I have finally been able to conclude my quarterly returns report from Q4 of last year. I have been sharing my detailed quarterly returns with readers since 2011 and I will continue to do so for the foreseeable future. Given the turmoil we are experiencing today it is going to be fascinating to see how these companies hold up as we are almost certainly headed for a significant downturn.

Q4 of 2019 feels like a decade ago now with how much the world has changed. Given how the economic crisis really didn’t get started until the second half of March we won’t see much impact from returns even in my Q1 2020 report. But this year is going to be interesting to say the least.

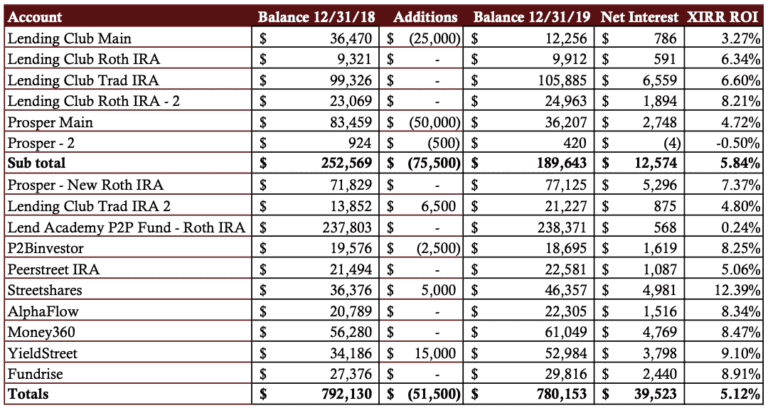

Overall Marketplace Lending Return at 5.12%

The overall returns for the calendar year 2019 of my marketplace lending investments stood at 5.12%. This is down over 1% from my last update but the drop is almost entirely due to my largest holding: the Lend Academy P2P Fund which took a major hit in Q4. More on that below.

Interestingly, my original six LendingClub and Prosper accounts had their best quarter since Q1 2017 as underwriting changes made in 2017 have continued to bear fruit for investors. My lone holding in double figures is once again Streetshares as it continues to perform extremely well.

Now on to the numbers. Click the table below to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way for individual investors to determine their actual return.

- The six older accounts have been separated out to provide a level of continuity with my earlier updates.

- I do not take into account the impact of taxes.

Now, I will break down each of my investments from the above table grouped by company.

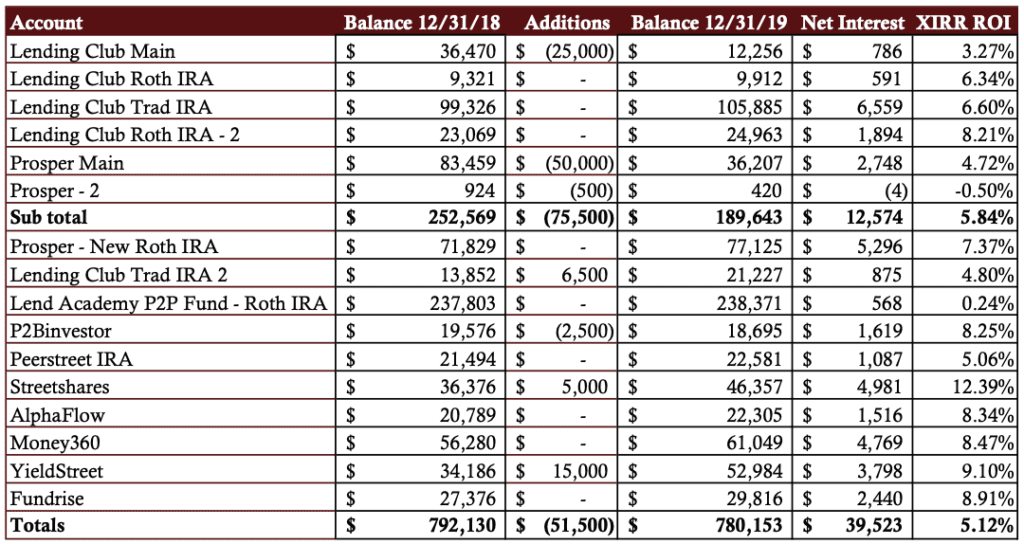

LendingClub

The above screenshot is from my wife’s traditional IRA account that has been open for almost 10 years. It was opened with around $53,000, with no additional deposits, meaning that it has now doubled in that time period. As I have written before I am liquidating my original LendingClub account that was opened in 2009 since it is taxable. For my consumer lending investments I am slowly liquidating my taxable accounts due to the tax advantages of an IRA account. For info on LendingClub’s response to the coronavirus you should check out Ryan’s recent update.

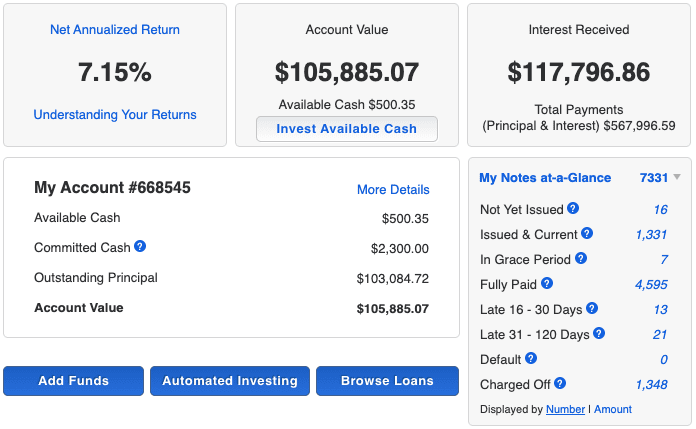

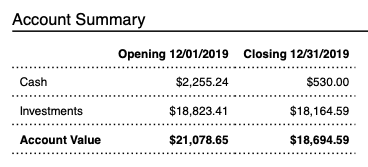

Prosper

As with LendingClub I am liquidating my main Prosper taxable accounts and focusing on my Roth IRA account (screenshot above) that I opened in 2014. I stopped reinvesting in my taxable account in September 2018 and have been withdrawing cash as it has built up, totally $50,000 in the last year. Overall, my Prosper Roth IRA has been my best performing account over the past several years as it was setup from the get-go as a more conservative investment strategy,

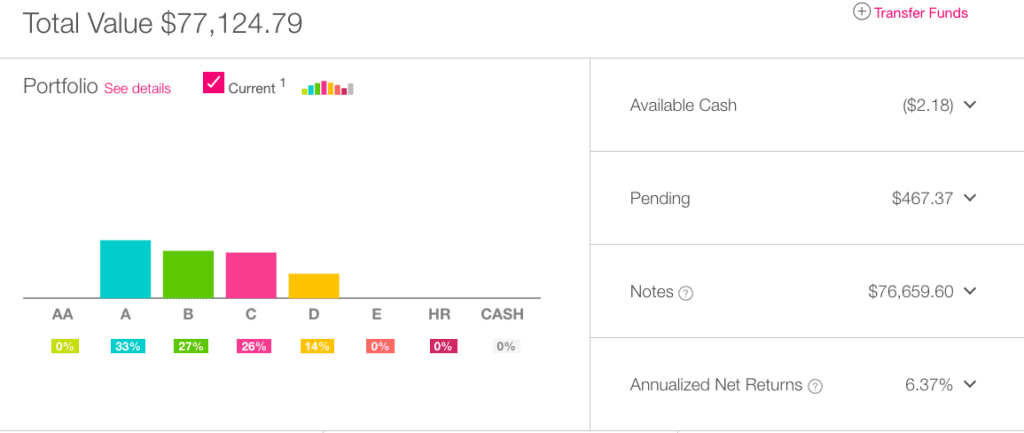

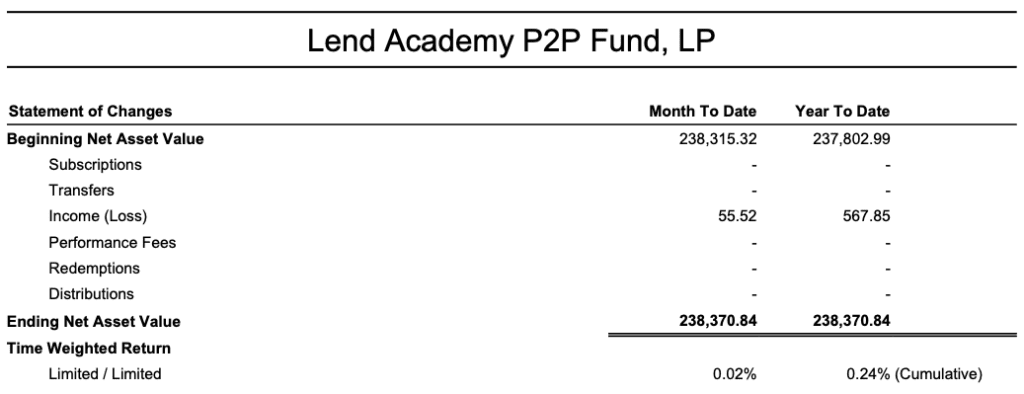

Lend Academy P2P Fund

As you can see in the above statement the Lend Academy P2P Fund, managed by NSR Invest, did not have a good year with just a 0.24% return. We had to take a write down in Q4 for an investment we made in a trade finance platform called SureFunding where we had a small position. This has resulted in a markdown of the value of this investment that has impacted the fund NAV. To be honest, we have underperformed with our own fund now for the past couple of years so we have made the difficult decision to close down the fund. We will not be reinvesting and will be returning money to investors as the investments wind down.

P2Binvestor

I have been a big fan of the asset-backed small business lender, P2Binvestor, for many years and I was on their advisory board until late last year. But with new ownership and no new investments available to investors for several months I have started to withdraw the cash as it builds up. They have also had some challenges with defaults but overall this has been a good investment for many years.

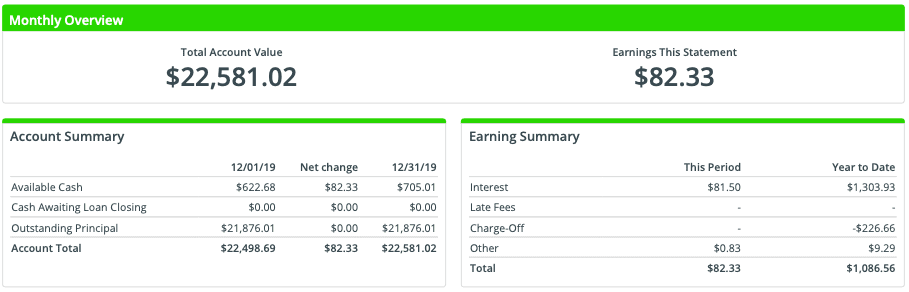

PeerStreet

I have been invested with real estate platform Peerstreet now for almost four years. While many platforms have struggled in the real estate niche Peerstreet has been a consistent performer. While they are having their challenges, like most lenders, during this difficult time I have always appreciated their transparency.

Streetshares

As it has been every quarter for the last several years, my top performer is Streetshares. I have been investing in every loan they make available for the past year as they only make a small fraction of their loans available to platform investors. Most of the loans are funded by institutional investors and their own Veterans Business Bonds. It will be very interesting to see how Streetshares performs going forward as the coronavirus takes its toll on small businesses, hopefully just on a temporary basis.

AlphaFlow

I have always liked real estate platform AlphaFlow as they have provided excellent diversification across many properties and regions. But alas, they closed down to individual investors late last year so they are slowly liquidating the portfolio as payments come in.

Money360

The Money360 fund is focused on commercial property. The fund invests primarily in bridge loans in the $3 million to $30 million range for commercial buildings across a variety of property types: office, retail, self storage, hospitality, industrial, multi family, manufactured housing and special purpose. These are 12-month to 36-month loans with an LTV of less than 75% and broad geographic diversification.

YieldStreet

YieldStreet provides access to unique investments that have traditionally not been available for individual investors. They have been in the news a bit in recent months because of a partnership with Blackrock, the world’s largest asset manager, as well as an interesting partnership with Citi. I am invested in such esoteric investments as two container vessel deconstructions, other marine financing for large vessels as well as an art portfolio. These are not the kinds of investments I have seen anywhere else.

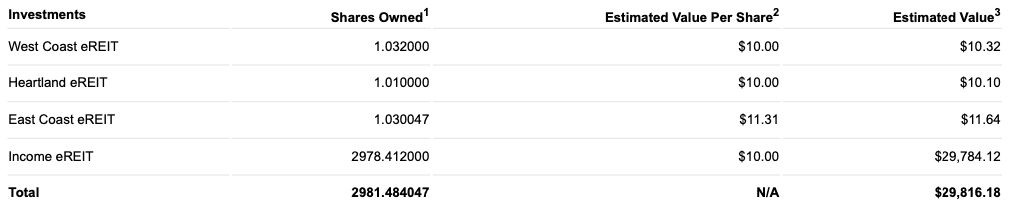

Fundrise

Fundrise is a real estate platform focused on the individual non-accredited investor. I opened up my account there four years ago and I continue to be impressed with their consistent returns. I am invested in their Income eREIT fund which is currently invested in 59 projects, primarily multi-family home construction. New investors can get started with just $500 and choose between Supplemental Income, Balanced and Long Term Growth.

Final Thoughts

I have been most pleased with the rebound in my Prosper and LendingClub accounts as returns continued to improve throughout 2019. The companies updated their underwriting models in 2017 significantly and have continued to tweak them since then, favoring a more conservative approach. This should help them weather the coming storm given the unprecedented economic conditions.

One of the criticisms the alternative lending industry has received for many years is the fact that it has never weathered a downturn. Well that is all about to change. I think Q2 of 2020 will be a quarter unlike any other in history. We will see who has not just solid underwriting but who has the broad base of investor support that will allow them to keep on lending. The companies that come through this well will be the new industry leaders but unfortunately I expect many companies to struggle and some will not survive.

Finally, I will highlight my Net Interest number. This is the money that my portfolio actually earned in the past year. With the struggles of my largest holding this number is down significantly from last quarter but at $39,523 it is still well above the lows I experienced in Q2 2018.

As always feel free to share your thoughts in the comments below.