When the CFPB released their long-awaited proposal on open banking rules in October there was cautious optimism from both banking and fintech groups.

Fast forward two and a half months, when everyone has had a chance to fully digest the 299-page proposed rulemaking, there are many suggestions for improvement. With the 60-day comment period ending this week, the CFPB has received over 11,000 comments.

Speaking at an event yesterday, CPFB Director Rohit Chopra said his agency is looking at "price gouging" in credit reporting.

With credit reports required for selling mortgages to Fannie and Freddie, mortgage lenders have no choice but to pay for them. Some lenders have shared that the costs for credit reports have increased by up to 400% since 2022.

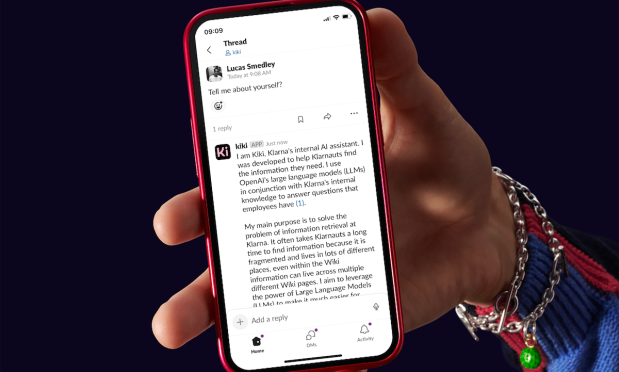

We learned back in February that Klarna's AI chatbot was doing the work of 700 people.

Today, Klarna is reporting about its employee's internal use of AI. It's internal AI assistant, named Kiki, is answering 2,000 employee questions a day and over 87% of its employees are now using it.

The SEC is at it again.

Over the weekend we learned that the SEC has sent a Wells Notice to Robinhood regarding its crypto activities.

Goldman's push into consumer finance continues to be a disaster. While CEO David Solomon had grand plans, the entire move has proven to be an unmitigated disaster.

When it comes to the adoption of generative AI in finance, we are still at the top of the first inning.

That is why it was really interesting to read Penny Crosman's article yesterday about what is top is mind for bankers when it comes to Gen AI.

The CFPB continues its attack on all kinds of junk fees charged by banks. This time they are targeting credit card late fees.

The buy-now-pay-later industry continues to grow in popularity. And part of the reason is consumers are starting to understand that most of BNPL stands outside the traditional credit scoring system.

Back in the go-go days of 2021 the two biggest names in crypto were known just by their initials: SBF (Sam Bankman-Fried) and CZ (Changpeng Zhao).

They often took to Twitter arguing with each other about where the market was going and whether certain tokens were overvalued. But there were no bigger names than SBF and CZ. They controlled the biggest crypto exchanges, outside of Coinbase: FTX and Binance.

Fintech Nexus Newsletter (June 11, 2024): Apple introduces Tap to Cash for iPhone to iPhone payments

Yesterday, Apple held its annual Worldwide Developers Conference (WWDC), during which it made several interesting announcements.

The most relevant to fintech is the new "Tap to Cash" feature that will be built into iOS18. As it sounds, this will allow users to send and receive Apple Cash simply by holding two iPhones together.