At the finale of the keynote stage in NYC, debt-as-a-service firm Sivo won the PitchIt competition, a firm building ‘rocket fuel’ for lenders.

Inviting CMO Alec Randall on stage to collect a trophy, Todd Anderson was happy to announce the Y Combinator-backed “Stripe for debt.”

Randall said it was great to be back in person at a LendIt event again, an ex-LendingClub and Consesys fintech expert.

“Sivo is a labor of love; our whole mission is to provide the rocket fuel to fund innovative lending programs globally that provide greater access,” he said, accepting the award.

“Sivo comes from inclusivo because we want to level the playing field in financial services for all people globally.”

Lend money without two years of raising

According to their pitch, Sivo provides debt as a service, an API risk protocol that enables fintechs, neo banks, and gig platforms to lend money to their users without raising debt. Randall said that the San Francisco-based startup strikes deals with debt and provides for gigantic credit lines that it divvies up for customers.

Randall said that lending startups typically have to wait up to two years to establish 700-page lending agreements with debt providers, using their balance sheets while offering products. The alternative Sivo provides custom-built debt as a service served up.

“There’s an obvious problem, where there are tons of new lenders with innovative lending programs that level the playing field or increase access to credit in general. They have to raise and use their balance sheet to bring their product to market, and then hopefully get a debt partner before they can move away from capital intensive to capital-light,” Randall said.

“Sivo sees this and approaches the marketplace, partnering and embedding with lenders early on and enabling lenders to bet on themselves. We don’t succeed unless lenders succeed.”

He said for example JP Morgan or any other significant debt provider can give Sivo lower cost of capital debt deals, each with its requirements to fulfill in the $25-200 million range.

Some capital sources have hyper-specific conditions, like ‘no auto lending, small business funding only with these funds.’ Using these debt pools and working them into the hands of fintechs and startup lenders, Sivo acts like a case-by-case craftsman of debt, writing two-page term sheets.

Downturn on the way

Regarding the fintech downturn this summer and down rounds, Randall said some clients who were moving away to other sources of financing for what he called brand recognition were on their way back. The terms are changing for financing in the fintech space, and margins are becoming thinner, he said, and debt financing helps both debt suppliers and customers diversify.

“Especially banks, banks make credit decisions at a category level, like ‘we’re not going to fund ‘small business in this sector in the U.S.,'” Randall said.

“While doing due diligence in real-time, we’re able to make decisions at an originator level, a lender level, not a category level. And then quite frankly, we can go down to the credit product and make them make decisions at a credit product level.”

He also said that with rising interest rates and inflation lowering buying power, funding capitulation is on the way, just like when the pandemic shutdown credit-checked the online lending space, surviving comes down to sound underwriting.

“Default rates will go up if your underwriting isn’t solid, and there are a lot of lazy lenders out there. It’s pretty easy to make money in an upmarket when capital is cheap,” he said.

“But when the rates go up, margins will compress because defaults are up; we know it, but not everyone we’re working with does. We meet with our originators monthly and discuss how they can de-risk their program to manage that default rate.”

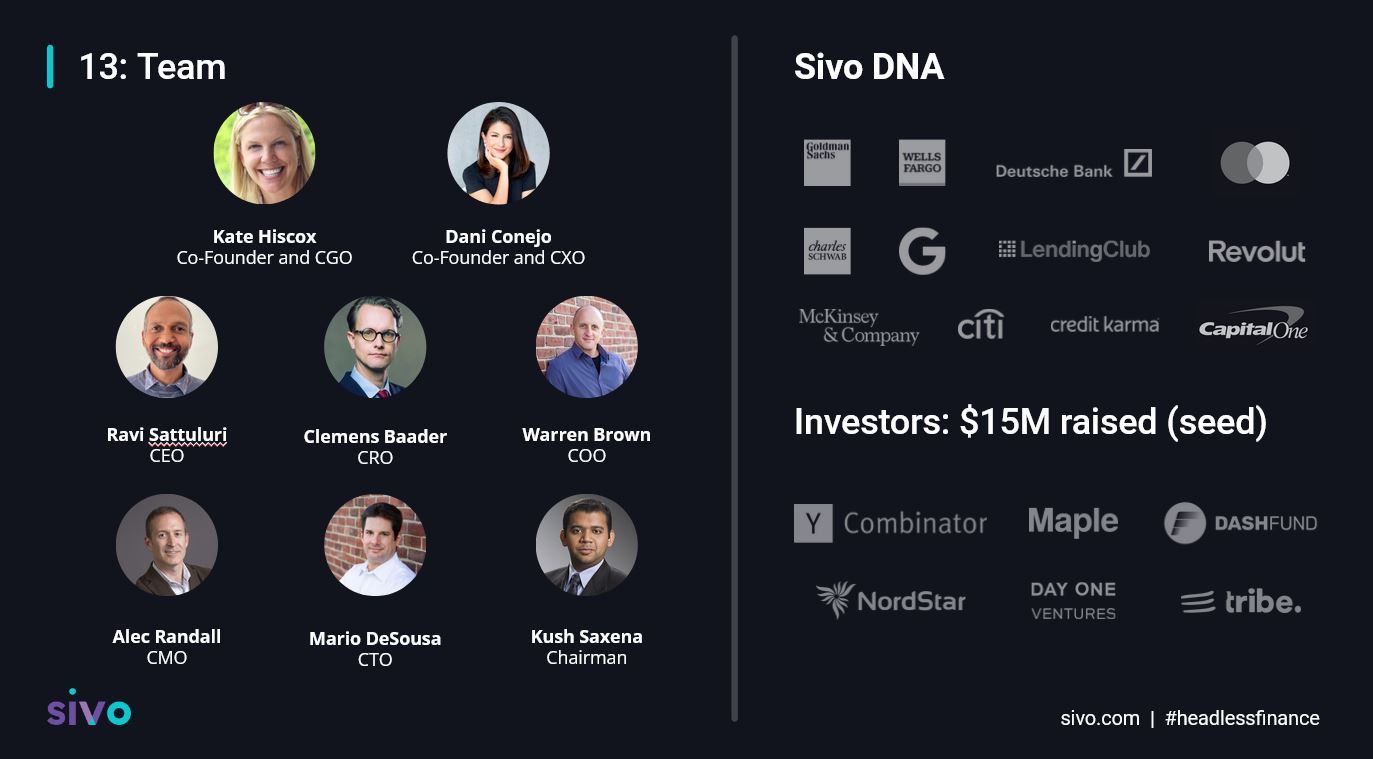

The team that leads a debt startup

Randall said that diligence is the only key to lending, and in Sivo’s case, the team behind the firm’s underwriting comes from an excellent track record. The firm has run debt programs for only nine months, with $6B in demand and $2 billion-plus in signed term sheets, with an estimated annual recurring revenue of more than $6m, he said.

“Ravi Sattuluri is our new CEO, and he is the perfect guy to lead us right now,” Randall said. “He built a lending business from $0 to 3 billion in originations; I think it had annual originations around $1.7B When he left.”

Randall praised the co-founder Kate Hiscox, a serial entrepreneur serving as the CPO.

“This is her sixth startup she took one company public, so she’s just a serial builder,” he said. “She keeps saying she hopes it’s her last startup, but I don’t think you’d ever get her to stop.”

Winning the YC ‘golden ticket’

Describing the origin story, he said Hiscox and co-founder Dani Conejo won the lottery with their consumer-focused lending startup and got into Y Combinator. While in the cohort, they met dozens of firms that, more than anything, needed specialized debt.

“While they’re in YC, they looked around they saw 70 other fintechs, almost every had a lending strategy was going to have to raise debt capital. At that point, they decided, ‘we’ll move further away from the customer we are passionate about, but we will be able to provide rocket fuel to all the innovative lenders. with greater impact'” he said.

Related:

They raised a $5 million seed at the end of the winter 2021 cohort; the rest is comparative history.

“At that point, They got permission to pivot. And so that was a big move. And then with that, they got the biggest valuation of their batch at $100 million.”

Nurture emerging fintech talent

In its seventh year at Fintech Nexus USA, Pitchit has become one of the leading startup events in the world, Todd Anderson, Chief Content Officer at Fintech Nexus, said.

He designed the platform to nurture emerging talent in fintech, providing selected finalists with unparalleled access to industry experts and invaluable exposure and branding at the event.

Randall took the stage in the innovation zone on the USA show floor, flanked by seven other hungry fintech startups.

The PitchIt Finalists:

- Connect Earth

- Chimney

- Netswitch

- Rocket Dollar

- Skeps

- Sila

- Sivo

- Upswot

Each, in turn, took the podium for a chance at changing their future and taking home the recognition of seven VC judges, including:

- Rakefet Russak-AminoachManaging Partner @ Team8

- Jesse PodellSenior Director @ Ally

- Keira MoonPrincipal @ TransLink Capital

- George RavichPresident @ Ravco Marketing, LLC

- Hillel OlivestoneHead of Corporate Development @ Cross River

- Jeffrey MeyersInvestor @ Citi

- Andrew SteeleInvestment Partner @ Activant Capital