The CFPB continues its attack on all kinds of junk fees charged by banks. This time they are targeting credit card late fees.

Goldman's push into consumer finance continues to be a disaster. While CEO David Solomon had grand plans, the entire move has proven to be an unmitigated disaster.

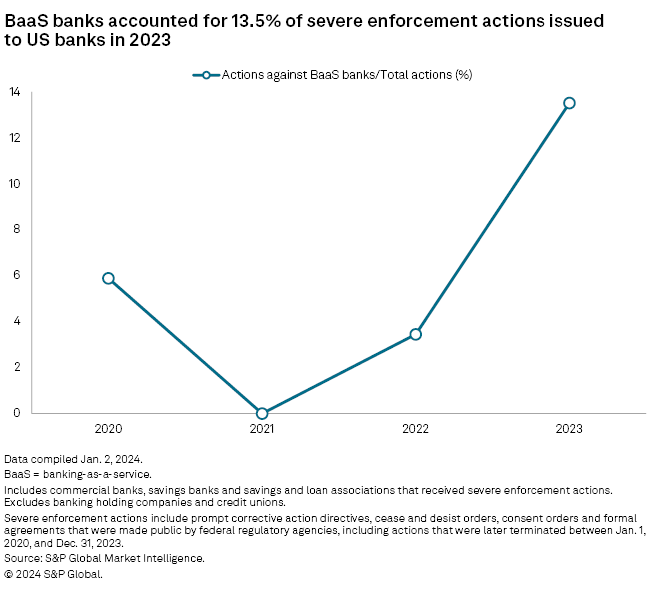

You could say Banking as a Service is under siege.

The number of severe enforcement actions BaaS banks received skyrocketed in 2023 to 13.5% of the total. When you consider there are probably only around 100 banks out of 4,800 that are involved in banking as a service, you can see why this number is disturbing.

While AI seems to be everywhere these days, one place it is getting real traction is in the compliance space.

There is a lot of manual, repetitive work in the compliance teams at large banks and fintechs. Hummingbird is looking to ease that burden with the launch of a new AI-based compliance tool.

By Isabelle Castro Margaroli For some time, we have been hearing about tokenization’s “trillion-dollar opportunity”. JP Morgan has taken a step...

The SEC has not had a great track record in court cases against crypto firms in the last few months. And another important case is playing out right now in a New York federal courtroom.

Back in June of last year the SEC sued Coinbase arguing that it was operating illegally and that it should register as an exchange and be overseen by the SEC.

We learned a couple of weeks back that the former head of Marcus, Swati Bhatia, had taken a job at Santander to lead U.S. consumer and business banking.

Yesterday, we learned more details about what this new job is going to entail.

Fintech Nexus Newsletter (February 13, 2024): The 50 Hottest Startups in Fintech According to Forbes

Forbes is out with its ninth annual Fintech 50 this morning, a subjective list of the hottest startups in fintech. The list is created by Forbes editors, is only open to private companies and it involves analyzing data as well as interviews with company CEOs and industry insiders.

In the kickoff to the Holiday shopping season, consumers are spending, with retail sales up 1.1% and e-commerce sales up 8.5% according to Mastercard SpendingPulse.

As we hear tell of Mint's demise it becomes clear that the market for personal finance management is evolving beyond just budgeting.