It is a bold or naïve CEO that prefaces a major announcement with the words, "This will shock the world".

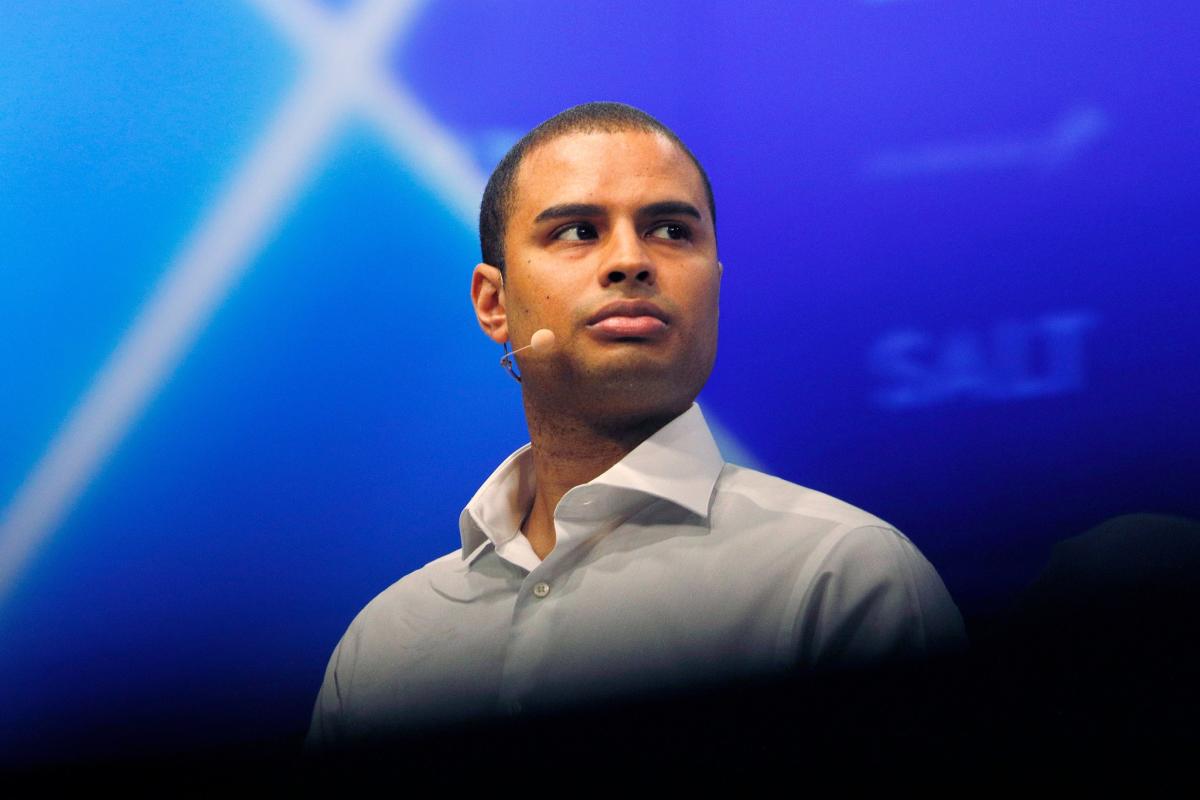

New PayPal CEO Alex Chriss said exactly that in his first public interview since becoming CEO. That was a week ago and he was referring to major announcements that would happen at the company's Innovation Day that it conducted yesterday.

While it is not yet a wave, fintech consolidation is starting to pick up. And yesterday we learned of another deal, this one in the investing space.

While this deal was telegraphed a few months ago there was an official announcement yesterday. Leading investment fintech Yieldstreet is acquiring the real estate platform Cadre.

BaaS fintech Synapse is having a rough year. Synapse and its clients need to be removed from Evolve's platform by December 31.

For the past two decades, the investment banking ecosystem in fintech has been dominated by one player: Steve McLaughlin's FT Partners. Now, that is not to say that other investments have not done deals. The really big deals are often done by the likes of Goldman Sachs, Morgan Stanley, or JPMorgan Chase.

Caitlin Long, the CEO and founder of Custodia Bank, has been fighting for access to the Fed payments system for many years. Custodia first applied for a Fed master account in October 2020.

After her application was endlessly delayed, she sued the Fed to review her application. They eventually did and ruled against her. So, she sued the Federal Reserve again.

The UK has published a number of proposals for stablecoin regulation and how to bring the digital asset into the economy.

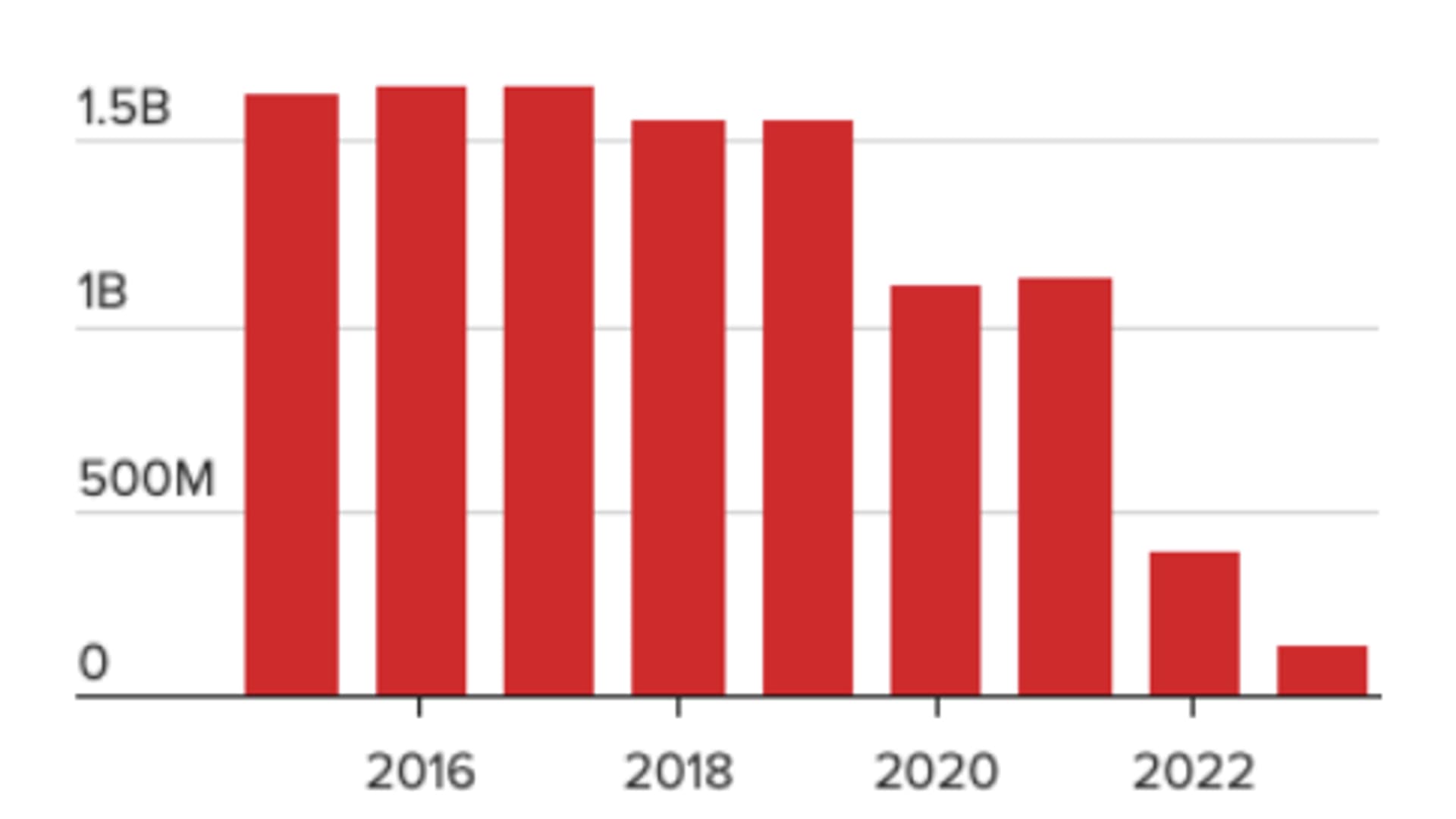

Overdraft revenue is on the decline, but recent filings show that JPMorgan Chase and Wells Fargo remain by far the largest generators of the controversial fees.

Late yesterday, we heard the news that Onfido, a pioneer in ID verification used by banks and fintechs all over the world, is going to be acquired by Entrust, a diversified security and verification company.

Visa is hosting its annual Visa Payments Forum in San Francisco this week, and yesterday, there were some major announcements. Some are calling this the biggest thing in card payments since the card chip.

Today, a new global report was released from Nasdaq and Oliver Wyman on illicit money flows and the numbers are sobering.

The Global Financial Crime Report quantifies the total amount of illicit financial activity and the number is an eye-popping $3.1 trillion. Included in this number is bank fraud covering payments, checks and credit card fraud which is estimated at around $450 billion.