I know I am very late with my update this quarter as many of you have pointed out in emails and comments. But rest assured I am still committed to sharing my results publicly and I apologize for the tardiness of this update.

I wish I had good news to share but alas the decline in my marketplace lending returns has continued unabated. The biggest culprit for my declining returns is my exposure to unsecured consumer credit. As I have written about many times in the past a decline in underwriting standards at the major consumer lending platforms in 2015 and 2016 led to a marked increase in defaults where returns for individual investors like myself were significantly below projections. Recent vintages indicate that this severe decline is being reversed but given the loans I am invested in are three and five years in duration the effects are still being felt inside my own portfolio and will be for some time.

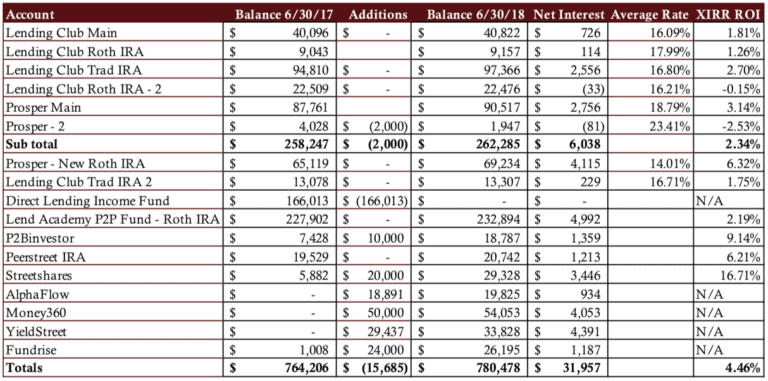

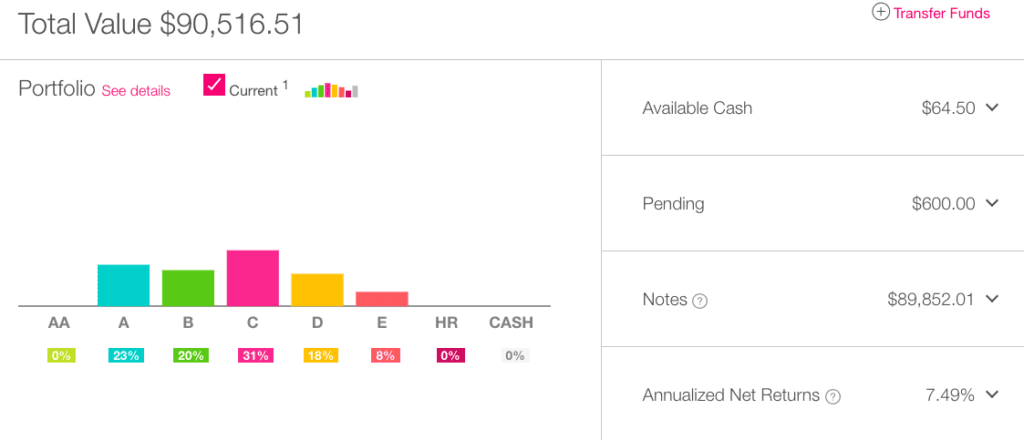

Overall Marketplace Lending Return at 4.46%

In my report from one year ago my trailing twelve month (TTM) return stood at 7.28% and I wondered whether my returns were in a downward spiral. That has proven to be the case as I am down almost three full percentage points over the last year as my TTM returns as of June 30 stood at 4.46%.

About 18 months ago I moved to a more conservative approach in my investing, focusing primarily on the lower risk loans at Lending Club and Prosper. The average interest rate of my portfolios continues to drop steadily every quarter but given my sizable portfolios of thousands of loans it takes a while for these changes to fully take effect. Interestingly, the one account where I have taken a more conservative approach from day one, my Prosper New Roth IRA, is easily my best performing consumer lending account with a TTM return of 6.32%.

Now on to the numbers. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

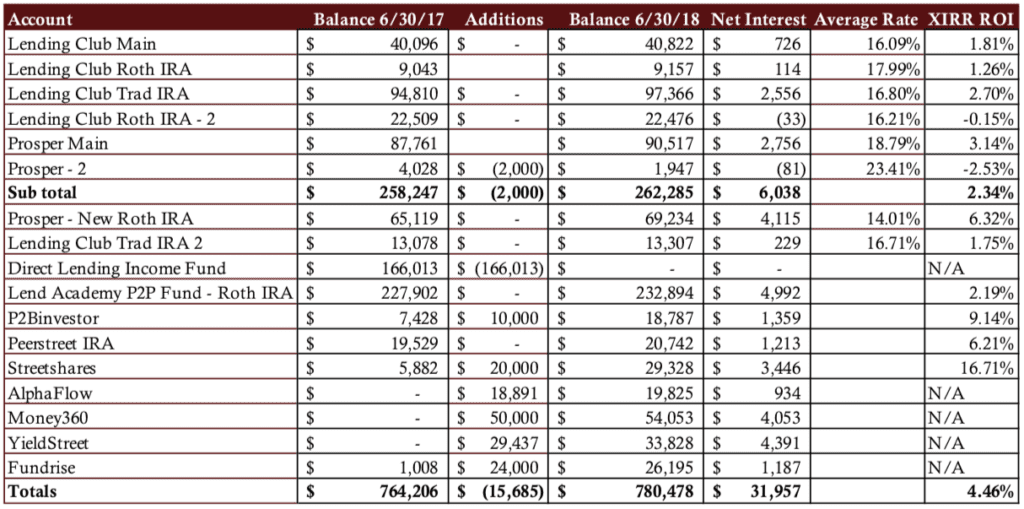

LendingClub

I have a total of five LendingClub accounts, four that have been open more than seven years and one (Lending Club Trad IRA 2) that has been opened for just under four years. The screenshot here is of my very first account that was setup in June 2009. While Lending Club shows a 7.08% return I ignore that number and do my own calculations based on the balances on my monthly statements. My TTM return for this account is just 1.81%. In fact, all my LendingClub accounts have had disappointing returns for some time now. The only good news here is that if you annualize just my Q2 returns I am doing much better. For this main LC account my annualized Q2 returns were 7.51% which gives me hope that the worst is behind me.

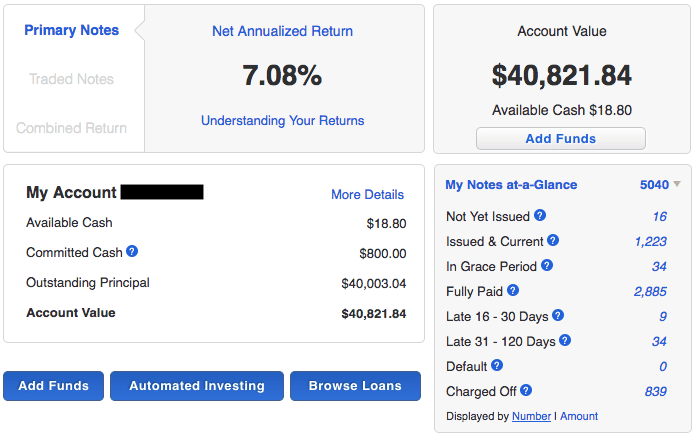

Prosper

The above screenshot is of my main Prosper account that was opened in 2010. It has also struggled with higher defaults over the last few months. I originally invested $50,000 in this account over a period of a year of 18 months and you can see that it has grown to over $90,000. But the growth has leveled off and I am seeing returns well below what I used to see just a year or two ago. Again, I have moved to a more conservative investment focus because that has served me well in my Prosper New Roth IRA account as I mentioned above. I am only exposing a very small portion of my portfolio now to the highest risk loans.

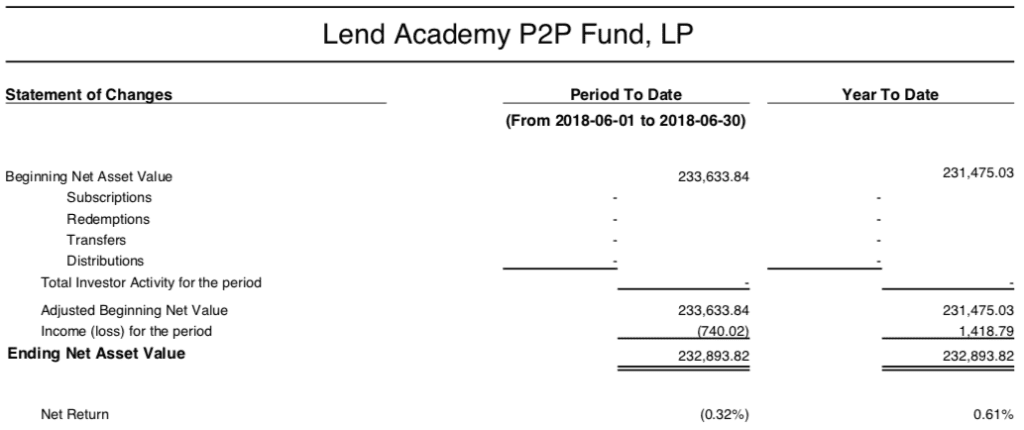

Lend Academy P2P Fund

The Lend Academy P2P fund, managed by the team at our sister company NSR Invest, invests primarily in LendingClub and Prosper loans with small positions in Funding Circle and Upstart loans as well. In the most recent quarter returns in the fund have suffered because of increased interest rates at LendingClub and Prosper. Because the fund uses a Fair Value valuation methodology, changes in rates affect the NAV immediately (this explains the negative return in June), which is different than many other funds in the space. Generally speaking, increased defaults have also led to significant underperformance from our own objectives.

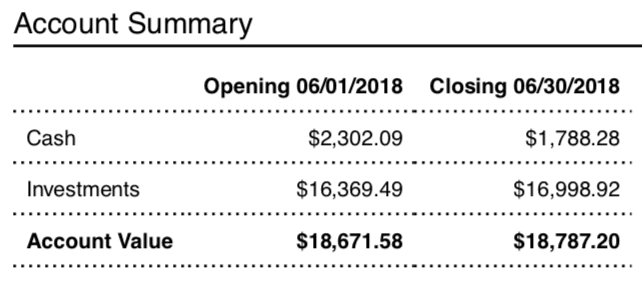

P2Binvestor

Asset-backed small business lender P2Binvestor has been very consistent and remains one of my favorite investments (full disclosure: I am on the advisory board of this Denver-based company). These are short-term loans, backed by accounts receivable, with 30-60 day liquidity. I like the diversification this investment provides given the small business focus. My only complaint is that I can’t deploy all my available cash into enough new deals so my cash tends to build up as you can see above. I really like their new bank partnership product and I would like to see more deals with this product as well as their traditional line of credit product.

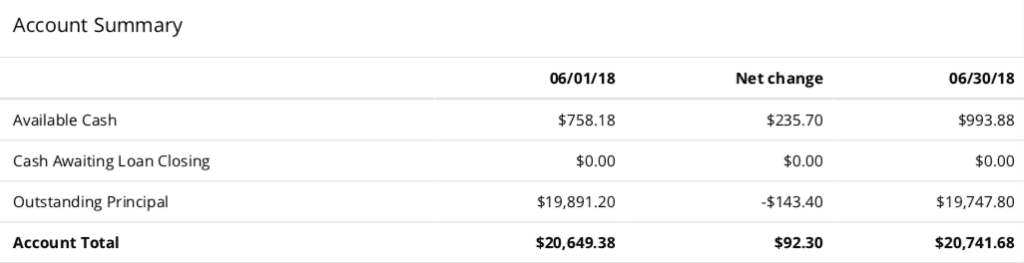

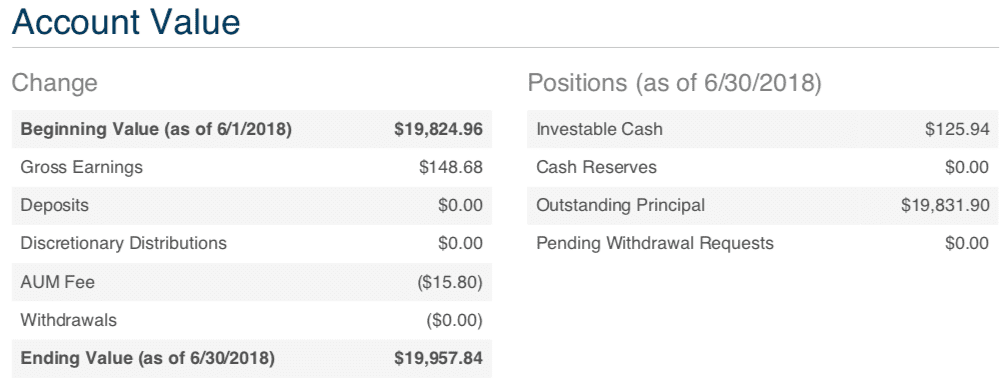

PeerStreet

PeerStreet is a real estate platform focused on fix and flip properties. These are short term loans, typically between 6 and 24 months (some loans are as short as 3 months), and they are backed by fix and flip properties. I started investing in April of 2016 and I made my 2017 maximum IRA contribution last year as well. They have a $1,000 minimum investment which allows for decent diversification and I use their automated investment tool to redeploy capital as it is paid back.

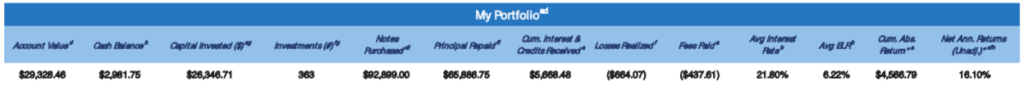

Streetshares

Streetshares continues to be my top performing investment, a position it has held for well over a year now. My TTM returns is astounding, at 16.71%, which is some of the highest returns I have ever received. I added an additional $20,000 in September last year so I realize many of these loans are still relatively new. I don’t expect these exceedingly high returns to continue but I am enjoying them while they last. The one issue with Streetshares is that they have reduced the number of loans available in their marketplace, they have focused on their Veteran Business Bonds, which pays a fixed 5% returns, and are fully deploying that channel. I have adjusted to this reality by increasing my allocation per loan and also I am using their auto investment tool to invest in every single loan they make available on the marketplace. This way I have been able to keep my cash drag to a minimum.

AlphaFlow

AlphaFlow is a real estate platform that allows investors to build a diversified portfolio of short term real estate loan quickly and easily. Most real estate platforms have a minimum investment per deal of $1,000 or $5,000 but with AlphaFlow they have a unique structure that gives investors exposure to 75-100 loans right off the bat. I have only $20,000 invested and I am in 115 loans across 18 states. They curate deals from other online real estate platforms as well as offline originators selecting only the best deals that meet their standards.

Money360

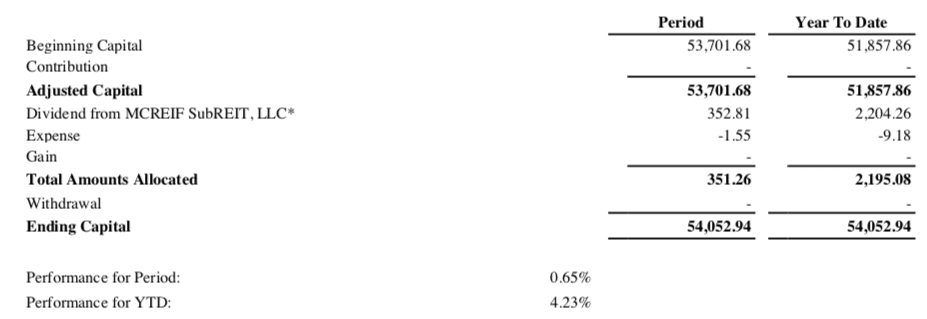

Money360 allows more diversification for my portfolio. I invested $50,000 in the M360 CRE Income Fund about a year ago to gain exposure to short term bridge loans for commercial property. The loans that Money360 holds in this fund are in the the $1 million to $20 million range for commercial properties across the US, an area where I have had close to zero exposure. You can see in my graphic above that I am on track this year for a return of 8.46%.

YieldStreet

YieldStreet is a really interesting platform that provides a wide range of investments with the common theme being they are loans backed by an asset. While they offer portfolios of real estate loans they have also had some really unique offerings. They offered, in what I think was a world first for individual investors, an opportunity to invest in a loan backed by a container ship – the $18.1 million loan was completely filled by Yieldstreet investors. With my initial investment here I chose to invest in a litigation finance offering called Diversified Pre-Settlement Portfolio XXIII. This is a portfolio of plaintiff advances related to 365 different personal injury cases. I have already received a bunch of principal and interest payments which is why my $35,000 original investment now shows a balance of less than $30,000.

Fundrise

Fundrise is a real estate platform that is completely focused on individual investors. While many of the investments I describe here are available only to accredited investors Fundrise makes their investments available to everyone. They have made it really easy for investors to get started with a minimum investment of just $500 in their starter plan. They have “advanced plans” with three flavors: Supplemental Income, Balanced Investing and Long Term growth. These are all backed by their eREIT technology which Ryan covered when they launched back in 2015. I am invested in a legacy product called their Income eREIT.

Final Thoughts

I have come to the realization that I am over allocated to unsecured consumer credit. This is an asset class I have been investing in for almost a decade, one that I have firmly believed in and one that has delivered oversized returns for many years. But when I look at my overall marketplace lending portfolio in the above spreadsheet 74% is allocated to unsecured consumer credit. I have decided I need to bring that allocation down so I will be considering different ways to do that in the coming months.

Having said that, I want to make one thing clear. I am not abandoning consumer credit. I still believe in the asset class, in the uncorrelated returns and I am confident that it will rebound from the lows that I have experienced. I am still going to keep a sizable position in consumer credit, I just would like to have a bit more balance in my portfolio with the obvious goal of increasing my overall returns and decreasing volatility. I will expand on my plans here in my next update.

Finally, as I do every quarter I want to end by highlighting the net interest number which for the last 12 months stands at $31,957. This is the lowest total I have had for many years, I hope and expect this will be my low watermark for total interest.

As usual feel free to share your thoughts in the comments below.