The American healthcare payments system is plagued with billing errors, fraud, and confusion. The average cost of it is estimated at around $325 billion per year.

While some medical bills are correct, the odds aren’t in patients’ favor. Around 80% of medical bills have errors, a quarter of which are due to typos. These mistakes, while seemingly tiny, can cause patients to pay thousands of dollars unnecessarily out of pocket, sparking a domino effect of life-changing proportions.

“You have most people living paycheck to paycheck. So the idea that all of a sudden somebody has to spend $500 – $2,000 out of pocket, that leads to homelessness, that leads to people not being able to feed their kids,” said Jonathan Anastasia, Executive Vice President, Crypto & Security Innovation at Mastercard.

Whether it be through error or fraud, healthcare billing is an area rife with complications, and patients are paying the price.

In a recent partnership, Mastercard joined forces with HealthLock, to bring clarity to patients’ medical bills.

Fraud Thrives within Chaos

David Burzynski, CMO, and Chief Customer Officer at HealthLock, explained that many unnecessary payments are made due to the complexity of the system. Patients are unaware of the types of errors that can exist and how they can be rectified, leaving them with no other option than to pay.

“Fifty-Six percent of Americans are confused by health insurance and medical billing,” he said.

HealthLock, a company providing patients with a service that helps keep control of their healthcare payments, has seen these issues and deployed machine learning and industry expertise to allow their customers to keep track of payouts associated with their name.

“Our product focuses on privacy, control, and savings,” said Burzynski. “As people are going to the doctor and receiving these bills, we want to protect them from data breaches, confusion, and overbilling.”

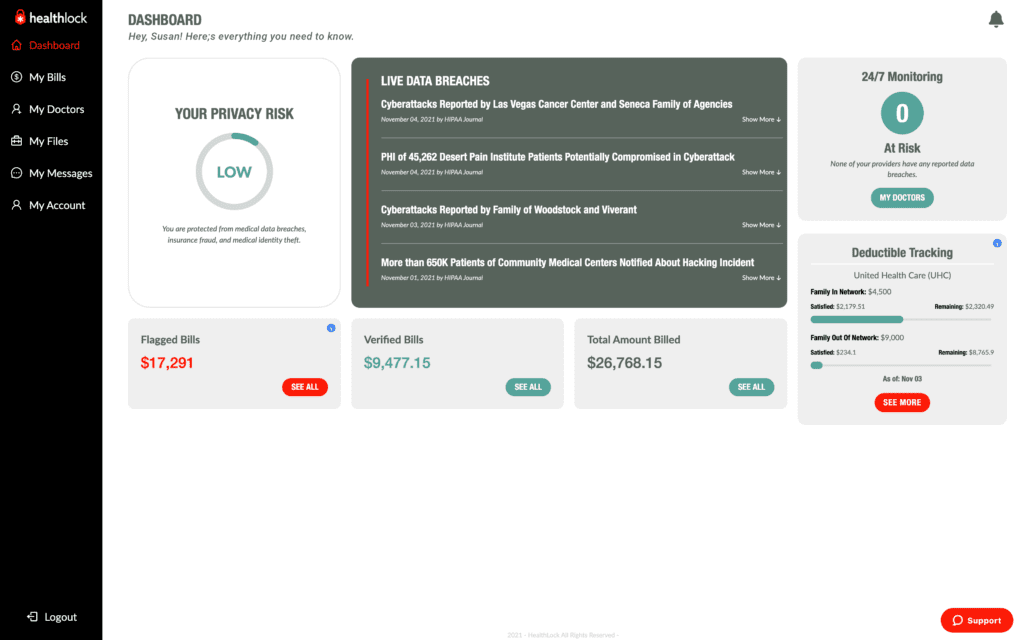

Based on a dashboard listing all healthcare claims associated with their identity, Healthlock flags the claims they believe could be erroneous, providing their customers with options that could save them money. Once the patient is synced with the network, the company automatically vets their claims.

“That continuous monitoring piece can’t be understated,” said Anastasia, explaining that this type of automation had allowed Mastercard to detect and stop fraud in other sectors they had entered.

Representatives of HealthLock told of instances where payouts were reduced by thousands simply because they had been marked as an elective procedure instead of an emergency. They explained that in many cases, out-of-pocket payouts happen due to a lack of knowledge about the system and the different outcomes codes and language may imply.

In addition, Burzynski explained, fraud was rampant in the healthcare payments system. The complicated nature of healthcare billing can cause discrepancies in claim filing, leaving a point of weakness that fraudsters can exploit. Breaches of health records by fraudsters and subsequent malicious activity have risen to more than 59 million cases last year, up from 40 million in 2020.

Fraud adds another layer to the level of erroneous payments, using the system’s chaos to fly under the radar. Burzynski said that due to the transparency afforded by the HealthLock dashboard, fraudulent claims can be made clear.

“In one case, we had a customer who’s identity had been used to claim for three treatments undertaken on the same day in three different states,” said Burzynski. He explained that these claims traditionally would have been approved due to the number of different healthcare providers, insurance providers, and patients’ lack of understanding of their bills.

“Expanding trust”

While HealthLock had developed its solution before Mastercard got involved, the partnership has allowed them to expand their reach.

Burzynski explained that the partnership will initially open HealthLock’s services to millions of US-issued HSA and FSA Mastercard cards, with plans to expand to other programs later in the year.

For Mastercard, the partnership is an “extension of trust” that has reached beyond its traditional positioning as a financial services brand.

“If you want to engage in an ecosystem, you want to know that all these different things are covered in the background,” said Anastasia. “So for ourselves, the extension of this idea that we are not just a credit card company, we are a technology company that provides all these solutions to help build trust in the ecosystem.”

The company’s experience in other sectors had allowed them to expand that knowledge to meet the needs of other sectors. Through their partnership with HealthLock, Mastercard was approaching the healthcare system’s payment downfall.

“All the things that are going on in the healthcare industry, we see the same sort of fraud that we’ve been stopping on his hardcore payments side as well. With our solutions utilizing AI and technology, we’ve been able to help protect 125 billion transactions last year. Our safety net product has stopped $35 billion of fraud attacks over the last few years.”

“The extension of that is the consumers involved in transactions when it comes to medical billing, when it comes to fraud, when it comes to data breaches. This is the proper extension into that area to help establish further trust of the consumer.”

RELATED : FIs Face Barriers to Fraud Fighting AI Adoption