The continued rise in social media usage and the associated creator economy has reached new highs post-pandemic.

Social media usage soared during the peak of the COVID-19 pandemic restrictions between March and June 2020. The use of social media platforms rose substantially (Instagram usage alone growing over 40%), with opportunities for social commerce and the creator economy.

In their 2021 report, The Influencer Marketing Factory estimated the creator market to be valued at $104.2 billion, with 61.9% of creators working full time in the sector for less than three years.

“Creators now mold culture,” says Jacob Casson, CEO, and Founder of content creator finance app Monet.

“Even on a micro-level…as we move across fashion, lifestyle, political views, different kinds of day-to-day cultures are largely led by the people that you engage with online.”

An example is apparent in the involvement of the White House with influencers. Both the Trump and Biden administrations have engaged with influencers in distributing information.

White House meets influencers

The most recent example is the March 11, 2022, White House briefing for 30 TikTok macro-influencers (influencers with more than 500 thousand followers) on information regarding the war on Ukraine.

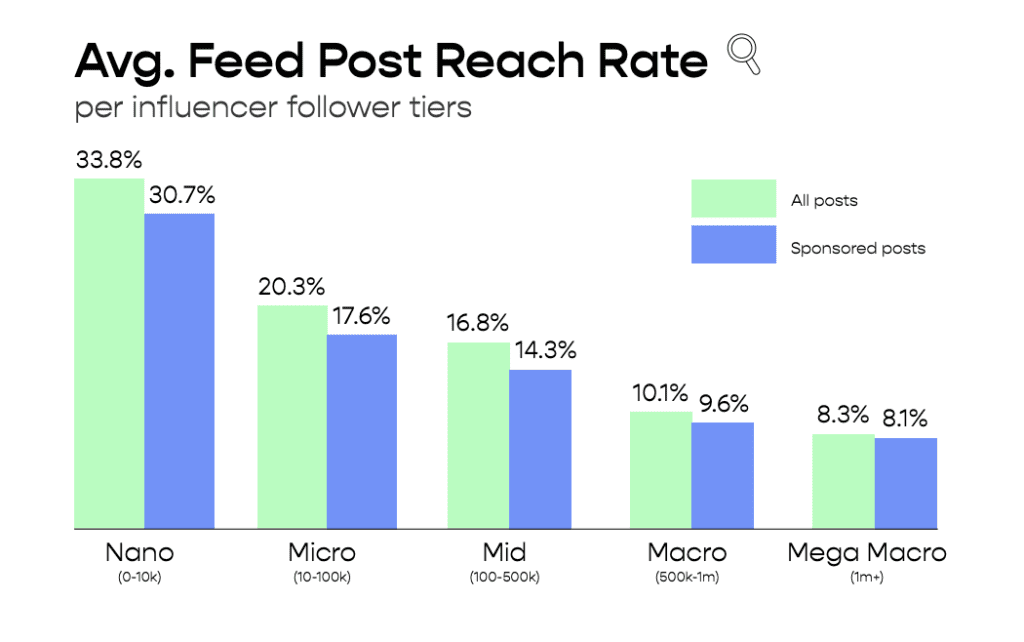

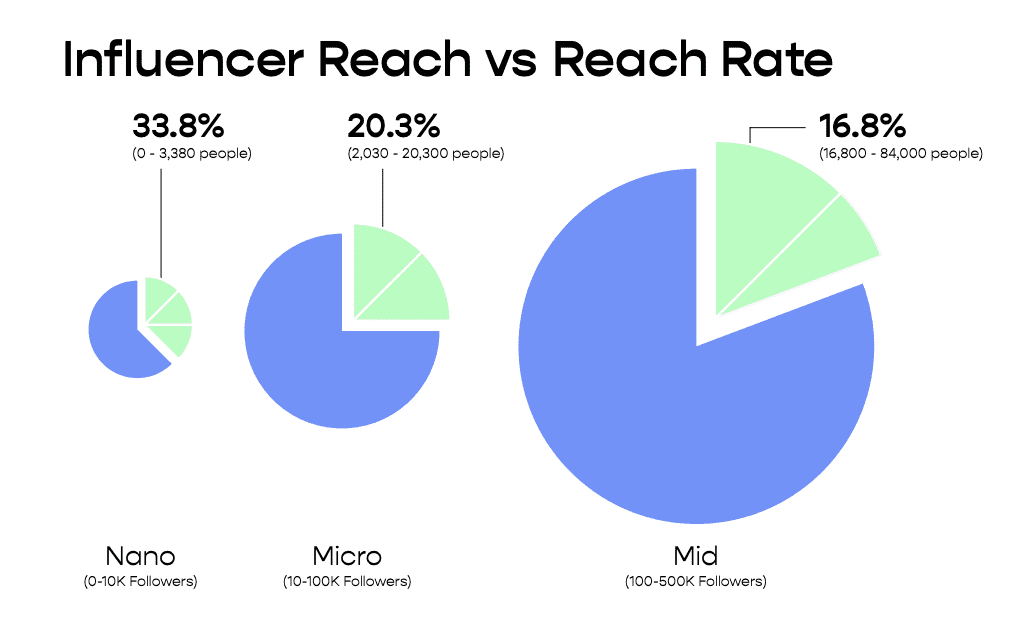

Putting this in context, a single mid-level influencer with 500,000 followers has an average reach rate of 16.8%, meaning 84,000 people could see each post.

Social commerce involves the collaboration of social media influencers and brands to reach and inspire consumers and increase sales.

The sector is set to increase 31.4% every year over the next six years, reaching $604.5 billion by 2027, opening lucrative avenues for brand engagement.

Given this sector’s rising importance and size with particular needs, new opportunities arise in the finance sector.

The creator economy

Bridging the territory of freelancers, passion economy, and artists, the accurate scale of the creator economy is uncertain.

The term “content creator” refers to using the internet and social media to monetize their interests and skills. This way bridges the freelancer economy with the passion economy, with people engaging in monetization to different degrees.

According to SignalFire, more than 50 million people worldwide consider themselves creators. Only two million consider themselves professional creators, with it being their full-time occupation.

It takes most creators three years to achieve significant yearly incomes beyond the $50K mark. However, the number of social media followers did not equate to higher incomes, with some niche sector creators receiving more engagement and follower loyalty, equating to higher revenue.

Effectively decentralizing entrepreneurship, the rising creator economy has brought the idea of individual ownership and revenue generation to another level of accessibility through the added tool of social media.

“The interesting thing about the creator economy is that it’s not vertical, it’s horizontal… it’s people effectively figuring out their passions and skills and looking to monetize them mostly online,” says Casson.

“Many people don’t think about creators as businesses, but they can end up making five grand a day and turning over £25,000 a month with only five days’ work. It’s an incredibly interesting ecosystem.”

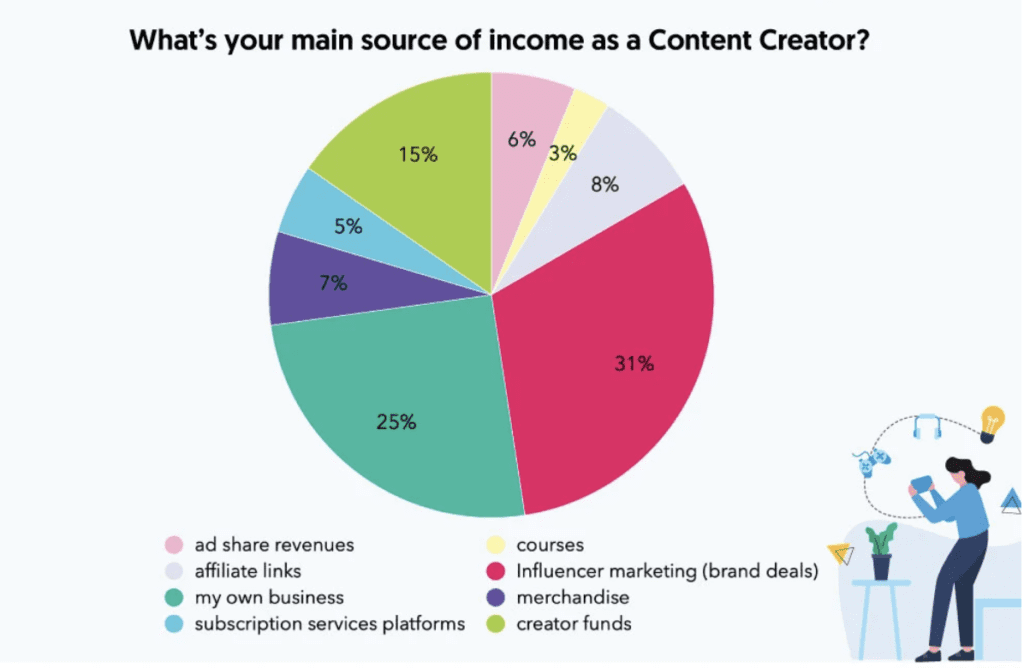

Generally, “creators” generate revenue in five different ways: On-platform monetization using social media platforms; B2B revenue from brand partnerships; founder revenue, where creators launch their own associated business; fanbase revenue through external subscription and tipping services; and asset-based revenue through investment in assets such as NFTs.

Although a lot of the current focus is revenue from social media platforms, the income is relatively small compared to the amount generated from the traditional invoicing for paid partnerships.

According to a survey carried out by The Influencer Marketing Factory, over half of the content creators questioned stated that their primary sources of income are generated from their associated business revenue or brand deals.

Issues with paid partnerships

The issues associated with invoicing the big brands involved in paid partnerships are not new, plaguing freelancers for years. Payment terms generally apply a time period of 120 days, causing issues with cash flow and late payments requiring a follow-up.

Given the small size of content creators’ teams, with many acting as sole traders with very little accounting knowledge, these issues can significantly distract from the activities that generate revenue.

There have been many businesses and services created to address the needs of the creators. Dedicated marketplaces such as Grin and Captiv8 have been designed to connect brands to influencers. In contrast, others such as Tubular Labs employ CRM Tools to help creators manage their workflows over different platforms. However, specialized tools to manage accounts and the finance generated from these partnerships and platforms are hard to come by.

“(During my time as a creator) I found that although I was really good at being in my business, I wasn’t necessarily good at running the business, and when those two things came on top of each other, I had some really heavy days” comments Monet Founder, Jacob Casson, “It wasn’t until I met more people in the space that I realized this was a problem across the board.”

Monet closes the gap in cash flow

Monet has been created specifically to address such issues. Although currently in Beta, the company has a waiting list of 8,000 potential users and focuses primarily on cash flow by offering to pay creator invoices the moment the partnering brand has accepted them.

“Realistically, the money generated by platform revenue is nothing compared to the money that is made from old school invoicing and doing work for brands, so we decided to solve the problem of cash flow first,” says Casson

Technically a form of insured risk lending, Monet takes on the risk of a delay in payment. Each partnership invoice is checked with the associated brand for validity. On acceptance, the payment is sent instantly into the creator’s Monet account, which has an associated debit card. At the same time, Monet organizes the invoice payment from the creators partnering brand to credit their loan.

“We focused on the biggest problem, the unpredictability of B2B revenue, and now we are working on a partnership for platform revenue,” states Casson. The company’s proposed development involves the creation of a dashboard connecting all the platforms the individual content creator monetizes with plans to enable advances in payments and possible lending in the future.

The future of content creator services

Titled as a financing and business platform, this is only the first step in their growth as a service provider to the creator economy. There are plans to create a “back office hub” focused on organizing accounts and taxes and specific tools to streamline functions particular to the creator economy.

Referring to the future development of Monet’s “Projects” Hub, a service focused on the monetization of content creator collaborations, Casson states.

“We believe in the collaborative workforce (of the creator economy). Where people who are highly unlikely to run a business together can use a Monet account to set up a project together for a pop-up business, with its bank account and terms attached, without launching a formalized business with its associated paperwork.”

Although the first step in their journey has focused on creating a bank account that could be used by sole traders and businesses in multiple sectors, it is these next steps that are key to the creator economy.

“Where we are going with it prioritizes creator needs…the more we go into working with platforms and different types of revenue it will become a lot more definitive about making money online.”