I love this industry. I love the fact that it is an efficient way to connect borrowers and investors, I love that borrowers can have a quick and seamless loan application process, I love that the industry is starting to achieve scale so that it can really make a difference. But most of all, I love the returns that marketplace lending can provide for investors.

So, every quarter I open the kimono, so to speak, and share the details of my returns. I have been investing since 2009 and I have several accounts now at both Lending Club and Prosper as well as a couple of funds. I go into some detail of every single account and also provide screenshots of each one.

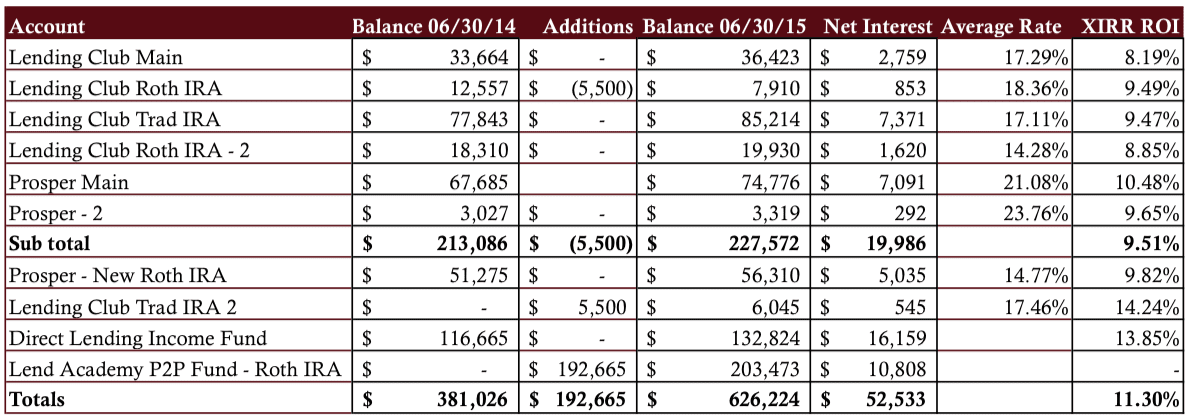

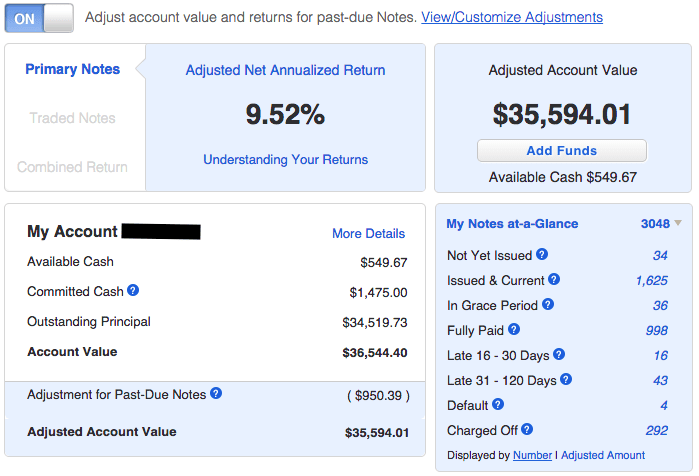

Overall P2P Lending Return at 11.30%

While interest rates offered to borrowers continue to decline across the board, the returns on my six main accounts, those accounts where I have been invested for several years, seemed to have stabilized. My trailing twelve-month (TTM) return for these six core Lending Club and Prosper accounts actually went up over Q1 from 9.29% to 9.51%. Overall, for all ten accounts my return came in at 11.30% this past quarter pretty much the same as it was in Q1 when it came in at 11.34%.

Below are the numbers of all my accounts. Click on the table to see it at full size.

As you look at the above table you should take note of the following points:

- All the account totals and interest numbers are taken from my monthly statements that I download each month. The account totals in the screenshots are slightly different because they were taken a few days after the end of the quarter.

- The Net Interest column is the total interest earned plus late fees and recoveries less charge-offs.

- The Average Rate column shows the weighted average interest rate taken directly from Lending Club or Prosper.

- The XIRR ROI column shows my real world return for the trailing 12 months (TTM). I believe the XIRR method is the best way to determine your actual return.

- The four new accounts have been separated out to provide a level of continuity with my previous updates.

- I do not take into account the impact of taxes.

- The extended chart showing returns displayed at Prosper and Lending Club as well as my adjusted returns can be viewed here.

Now, let me go through each account in turn, to give you some context to the above table.

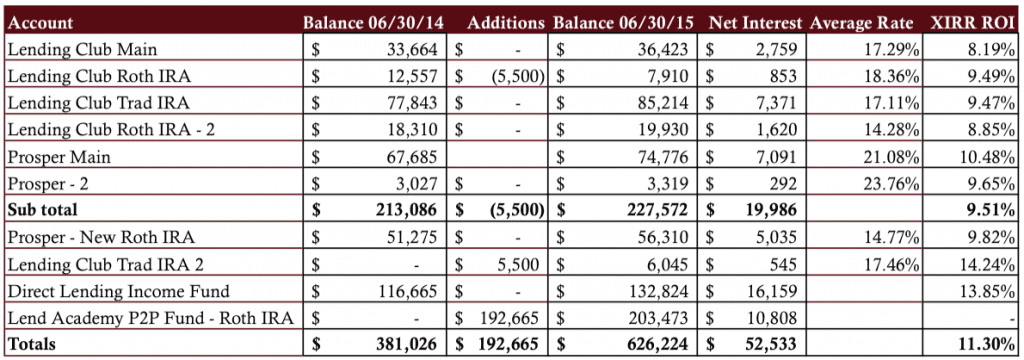

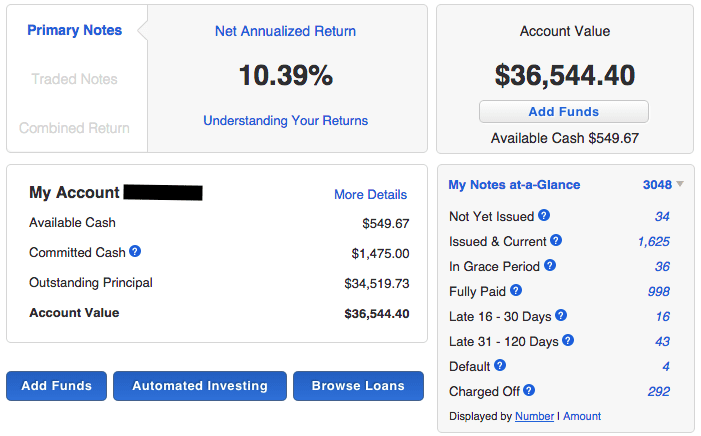

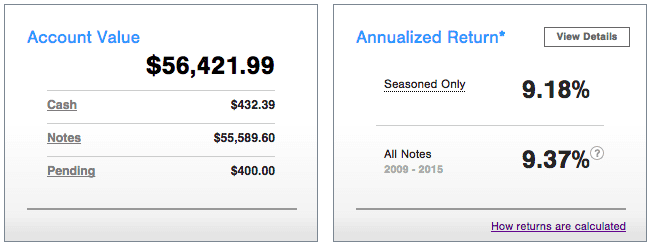

Lending Club Main

My first account in P2P lending was this Lending Club account that was opened in June 2009 with just $500. I have since added almost $25,000 to that initial amount. Because this account is so old I have gone through several cycles with the money invested. It is interesting to note that I have had 292 charged off loans in these past 6+ years against 998 loans that have been fully paid.

One thing I like to show everyone with this account is the difference between a regular Net Annualized Return (NAR) and Adjusted NAR. You can see the adjusted number below, it is almost a full percentage point less than the regular NAR. For new accounts this difference can be much larger in the 3-4% range or even more.

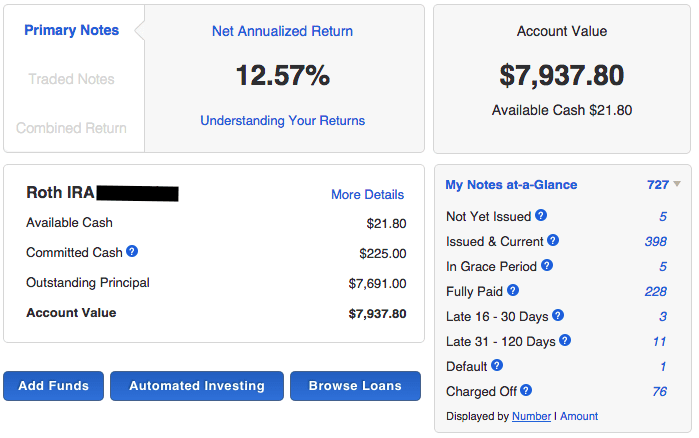

Lending Club Roth IRA

I opened this Roth IRA account with $5,000 back in 2011. This has always been my most aggressive Lending Club account, I have only ever invested in loans graded D, E F and G but this account has always performed well for me. Last year, I made a small mistake with this account. I made my $5,500 Roth IRA contribution as I do every year but after completing my tax return my accountant told me that my income was over the limit for a Roth IRA so I had to re-characterize this deposit as a Traditional IRA which is why I now have both a Roth and Traditional IRA in my name at Lending Club. Thankfully, Lending Club made this process quite easy.

Lending Club Traditional IRA

This account is more than five years old now. This IRA is in my wife’s name and it is a combination of many 401(k) and IRA accounts that were rolled over into one Lending Club account back in early 2010. This account has rebounded nicely over the past six months. My TTM return has gone from 8.01% six months ago to 9.47% in this most recent quarter, not bad for a mature account.

Lending Club Roth IRA – 2

This is my wife’s Roth IRA that I opened at the same time as the Traditional IRA above. While I initially opened this account with a conservative approach (mainly B and C grade), I migrated to a more aggressive approach about two years ago and the returns have reflected that. My TTM return bottomed out at 4.91% in Q4 of 2012 and it is now back solidly in the 8-9% range. This is my only account where I use Lending Club’s automated investing service with a custom filter (my Super Simple filter).

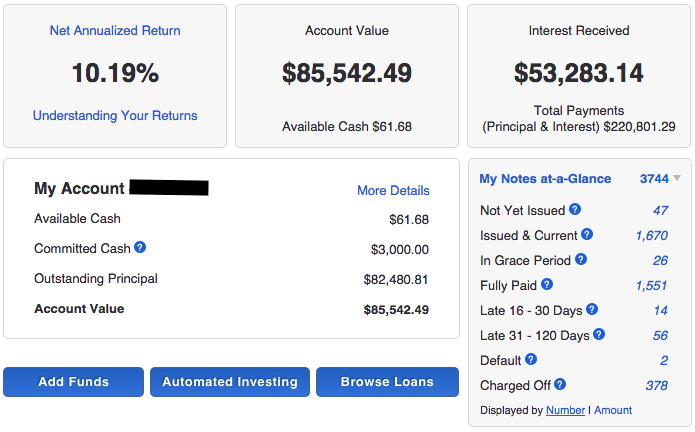

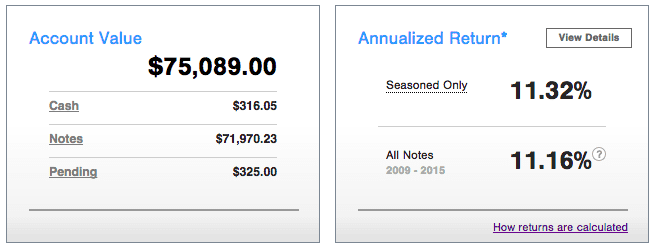

Prosper Main

I opened my first Prosper account in September 2010 so this account is nearing its five year anniversary. I have made exactly $50,000 of deposits into this account since 2010 and this past quarter the account total just passed $75,000. This continues to be one of my best performing accounts and is the only account at either Lending Club or Prosper that has returned at least 10% every year since 2010.

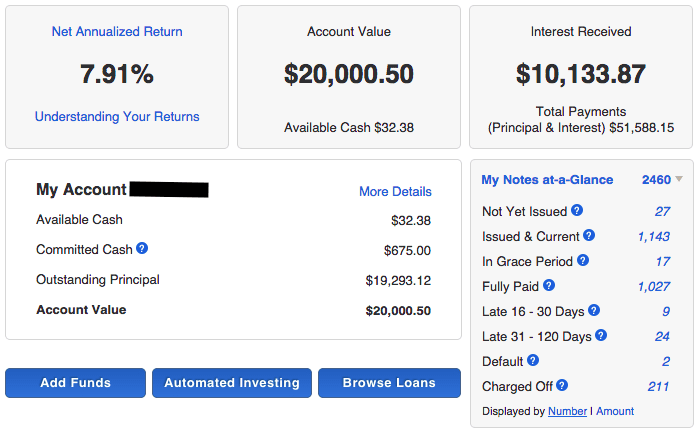

Prosper – 2

This is the most aggressive account I own with an average interest rate of 23.76% and it is also the least diversified. It has been an experimental account where I see what it is like to invest in the highest risk loans with fewer than 150 notes. With more than four years of history now this account has been by far my most volatile with returns fluctuating from less than 5% to more than 20%.

Prosper Roth IRA

Most of accounts here are invested in the highest risk loans. I decided I needed one account that was a little more conservative. So when I rolled over my Roth IRA from a hedge fund last year I decided to balance things out a little. This account has an average interest rate of 14.77% and invests in all loan grades from AA through to HR but with the majority in A, B and C grades. It is managed by my own firm, NSR Invest, using our balanced approach.

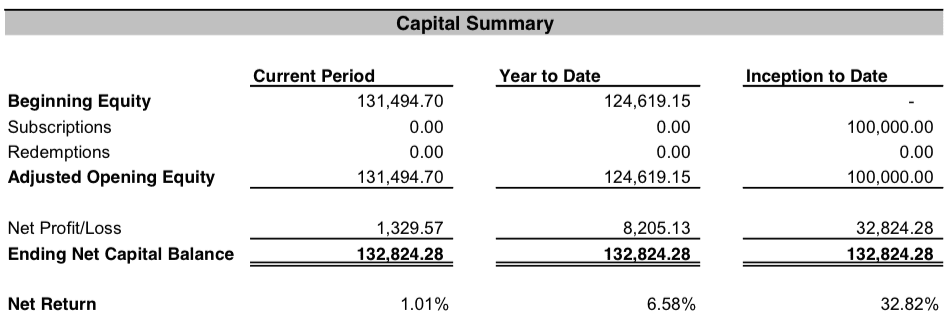

Direct Lending Investments Fund

Once again the Direct Lending Income fund is the best performing investment in my entire portfolio. It has been a remarkably consistent performer since I opened this account back in April 2013. It invests in short term, high yield small business loans and is a nice diversification with the bulk of my P2P lending portfolio focused on consumer loans. Brendan Ross, the fund manager, has created the largest and highest yielding small business fund in the industry and I continue to be very happy with the returns.

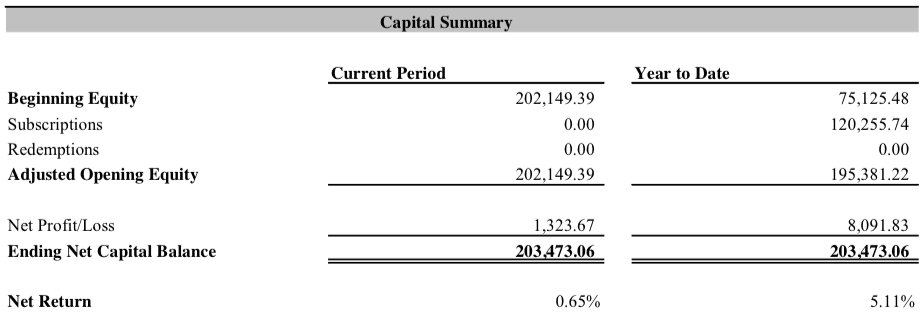

Lend Academy P2P Fund

With the rollover of this almost $200,000 IRA account I now have my entire retirement portfolio invested in P2P lending. I am comfortable with this decision, particularly given the recent gyrations in the stock market. Anyway, this account is with my own Lend Academy Fund where we invest in loans issued by Lending Club, Prosper, Funding Circle and a small position in Upstart.

Final Thoughts

As I write this the stock market is going through some of the worst volatility we have seen since 2008. While I still have a significant chunk of my net worth in the stock market the percentage is reducing every year as I concentrate more of my investing in this industry. Despite the fact that yields are definitely falling I think the consistency of returns of P2P lending make it a very compelling investment today. And with my returns solidly in double digits for three years now I am comfortable continuing to add to my positions here.

I always like to end these reviews with a focus on one number: net interest earned. This reflects the increase in value of the account after all charge-offs and fees have been taken into consideration (although I don’t show the impact of taxes). The amount of interest I have earned in the past 12 months has reached a new high of $52,533, I am over half way to my goal of $100,000 per year.

As always, I am happy to hear what you think. Let me know in the section below if you have any questions or comments.