In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

Last quarter we discussed that any reported returns from screenshots of the account should be taken with a grain of salt. Once this account becomes seasoned around the 18 month mark we will begin to provide returns using the XIRR calculation.

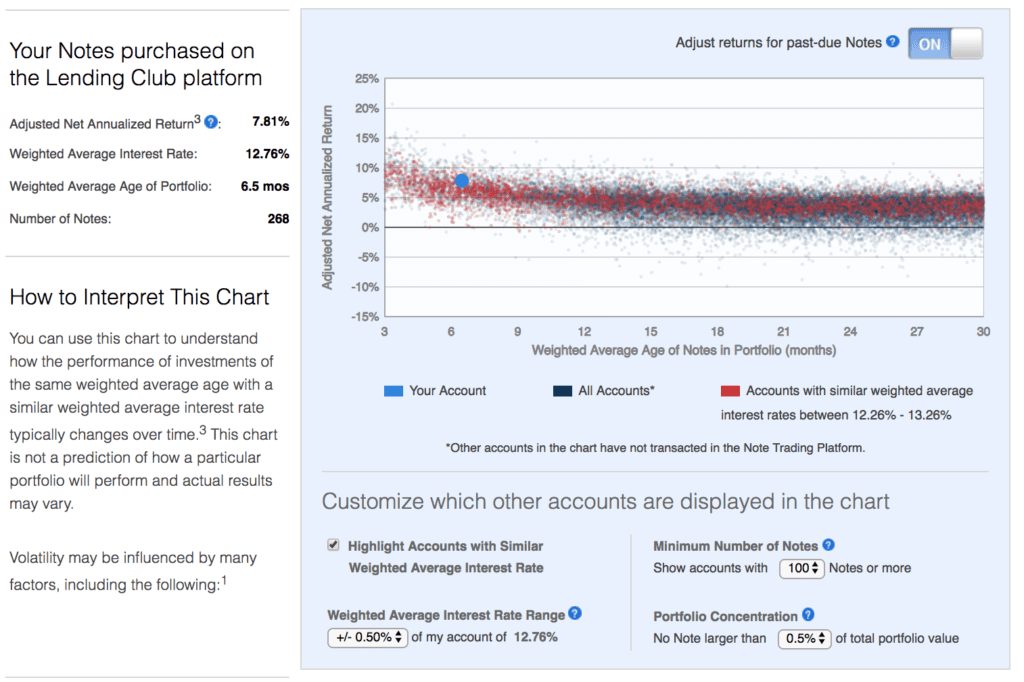

Note that the account currently has a weighted average age of 6.5 months. The below chart depicts a gradual decrease of adjusted annualized return until returns finally settle. With this account I took a balanced allocation to loan grades which has resulted in a weighted average interest rate of 12.76%. All notes are purchased through LendingClub’s automated investment feature. Returns are likely to fall in the middle of the road as you can see other investors have experienced as evidenced by the red dots below.

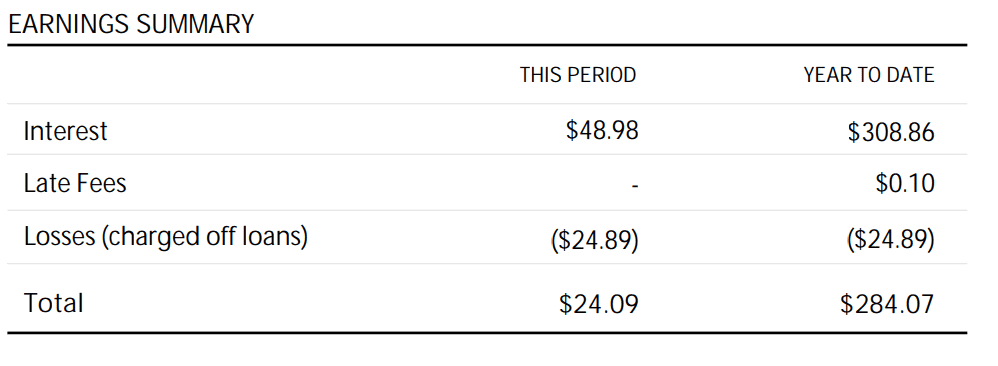

The below screenshot was taken from my September 2018 account statement. I’ve earned $308 in interest and have officially had one loan charge off to the tune of $24.89. While early charge offs are rare, particularly with a more conservative account they do happen. In this case, a B1 loan with an interest rate of 9.43% charged off after only receiving only one partial payment of $0.79. The principal portion of the payment was $0.11 which resulted in the charge off of $24.89. This borrower also paid $0.58 in interest, a $0.10 late fee and LendingClub’s investor fee was $0.12. After receiving partial payment on 7/5/2018, it took until 10/14/2018 for the loan to officially charge off.

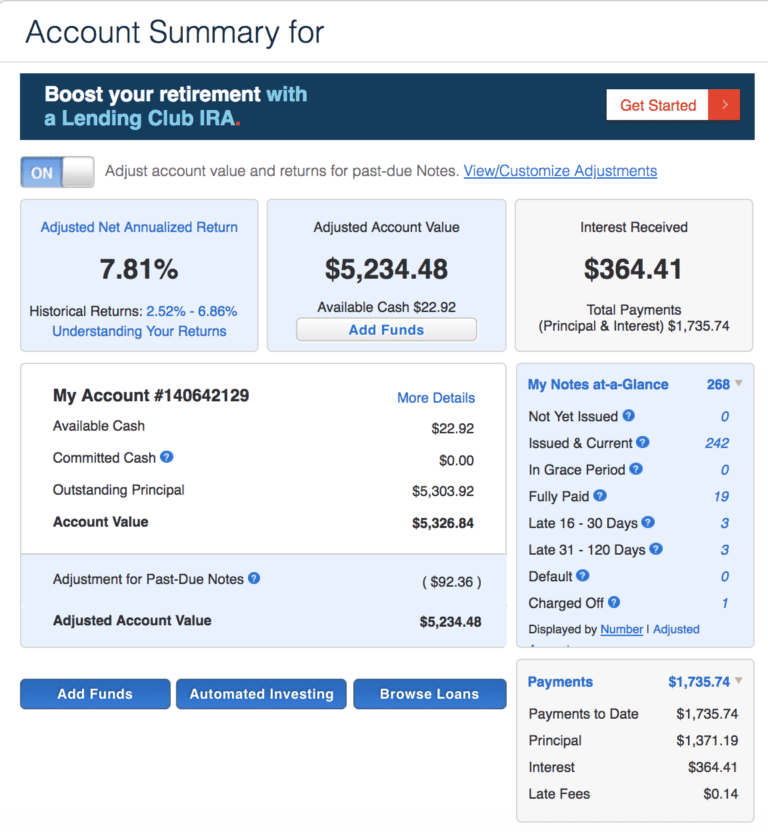

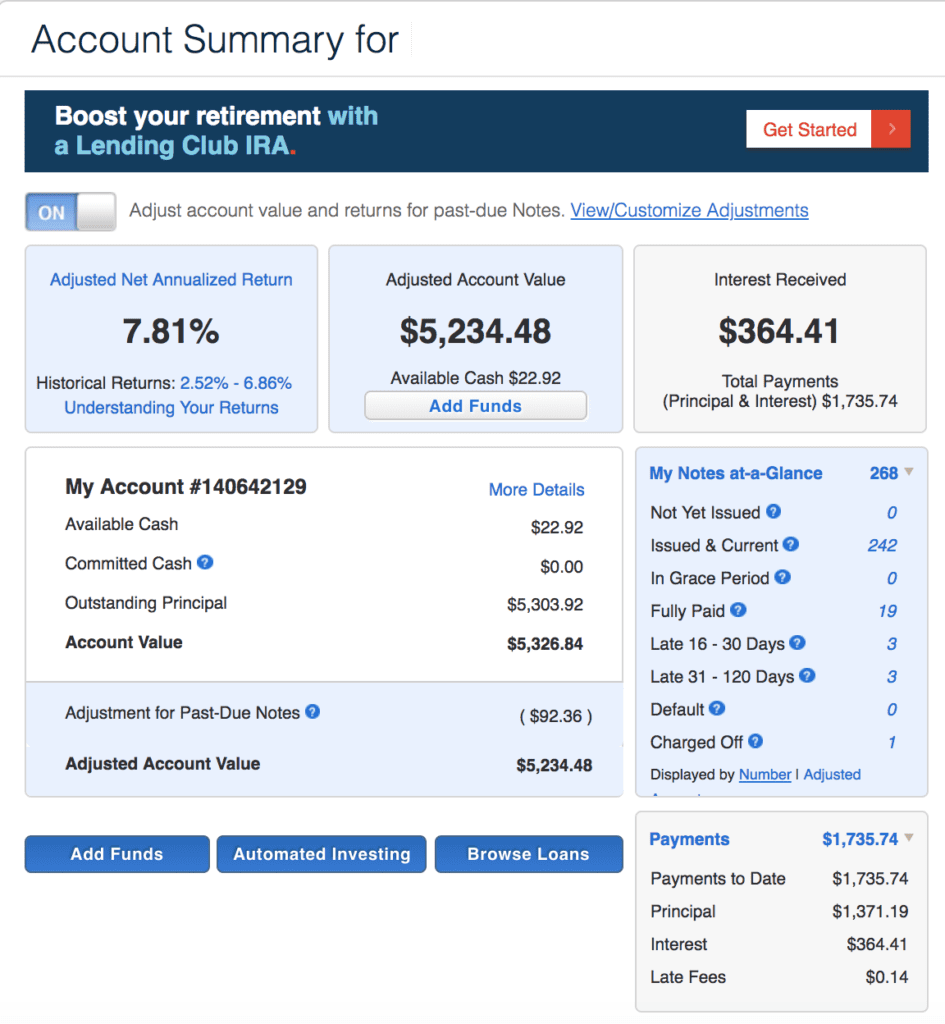

Below is my account summary as of November 1st, 2018. At this point principal and interest payments are regularly coming in and being invested into new notes. Nineteen loans have already been fully paid on the account. I also like to compare the historical returns metric that LendingClub provides. At the time of account opening this was 2.94% – 6.98%. As you can see below it has decreased slightly since I opened my account.

Conclusion

What I am keeping a close eye on is how LendingClub responds to interest rates. As of Q2 2018, LendingClub has increased rates between 49 to 109 basis points this year, depending on loan grade. In late September the Fed increased rates for the third time this year. CD rates continue to rise and 2 year CDs are already paying more than the lower end of my expected return. With more interest rate increases expected LendingClub is going to have to adjust rates accordingly given that there are no guarantees with unsecured consumer lending.