Let’s look at the recent Fortnite blackout and compare it to neobank Chime's embarassing down time, as well as explore the business model implication of what it means to be the social square where people hang out. Does Finance have such an equivalent? Maybe it is Venmo, crypto Twitter, or the credit unions. We also look at statistics behind influencer marketing, and how influencers have usurped the position of music labels. Perhaps banks should get ahead of this game too.

The image is taken from an AI paper which explains how to use generative adversarial networks (i.e., GANs) to hallucinate hyper realistic-imagery. By training on hundreds of thousands of samples, the model is able to create candidates representing things like “just a normal dude holding a normal fish nothing to see here”, and then edit out the ones that are too egregious.

The reason the stuff above is so scary is actually that you can mathematically transition in the space between images. So for example, you could move between “a normal dude” and “just a normal fish” and have nightmare fish people. Or you could create a DNA root for an image which is part dog, part car, and part jellyfish. Check out the video below and the very accessible https://www.artbreeder.com/ website to see what I mean.

This week, we look at:

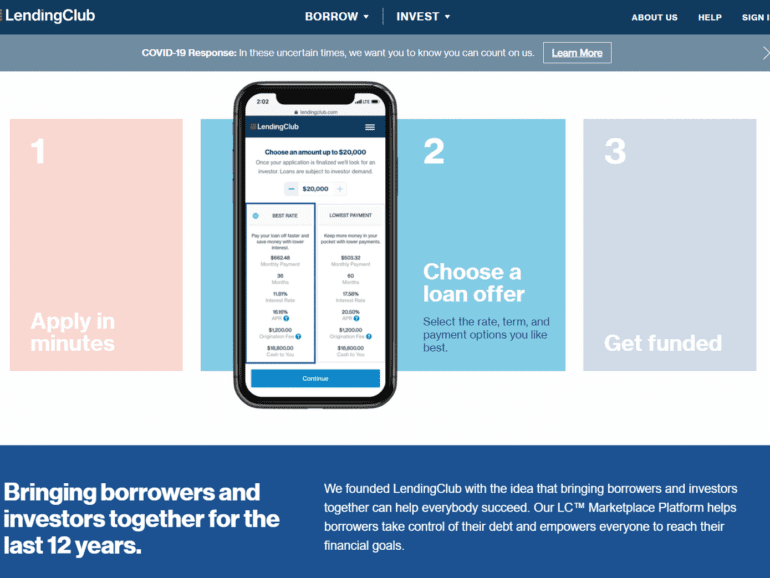

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma

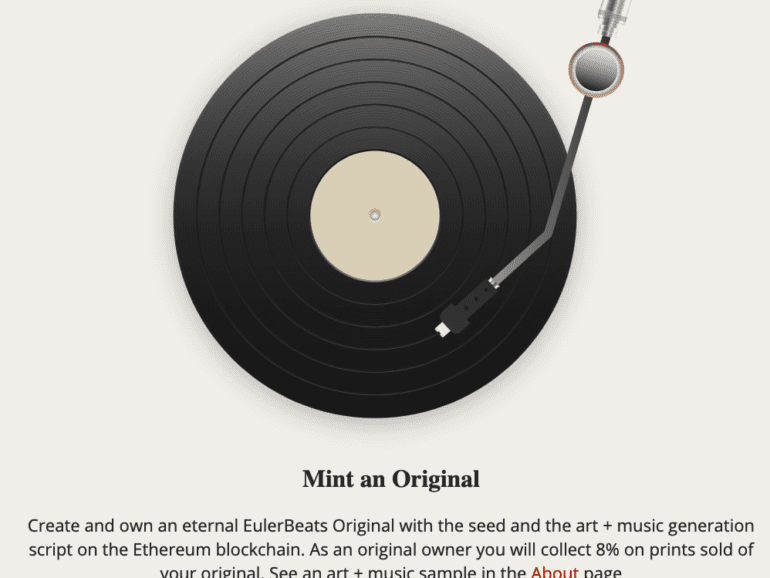

In this conversation, we talk with Tyler Mulvihill of Treum and EulerBeats, about how he became involved in the very first non-financial production grade blockchain use case, tracking & tracing tuna from Fiji to New York using Treum. Additionally, we explore the nuances of NFTs and how EulerBeats is using bonding curve economics to price the future of NFT use rather than mere collection.

This week, we look at:

Square acquiring Tidal and its 1-2 million of subscribers for $297 million, and the logic for what a payment processors has in common with the creative industry

How celebrities and creators like Mark Cuban, Gary Vaynerchuk, Grimes, 3LAU and others are generating millions in NFT sales

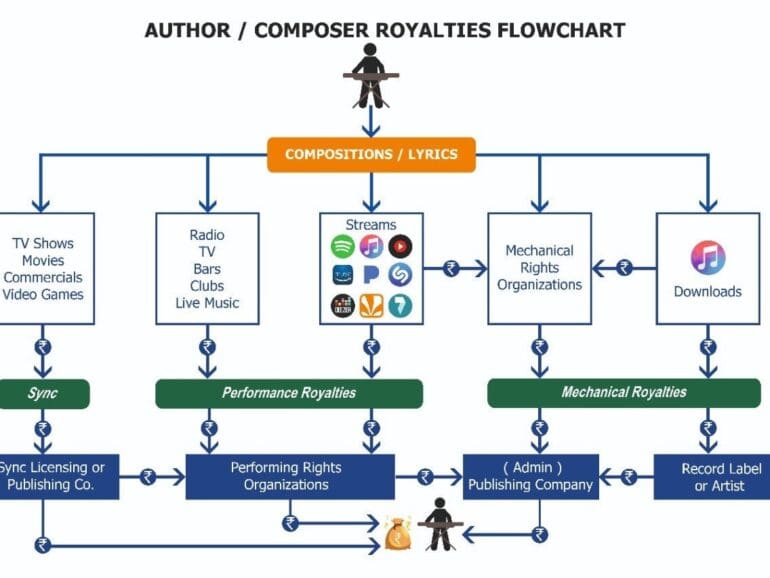

The impact on the economic model of the music industry, including a look at royalty structures, revenue pools, and financial vehicles when tokenized

The philosophical divide growing between a feudal platformed commons (e.g., YouTube) and a collectivist anarchist capitalism