In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

- New LendingClub Account Performance – Q3 2018

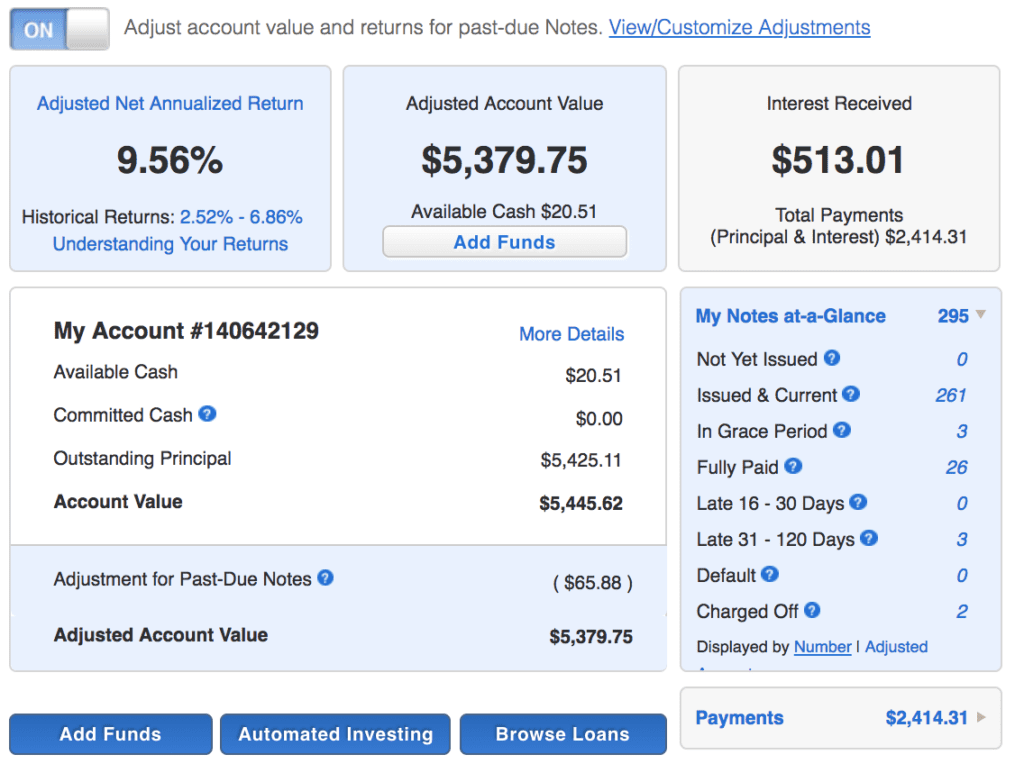

One of the things required for investing in marketplace lending is patience. Even though our new LendingClub account has been open around 9 months we still won’t have a full grasp on returns until around the 18 month mark. For now we can continue to look at the trends we’re seeing in the account.

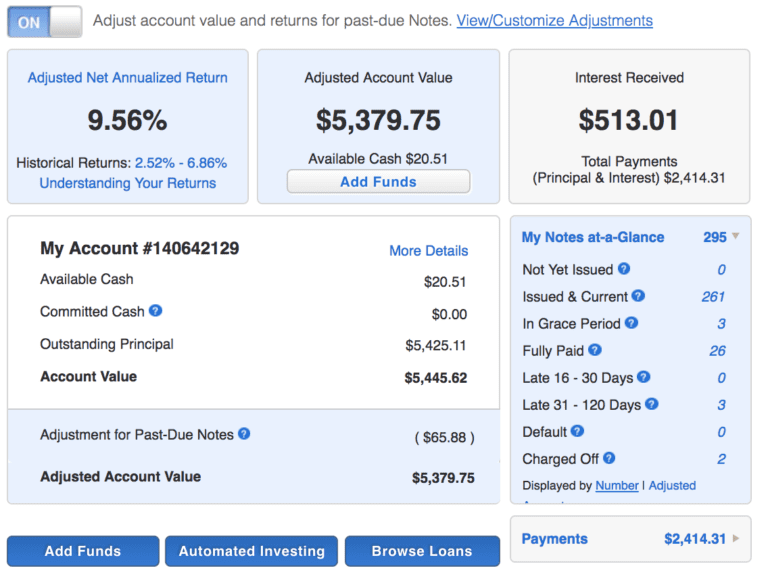

What’s interesting is that my adjusted net annualized return is now 9.56% as of January 23 2019, significantly higher than last time I checked in at 7.81%. This is largely due to an improvement of the amount of loans that were in the buckets between late through charged off. It is a good example of how any numbers displayed early on in an account’s history should be taken with a grain of salt.

My portfolio now has a weighted average age 8.5 months and judging by the chart below I am currently trending above accounts that have a similar average interest rate.

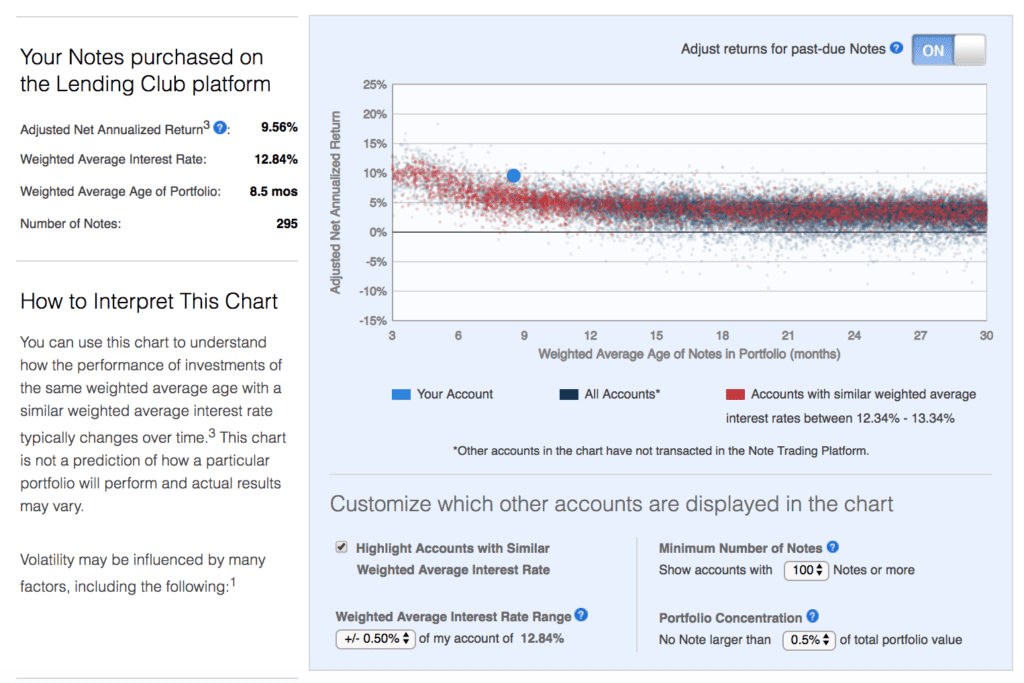

Remember that for this account we have left the loan selection completely up to LendingClub’s Automated Investing service. As of today my account shows that I am currently overweight in my allocation to C grade notes and underweight in A grades.

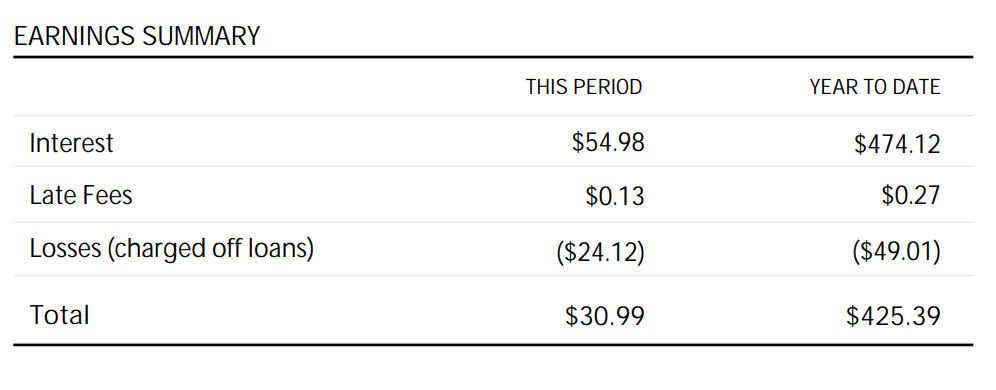

Finally, it’s worth taking stock of the total interest earned for the year. Below is the screenshot from my December 2018 statement outlining my total interest earned for the year of $425.39.

Every quarter I like to look at any changes or communications related to LendingClub’s platform. LendingClub shared their Q3 2018 platform update which provides their thoughts on the economic backdrop, credit environment and interest rates. The company made changes to grades A and B loans which was the fourth increase in rates for 2018 at the time of the update. Interest rates rose between 49-114 basis points depending on the grade and sub grade. In addition to the platform update, the company released a Marketplace Insights report which specifically addressed marketplace lending in a rising rate environment. This report went in depth on this rate cycle, how marketplace lending has performed compared to other assets, changes to their platform over their history and the impact of other macroeconomic measures. You view their report for free here.