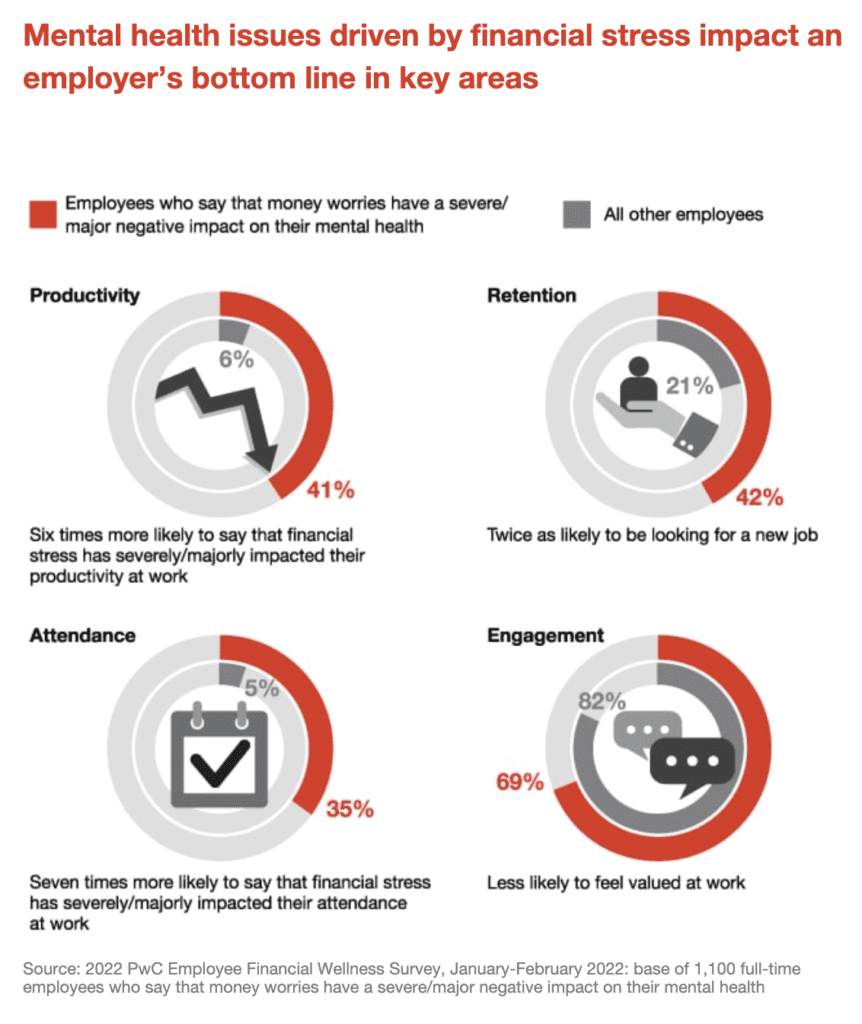

As the cost of living crisis continues, financial health concerns are taking center stage. For employers, the added stress may take more toll on their businesses than pure costs.

In a recent survey by PwC, financially stressed employees have reported issues with finances affecting multiple areas of their personal lives as well as attendance and productivity at work. This year, employee rationale for changing jobs has shifted, with 65% citing monetary issues as a primary reason for changing jobs, up from 38% in 2021.

Traditionally, employers have not engaged with their employee’s finances aside from the regular paycheck. Employees, for their part, are reluctant to ask their employers for help, with 27% saying their finances are a private matter. One-quarter of employees are embarrassed to show other people they are in debt.

“I feel like in the past there has been a stigma that you can’t support employees, with their finances at work, but it’s really a must,” said Toni Smith, Reward and insights Manager at Ricoh UK. “Employers do need to start looking at that. This is a longer-term view. Providing support and initiatives for mental health and financial well-being helps open conversations and remove the stigma around it.”

The FCA attributes 4 million days off work due to financial worries and the stress associated, costing businesses over £1.6 billion. With increased challenging conditions, these numbers are likely to rise.

Financially stressed employees are twice as likely to look elsewhere, with 75% saying they would be attracted to a company that cares about their financial well-being.

“With day-to-day financial well-being issues and the cost of living crisis, we’re in a bit of a perfect storm,” said Phil Elwell, Marketing Operations Manager for MyEva. “If employees can take control of day-to-day finances, that reduces stress and improves mental and physical well-being.”

Long-term budgeting issues cause a retirement gap for many

Over 20 million adults in the UK don’t feel confident managing their money, and 11.5 million have less than £100 in savings. Low levels of financial literacy can have knock-on effects, causing budgeting issues and rising debt. Long-term provisioning can be crucial, especially at retirement age.

The MyEva app was initially designed to assist in the pension provisioning process, looking at longer-term financial health. The platform is integrated with the employee’s pensions data, giving options on whether they want to adjust contributions.

“Employees can visualize the quality of life their contributions will eventually give them in addition to the state pension,” said Elwell. “I think it can be a bit of a shock for many people when they do that exercise. What they’re currently paying in may seem like enough, but when they look at what it will actually give them in retirement, it’s a bit of a wake-up call.”

He explained that pensions had in the past been an area employees had struggled to engage with, resulting in a retirement gap.

Currently, the state pension makes up just over half of the income of middle-income pensioners, while for lower-income citizens, it makes up around 80%. The state pension alone has its issues, with many citizens of retirement age being forced to work longer before receiving their weekly payment. Payouts of £185 per week make the contributions from employment essential for employees to maintain a similar quality of life on retirement.

Ricoh UK quick on the uptake

Ricoh has known the importance of engagement with employees’ financial health for some time. They first partnered with Wealth Wizards to introduce the MyEva platform to employees in 2019.

“We wanted to understand our employees, views, and requirements around financial support,” said Smith. “We wanted to offer financial support to our employees. But we needed to understand the demographics and who wanted that. So we were introduced to MyEva in 2019 as the technology that could help us with that.

“We started with a target of 10% of the employee population to be registered. Now a third of our population are registered using the MyEva app.”

Ricoh, although an international company, employs thousands of people in the UK, meaning that the one-third uptake of the app is significant.

“MyEva helps our employees coordinate their spending and work out weekly or monthly budgets to help manage their bills,” said Smith. “While saving during the current cost of living crisis can be challenging, several of our employees are actively seeking regulated advice on areas such as mortgages, savings, and pension contributions and consolidation.”

As well as provisioning for pensions, the app assists employees in setting savings targets and keeping track of their daily spending. Employees also have free access to a financial advisor.