the Australian Government Financial Literacy Board. He talked about the efforts being made by Australia when it comes to financial literacy and that Australia is now ranked fourth in the world for money skills based on a recent test of 14-year-olds. He also talked about how the finance industry uses too many buzzwords and jargon and that alienates the average consumer. We need to truly keep it simple if we want mainstream acceptance.

Another highlight of the day was a lighthearted presentation by Daniel Foggo of Ratesetter Australia who compared the risks of peer-to-peer lending with the seven deadly sins. It was reminiscent of the keynote presentation by Ratesetter UK CEO Rhydian Lewis at LendIt Europe back in 2014. Sam Griffiths of AltFi Data gave us a statistical view of the market down under showing that around A$260 million had been originated through the end of last year and around A$500 million is expected to be originated this year. Australia was actually the fastest country in the world to reach the A$250 million mark in total originations so it is clear the industry is gaining traction down under.

John Price is a commissioner at ASIC, the Australian equivalent of the SEC, and he talked about how his organization is really trying to foster financial innovation. His agency has created an innovation hub to help fintech businesses develop innovative new financial products. It reminded me of similar initiatives set up by the UK government.

One of the challenges of the Australian P2P lending industry is a lack of credit data. This was a common topic revisited many times. Unlike in the United States credit data in Australia has been based purely on negative data, reporting to the bureaus only when borrowers miss payments or have some other kind of negative credit event. Laws were changed in 2014 to allow the sharing of positive credit data but as yet none of the large banks have signed on with this initiative. Until they do platforms have to be more creative and cautious with their underwriting.

All in all it was an excellent day in Sydney. I was chatting with Noah Breslow after the conference and we both commented on how the energy and the vibe in the room reminded us both of the very first LendIt conference in New York in 2013. There was a lot of enthusiasm and exuberance and a felt sense that this was the start of something big.

Throughout the day I was able to chat with pretty much every major platform down under and was able to get a real sense for where the industry is going. Platforms face many of the same challenges as other parts of the world but the industry is still very nascent in Australia. Most platforms have been operating for less than a year and even the major players are still quite small. But that will change with time.

I am very glad I decided to make the trip and experience the first major gathering of our industry down under. It was a bonus that I was also able to spend some time with family and friends (Sydney is my hometown). But no more big trips for me. Crunch time is about to start for LendIt USA 2016 as that conference is now just over six weeks away.