In April 2018, LendingClub provided us with $5,000 to open a brand new account. Since then we have been chronicling the status of the account on a quarterly basis. Below are links to the full series of blog posts in chronological order:

- How to Open Up a New LendingClub Account in 2018

- Setting Up LendingClub’s Automated Investing Tool

- New LendingClub Account Performance – Q2 2018

- New LendingClub Account Performance – Q3 2018

- New LendingClub Account Performance – Q4 2018

- New LendingClub Account Performance – Q1 2019

- New LendingClub Account Performance – Q2 2019

- New LendingClub Account Performance – Q3 2019

It has been fascinating to watch LendingClub’s transition since they first started out. At first the company set out to disrupt the banks, allowing individual investors to earn the spread that banks would otherwise collect on deposits. LendingClub’s model was first proven out by retail investors, but institutional investors quickly realized there was money to be made by funding unsecured personal loans. Soon ever more conservative investors such as large banks began to participate. This transition needed to happen as LendingClub grew into the largest personal loan provider in the US, an accomplishment that I believe is often overlooked.

If you’ve been following LendingClub recently you’re already aware that they are now becoming a bank with their acquisition of Radius Bank. While a fintech company becoming a bank is an interesting proposition there are probably a fair amount of individual investors that have been around for quite some time left scratching their heads, wondering what happened to the vision of LendingClub turning the bank model on its head. The recent earnings call was filled with discussions around the benefits of LendingClub becoming a bank, and among them was having access to deposits. I don’t think anyone would have predicted in 2015, the time when there was plenty of irrational exuberance, that LendingClub would eventually buy a bank. It is hard to say what the future of LendingClub looks like and it will be some time until we see the Radius Bank actually close.

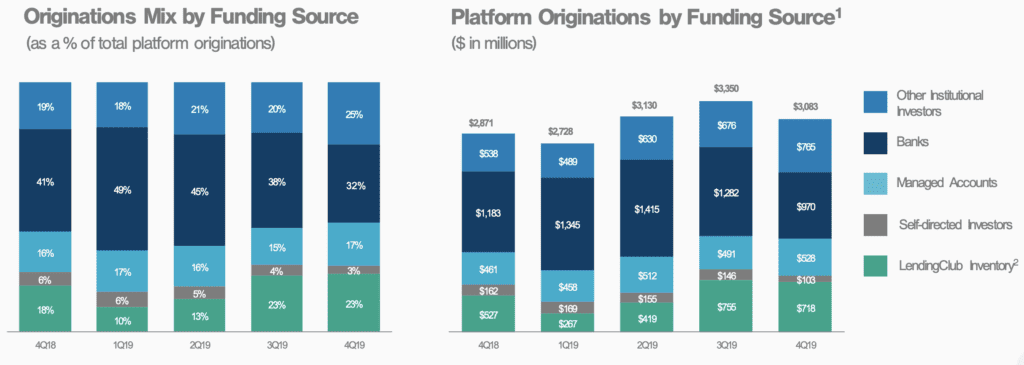

What we do know is that the individual investor continues to make up less and less of LendingClub’s platform. Over the long term it wouldn’t be surprising if LendingClub shuts down the retail investment platform. We don’t have any inside information, but individual self-directed investors made up just 3% of originations or $103 million in Q4 2019.

LendingClub Account Returned 4.4% in 2019

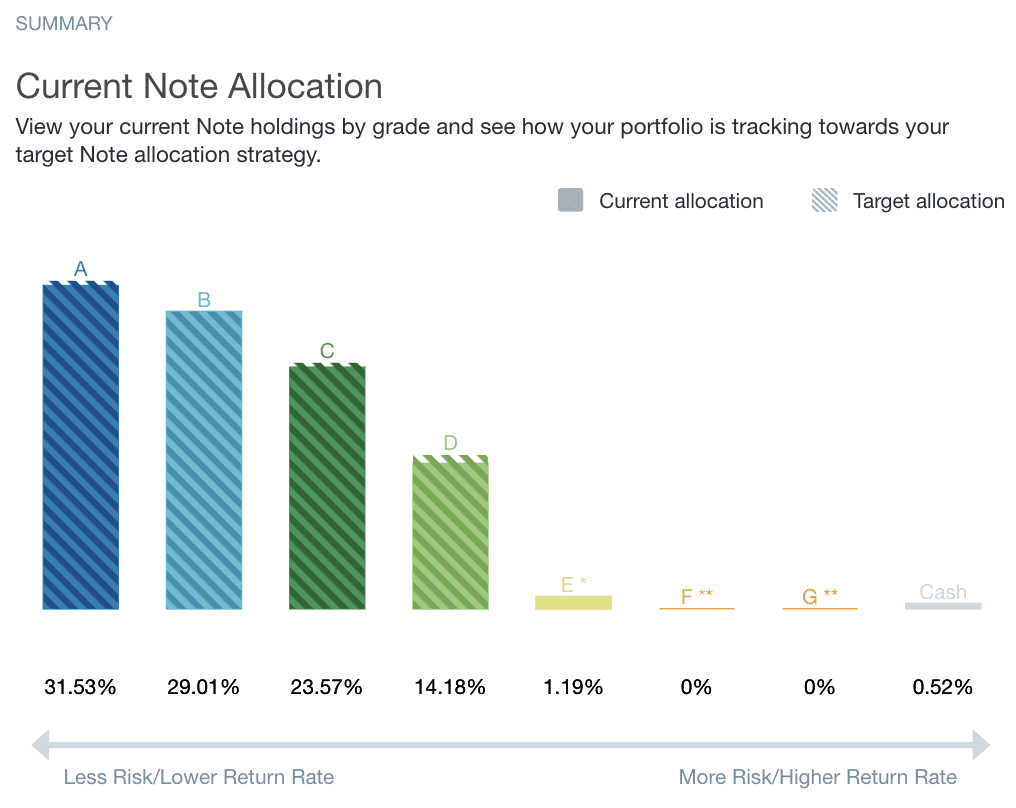

The account we’ve had since the beginning of 2018 is nearly seasoned and we now have a pretty good idea of where returns are going to fall. The current note allocation is LendingClub’s suggested allocation which skews more conservative. The return calculated using the formula XIRR for the year ending December 31, 2019 was 4.40%.

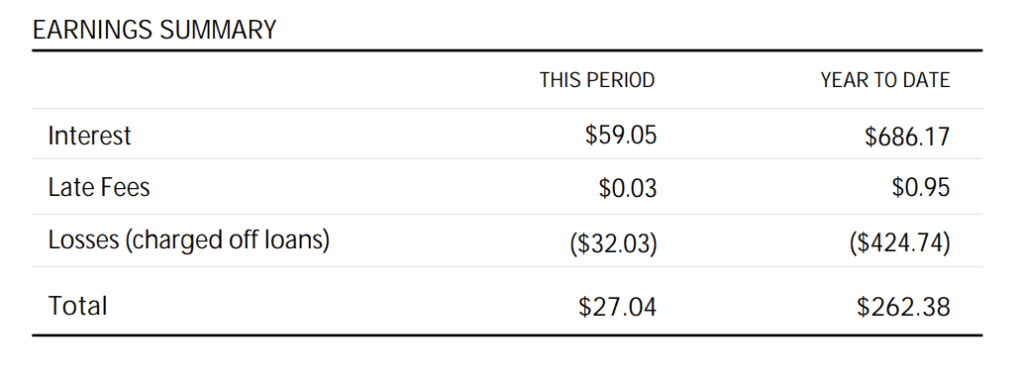

Below is a screenshot taken from my December 2019 statement which shows the net interest earned after losses.

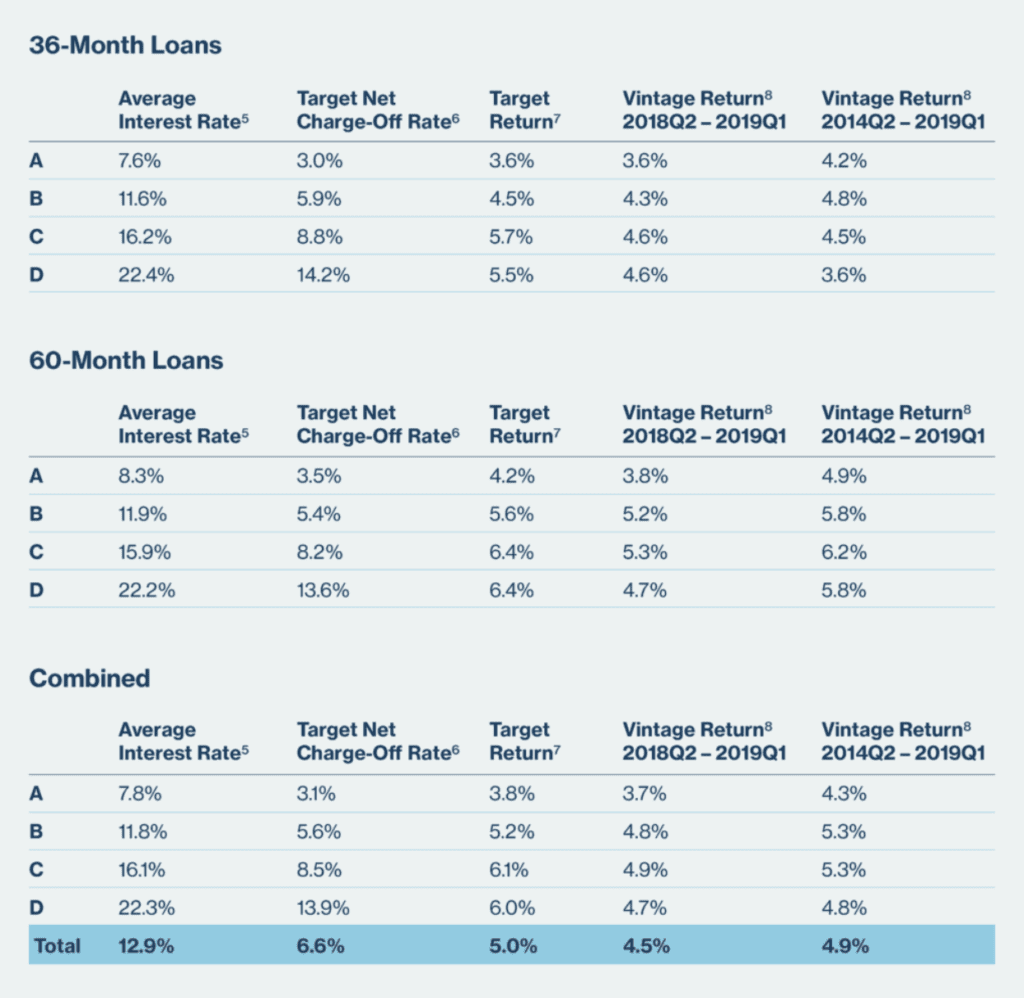

Every quarter I also like to delve into LendingClub’s quarterly update. From my perspective it seems as though returns should be trending towards the higher end of LendingClub’s estimate given the current economic environment. Yet it seems like there is more to the story with LendingClub noting a 8-10% cut of the Prime program loan origination in 2019. They continue to adjust the portfolio mix away from high risk borrowers and toward their core population of debt consolidators. The quarterly update notes “a similar scale of cuts for 2020, with some trimming already taken place in January”.

LendingClub provided the below note which leads one to believe that returns could trend higher going forward:

We believe that last year’s credit changes, bolstered by tools such as our early delinquency model, which has enhanced our ability to detect borrowers more likely to default earlier in the loan cycle, leave us in a solid position for 2020. Following the investments we have been making in technological and other capabilities, we are seeing favorable results on our collections effectiveness, which we have not yet incorporated in our target returns.

Interestingly, LendingClub is also changing the way they publish returns in quarterly updates, from forecasted returns to instead presenting target returns. The most recent chart from the quarterly update is below.

Conclusion

The account opened in 2018 is falling in line with LendingClub’s target returns though it is admittedly on the lower end. It seems as though LendingClub may be reacting to these lower returns as they continue to make cuts even on the higher grade loans. It will be interesting to see how these changes play out in this portfolio going forward.