Today, Google has announced a pilot program with Affirm and Zip to bring BNPL natively into the Google Pay wallet.

Consumers continue to choose BNPL as a payment option and its popularity continues to grow, particularly during the holiday shopping season.

Twitter/X has been going state-by-state obtaining money transmitter licenses. The social media platform is now approved in 12 states.

No, you did not wake up back in 2021 but there is news this morning of a €285 Million (over $300m) fintech funding round.

Germany-founded but London-based SumUp has closed the massive funding round that is "mostly equity" which tempers our initial enthusiasm somewhat. But even a nine-figure equity round is enough to make the news these days.

Much has been written about the looming end to the Apple-Goldman Sachs relationship (we even produced a cartoon about it). And while this is a big deal for Goldman and Apple, the average Apple Card holder likely does not give it a second thought.

Yesterday, the OCC issued new guidance for banks, addressing the risks of buy now pay later lending. The guidance focused on the popular "pay in 4" segment of BNPL.

Not surprisingly, the national bank regulator recommended tight oversight of third-party servicers, the importance of transparent loan terms and fraud mitigation.

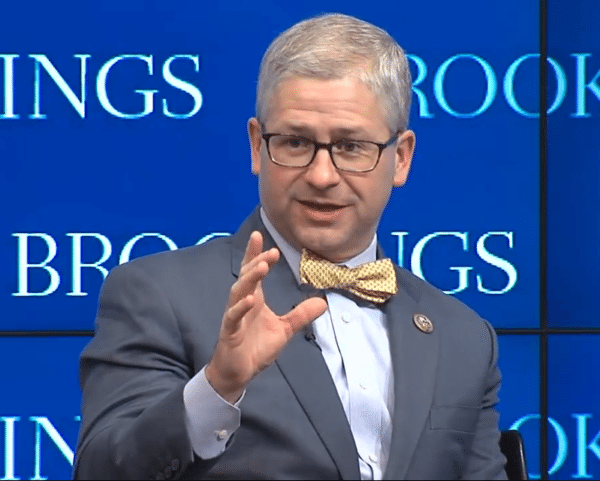

House Financial Services Committee Chairman Patrick McHenry (R-NC) announced yesterday that he will not be seeking reelection to the North Carolina seat he has held for almost 20 years.

Over the years whether serving as the Committee Chairman or as the Ranking Member, he has been a tireless champion for financial innovation on the House Financial Services Committee.

ChatGPT launched a year ago and the tech world will never be the same. The New York Times has an in-depth look at the impact of this revolutionary new product, focusing on big tech.

It is interesting to me that one of the greatest tech launches of the past decade came not from a big tech company but from an AI startup that was not even seven years old and was set up as a non-profit research lab.

In the kickoff to the Holiday shopping season, consumers are spending, with retail sales up 1.1% and e-commerce sales up 8.5% according to Mastercard SpendingPulse.

While it is not yet a wave, fintech consolidation is starting to pick up. And yesterday we learned of another deal, this one in the investing space.

While this deal was telegraphed a few months ago there was an official announcement yesterday. Leading investment fintech Yieldstreet is acquiring the real estate platform Cadre.

Swift announced today that the European Payment Council's awkwardly named One-Leg-Out Instant Credit Transfer scheme (OCT Inst) went live this week and it enables payments to and from Europe to be processed 24 hours a day, seven days a week.