NEW YORK, N.Y. — Shivani Siroya and her team at Tala could be onto something.

The founder and CEO of the mobile lending app that provides financial access to underserved populations in four countries point to building trust to grow a customer base and believing in her instincts.

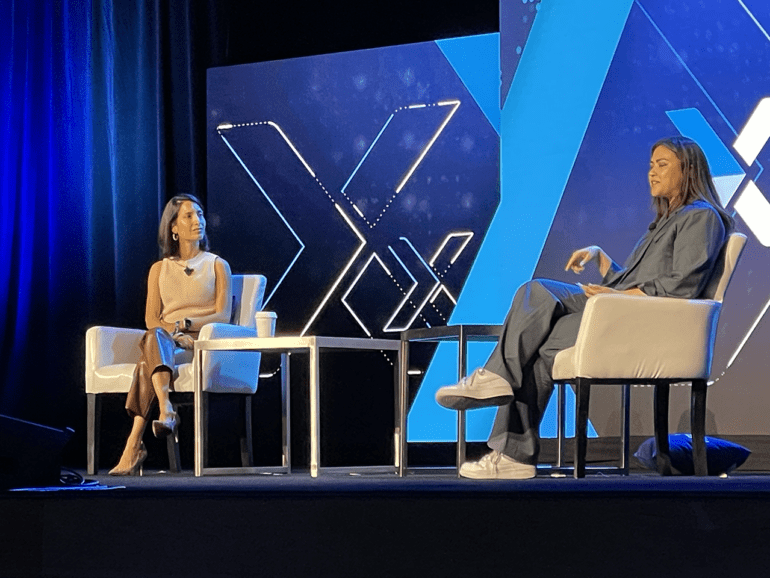

“A phrase that comes to mind when I think of radical trust is ‘the best way to predict the future is to create it,'” Siroya said Thursday to Nicole Casperson, founder of media brand Fintech is Femme, during their talk on the keynote stage at Fintech Nexus USA 2023.

“I saw that potential when I lived and worked in emerging markets for almost five years. It was that belief in the purchasing power potential of this segment. That kind of keeps me fueled. It’s ultimately, what I believe is going to make Tala successful is the fact that we’ve banked and decided to build uniquely for this segment, and nobody else has.

“So in that sense, when I think about radical trust, it’s going back to that question of, ‘what’s the future we want to create?’ We want to create a future where we’re in a place of saying yes more often. That goes to every piece of our technology and all of our decisioning.”

Creating value with underserved populations

Siroya has a global health and finance background, having worked for the United Nations, Citigroup, UBS, and Credit Suisse before founding Tala in 2011. Tala, which offers microloans of $10 to $500 for customers through its app, has since provided $4 billion to eight million customers in Kenya, Mexico, India, and the Philippines. That amount increased from $2.7 billion, serving more than six million people the year before.

“All of the ways that we show up in the world is that when most banks say no, we’re actually in the place to say yes because we’re looking at a pool of a population and saying, instead of just thinking of it as ‘how do we assess risk?’ we’re thinking of it as ‘how do we look at this population and create value? How can we give every single individual some value?'” Siroya said. “From there, if you believe that everyone has value and can generate value, then you’re setting your business up to be a real generational business.”

A phrase that comes to mind when I think of radical trust is ‘the best way to predict the future is to create it

Shivani Siroya

Tala uses mobile data its customers provide and behavioral data it gathers through the app. Their interactions with them help create a picture of their daily life, Siroya said, which is why they “have been successful if we’re able to use that data to provide the right offer at the right time.”

“The way that we calculate the creditworthiness is using a wide variety of different data sources, but ultimately, it all comes from the customer,” she said. “We thought of it as this customer doesn’t have traditional data. It’s not sitting in a bureau. It’s not sitting in some sort of bank database. It’s all in cash. Eighty percent of the world still uses cash as a primary mechanism for transactions.”

Being there means walking among those you serve

Tala had to think about building its customer base in such a way so they could meet their customers “where you are,” Siroya said.

“If you want to create that feedback loop, then you need an ecosystem approach,” Siroya said. “If they go to a business center to accept money, you must be there. If they want to pay a bill somewhere else, you need to be there because you’re ultimately giving them the power to protect their money, use it, and grow it. That requires you to take an approach: how am I going to do the give and take, so if they’re cashing in at a place where they’re cashing out and using the money, we’re there.

“That’s what I would say is the Philippines approach for us: having to rethink how can this work (in most of) the world because most of the markets outside of the US look like the Philippines.”